EXCLUSIVE: Tiffany & Co. CEO Anthony Ledru Outlines Plans to Modernize Historic Jeweler

NEW YORK — Tiffany & Co. chief executive officer Anthony Ledru is a man fast on the move.

In his first year on the job, the tenured luxury executive has been hot-pressed to revitalize Tiffany — a brand he labeled an “American cultural icon.” He is keen to see the bulk of the changes implemented over the next 36 months, a quick turnaround that mirrors the cadence at which he speaks.

More from WWD

“It’s as much about protecting [Tiffany] as it is about changing it. We inherited a giant sleeping beauty and I think it’s awakening quickly. 2021 was a warm-up, we still have a lot of work to do, particularly if you look at that what we have in our hands is one of the oldest jewelry companies with a global reach worldwide,” he told WWD during a sit-down interview at Tiffany’s global headquarters here, where its new “Botanica” high jewelry was being shown to press.

What Ledru brands as “inherited” was, of course, the largest luxury acquisition in history — which saw Tiffany’s new parent company, LVMH Moët Hennessy Louis Vuitton, purchase the American jeweler in a $15.8 billion deal that resulted it being delisted from the stock market. In January 2021, Ledru arrived as the jeweler’s CEO from Louis Vuitton, where he was most recently executive vice president for global commercial activities. But he had worked at Tiffany before until late 2014, serving less than two years as its senior vice president for North America.

Now in the jeweler’s biggest decision-making seat, Ledru outlined his plans for Tiffany, which are set to roll out at a lightning pace.

First on the agenda is to refocus and grow its many jewelry pillars, spanning sterling silver to high jewelry. In the next 24 to 36 months, similar full-force attention will be paid to categories including watches, gifting and leather goods, in a bid to reclaim Tiffany’s leading position as the store for democratic luxury.

A reenvisioning of Tiffany’s retail experience is also high on the list — with plans to renovate some 30 to 50 stores a year, open select new global flagships or, “embassies,” as Ledru called them, and rechristen Tiffany’s Fifth Avenue flagship in Manhattan under LVMH’s eye after a total renovation that could be ready in time for the 2022 holiday season.

This is all amid a more macro plan of modernizing Tiffany for future generations by applying star power and nimble, on-trend thinking to the fine jewelry space, which can be notoriously slow and old-fashioned.

“We move quickly — I believe that moving with speed and being efficient is not an enemy of success,” Ledru said of his targeted timeline. Tiffany’s current staff, he explained, was strategically assembled with this in mind. Particular attention was paid to individuals coming from the wider fashion industry, who Ledru believed could bring a faster pace of thinking.

“We are living in a fast-moving world and that’s an important skill set for a lot of people coming from the fashion world, where there are a lot of drops and you have to react quickly — that’s what you need in hard luxury now a bit to manage,” said Ledru, adding the jeweler’s current workforce is one-third original Tiffany staff, one-third LVMH veterans, and another equal share coming from outside both companies.

While born in Bretagne and raised in Lille, France, Ledru considers himself half American — owing to the amount of time he has lived here. He acknowledged that he is under “a lot of pressure” in a role that investors are watching with the enthusiasm of an NBA playoff, while jewelry insiders are looking on with a vicious eagle’s eye.

