Groupon (GRPN) Q3 Earnings Beat Estimates, Revenues Miss

Groupon, Inc GRPN reported third-quarter 2021 non-GAAP earnings of 38 cents per share, which beat the Zacks Consensus Estimate of 3 cents. The company had reported non-GAAP earnings per share of 15 cents in the prior-year quarter.

Revenues of $214.2 million missed the Zacks Consensus Estimate by 1.7%. The figure declined 29.6% on a year-over-year basis (down 30% excluding foreign exchange effect).

Region-wise, North America revenues plunged 20.6% from the year-ago quarter’s level to $143.1 million. International revenues fell 42.6% (down 43.7% excluding foreign exchange effect) year over year to $71.1 million.

Groupon’s ongoing restructuring efforts and its pivot strategy look promising. Through the pivot strategy, the company is expanding inventory to boost billings growth as well as improve purchase frequency and modernize the marketplace. In the quarter under review, the company rolled out “Grab Life by the Groupon” brand repositioning campaign.

The company added that it was on track to achieve $225 million in savings by 2022 under its restructuring initiative.

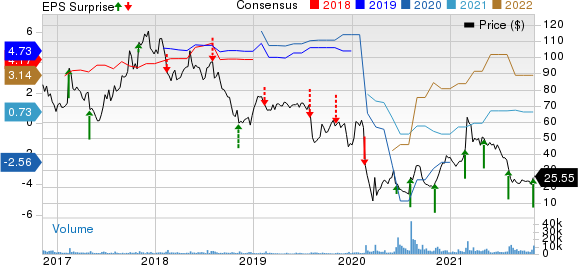

Groupon, Inc. Price, Consensus and EPS Surprise

Groupon, Inc. price-consensus-eps-surprise-chart | Groupon, Inc. Quote

The company aims to expand deal inventory available for repeat purchase to 80% by the end of 2021. In the quarter under review, the company expanded the deal inventory for repeat purchase to 75%.

Quarterly Details

Service revenues (92.9% of revenues) were up 28.3% year over year to $198.9 million. Product revenues (7.1% of revenues) deteriorated to $15.2 million from $148.9 million.

Consolidated local revenues of $175.2 million surged 29.7% from the year-ago quarter’s levels. North America Local revenues increased 31% and International Local revenues increased 23.3%, excluding foreign exchange effect.

Consolidated Travel revenues increased 10.4% year over year to $8.7 million. North America Travel revenues inched up 0.9%. International Travel revenues increased 23.4%, excluding foreign exchange effect.

On a consolidated basis, Goods revenues declined 81.2% year over year to $30.3 million. North America Goods revenues declined 88.1%. International Goods revenues declined 75.3%, excluding foreign exchange effect.

In the third quarter, consolidated gross billings were $553 million, down 7.9%, excluding foreign exchange effect.

North America gross billings were $385.4 million, up 6.4% year over year. International billings were $167.6 million, down 30.1% excluding foreign exchange effect.

North America Local and Travel gross billings increased 38.4% and 0.6%, respectively. Goods gross billings declined 60.3% on a year-over-year basis.

International Local and Travel gross billings fell 10.4% and 22.7%, respectively. Goods gross billings declined 55.3% on a year-over-year basis, excluding foreign exchange effect.

Owing to the coronavirus crisis-induced negative impact on demand, consolidated units sold during the reported quarter fell 26% year over year to 15.7 million.

Region wise, North America units were down 20.1%, while International units were down 35.8% year over year

Customer Metrics

As of Sep 30, 2021, Groupon had approximately 24 million active customers compared with 24.9 million at the end of the previous quarter.

As of Sep 30, 2021, the company had approximately 15 million active customers based in North America and 9 million active international customers.

Operating Details

In the third quarter, gross profit came in at $181.4 million, up 13.4% (up 12.7%, excluding foreign exchange effect) year over year.

International gross profit increased 8.6% year over year and 6.4% excluding foreign exchange effect to $54.6 million. Under the International segment, excluding foreign exchange effect, Local and Travel categories reported a gross profit increase of 27.3% and 30.7%, respectively. Goods category gross profit plunged 49% year over year.

Coming to North America region, gross profit increased 15.6% to $126.8 million. Local category reported a gross profit increase of 31.6%. Travel and Goods categories’ gross profit fell 2.9% and 57.1%, respectively.

Non-GAAP adjusted EBITDA came in at $34.6 million compared with adjusted EBITDA of $30.8 million reported in the prior-year quarter.

Selling, general and administrative (SG&A) expenses fell 3.8% year over year to $119.5 million in the reported quarter. Marketing expenses surged 69% year over year to $53.2 million.

The company reported an operating loss of $3.7 million compared with an operating loss of $16.2 million in the prior-year quarter.

Balance Sheet & Cash Flow

Groupon exited the quarter ending Sep 30, 2021, with cash and cash equivalents of $476.8 million, down from $565 million, as of Jun 30, 2021.

In the third quarter, the company used $74.2 million of operating cash flow compared with $34.3 million used in the prior quarter.

Free cash out flow came was $87.6 million compared with $46.8 million of free cash outflow reported in the previous quarter.

Guidance

For 2021, Groupon now expects revenues in the range of $950-$975 million compared with the earlier range of $950-$990 million. Adjusted EBITDA is projected between $130 million and $135 million compared with the earlier guidance of $115-$125 million.

Zacks Rank & Stocks to Consider

Groupon currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Advanced Micro Devices AMD, Synaptics Incorporated SYNA and Broadcom AVGO. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Long-term earnings growth rate of AMD, Synaptics and Broadcom is pegged at 46.2%, 10% and 15%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Groupon, Inc. (GRPN) : Free Stock Analysis Report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research