Home Depot could be the quiet winner of the connected home

Home Depot (HD) has been on a tear. The company posted 7.7% comparable store sales growth as business has been boosted higher by still-surging housing prices, best-in-class execution, and storm and weather related needs. But while Tuesday’s third quarter results highlighted these drivers, a completely separate category could hold the secret to its next leg of growth: The connected home.

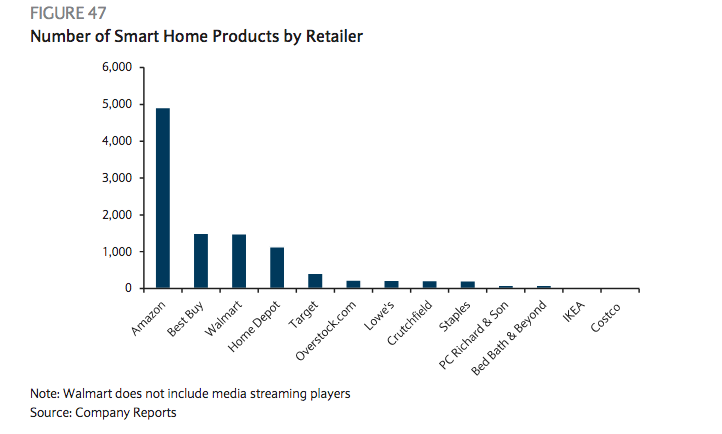

Alphabet (GOOGL) and Amazon (AMZN) are often considered the big winners of the connected home opportunity, particularly with virtual assistants like Google Home and Alexa. But analysts say Home Depot could be the quiet winner in the category.

“We have quite a bit of product that’s selling very nicely with strong growth year-over-year,” VP of Merchandising Ted Decker said on the company’s earnings conference call. “It’s a category we’ve put a lot of effort into, lots of photos and 360° spin and features…It’s all part of our end-to-end thinking and business model development for appliances.”

Barclays’ Matthew McClintock said this could represent an important growth driver for the company going forward.

“Connected Home is potentially a next leg of growth for Home Depot,” McClintock told Yahoo Finance. “They’re one of only a few retailers that address the category in a physical way. The connected home creates an event where many people have to upgrade many elements of their home—from light bulbs to refrigerators and beyond.”

McClintock added that while Target (TGT) and Walmart (WMT) offer these products as well, their customer service offering isn’t as well positioned as Home Depot.

“Home Depot’s labor model is more well situated for this complicated category where consumers have minimal knowledge and experience with specific products and are looking to make decisions,” he said. “Home Depot is among the best positioned.”

Meanwhile, the connected home is also a meaningful category for Home Depot, McClintock added, because the price-points of the products are high for the appliances. (Plus, consumers may be more willing to spend more given long-term energy savings of smart-home products).

Big-ticket items have been an important driver for Home Depot in recent years, and this could accelerate. There is an opportunity for the do-it-yourself (DIY) customer that wants to upgrade his or her home but also for the professional do-it-for-me (DIFM) customer. For example, McClintock explained that Amazon has been showing up at homebuilding and trade shows, offering people free Alexa installation services. And the appeal of these offerings to professional customers could accelerate.

Home Depot was an early entrant in creating a partnership with smart home enabled products and apps. In July 2014, the company announced a partnership with Wink, a smart home platform that allows users to connect to different smart home products from GE, Nest, Schlage and Philips to smart phone apps. Wink-enabled appliances (which include light bulbs, window shades and water heaters) are available at Home Depot and Wink is also integrated with both Amazon’s Alexa and Google Home.

While elements of the “connected home” have been around for 20 years, virtual assistants—particularly Amazon’s Alexa and Alphabet’s Google Home—have caused the industry to take off.

Barclays estimates the Connected Home opportunity could reach $300 billion by 2020, larger than most publicly available estimates. And 80% of future major appliances sold in three years will be connected, according to Barclays.

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

GE CFO: The dividend cut is about improving total shareholder return

Secretary Mnuchin: Corporate tax cuts are about bringing jobs back to the US

Benioff: Companies like Facebook and Twitter must take ‘full responsibility’ for what they’ve created

Marc Benioff: We can’t leave anyone behind during the ‘fourth industrial revolution’