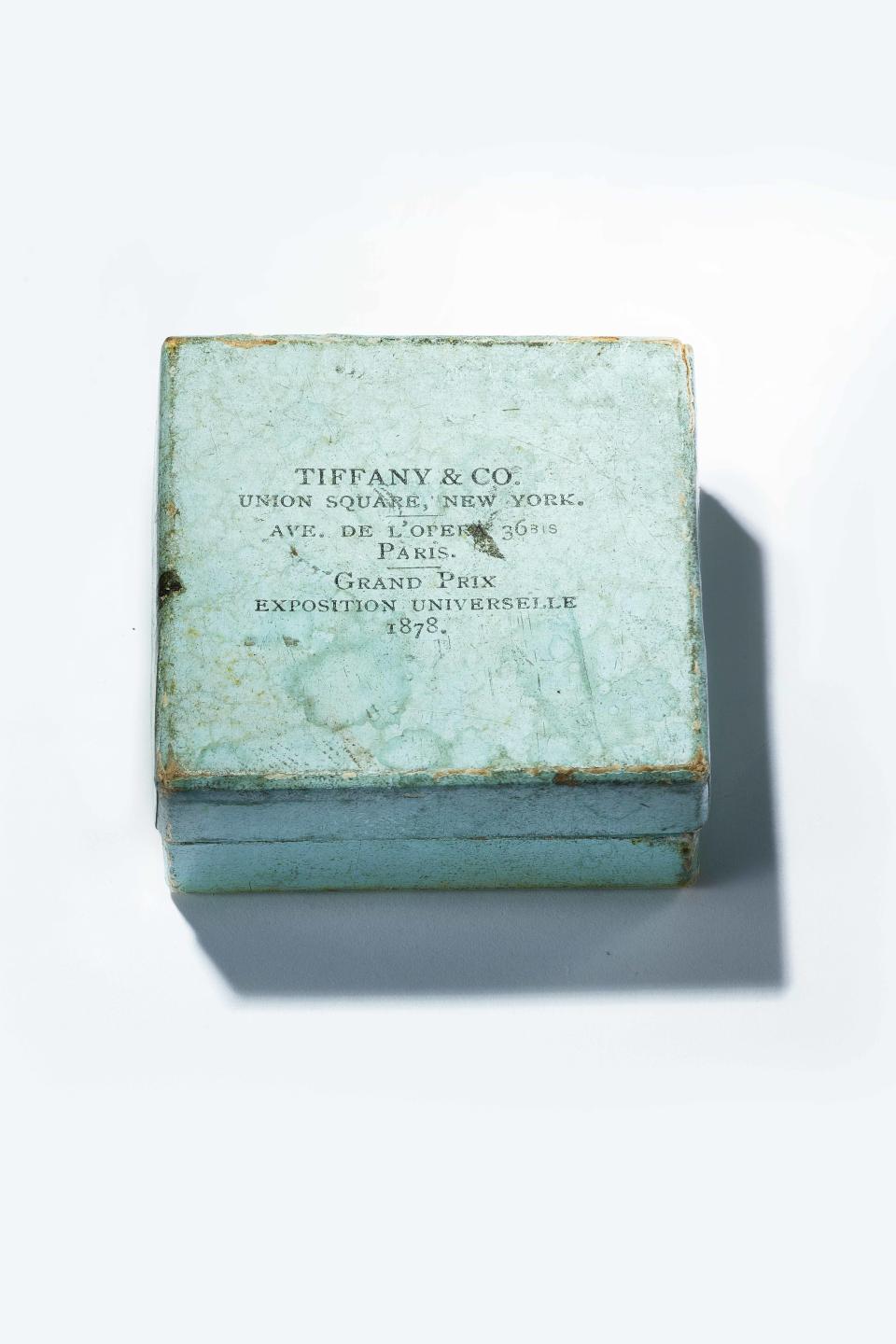

But contrary to jewelry purists’ suspicions and fears, Ledru is not the by-the-numbers luxury implant that many had thought. He displays an authentic passion and reverence for Tiffany’s history and can run down as many of its important milestone dates as he can the carat weights of significant pieces in its new Botanica collection. When WWD arrived in his corner office, with its sweeping Manhattan views, he was more excited to show off the archival pieces he had personally chosen to discuss than the grandeur of an LVMH executive suite. Among them was an original Tiffany Blue Box dating back to 1878 that had been reacquired by the jeweler in 2006.

Courtesy of Tiffany & Co.

There was also a gold, opal and demantoid garnet “medusa” necklace designed by Louis Comfort Tiffany — he of the famous Tiffany lamps and son of Tiffany founder Charles Lewis Tiffany — casually perched on a tuffet of black velvet. Ledru had instructed archivists to buy the piece at any cost and so the necklace, tarnished and still in need of significant restoration, became the subject of a bidding war with a “big museum.”

A quick search revealed that the jeweler purchased the necklace in November via auction at Sotheby’s for $3.6 million (excluding buyers’ premium), which is significantly higher than its $100,000 to $200,000 anticipated price. Ledru said if another one presented itself on the market, he would buy that one, too — just one example of the level of resources he has been given to succeed in his mission.

Tiffany’s new Botanica Blue Book line is the first in a trilogy of high jewelry collections to be released this year. It is based on three pillars pulled from nature that are significant to Tiffany’s archives — dandelion, orchid and thistle — and will be revealed late next month at Tiffany’s Blue Book event in Miami.

Ledru said high jewelry, which has been at the forefront of Tiffany’s brand “elevation” since his arrival, is also its fastest-growing category. Spotted on everyone from Hailey Bieber to Jay-Z, the sector is speaking to Tiffany’s new vision at its highest level and owes a significant portion of its pieces to Jean Schlumberger, an experimental midcentury designer whom LVMH is keen on reviving out of the archives. The designer’s seminal “Bird on a Rock” brooch design was one of the first pieces to be reintroduced under the French parent company’s watch and now has a six-month wait list.

Weston Wells/WWD

The Botanica collection includes the largest bird on a rock ever mounted, this one on a purplish-pink 113-carat morganite stone.

On the larger front, Botanica — with future iterations to be unveiled in London in June and select cities in China beginning in October — looks to floral iconography as a means to “lift up extraordinary gemstones,” said Tiffany chief gemologist Victoria Reynolds, who spearheads the annual collections.

This Blue Book collection is among the best in recent history and digs into Tiffany’s pillars of American wit, sensibility and craftsmanship. Unlike previous outings, it uses nature as more of a nuanced compass than a means for literal inspiration. In the interest of wearability, many pieces are modular and can be used in various configurations.

“The idea of transformability is always important to us. There is a very distinct point of view in each chapter, and each of them goes back to the archives. It wasn’t about going to the archives needing inspiration, it was about finding inspiration and reinventing it — there is nothing else that looks like this,” said Reynolds.

A necklace in the collection’s “orchid” section is comprised of two diamond chains that are cinched by a 51-carat fancy intense yellow diamond that can also be worn as a brooch. Tiffany’s jewelers revived a Schlumberger bracelet sketch that was originally designed as an option for the Tiffany Diamond. It took them more than three years to figure out how to actually produce it, placing a 48-carat aquamarine at its core.

The best example of the collection’s design ingenuity, however, is its “dandelion” section, in which three different cuts of diamond fan outward to create a sense of lightness, shape and texture. “When you blow on a dandelion, it disperses and goes all over — we thought diamonds were the perfect gemstone for this,” said Reynolds. The pieces, also transformable, play to Tiffany’s Art Deco heritage and leading diamond authority — with stones so colorless they’d make a fine engagement ring look rusty by comparison.

Courtesy of Tiffany & Co.

Blue Book’s fineries are endless and are rooted in a distinctly American, turn-of-the-century aesthetic. Ledru said that criticism that he is trying to turn Tiffany into a European luxury house is unfounded and that the jeweler has had a global approach since its founding. He cited founder Charles Lewis Tiffany’s gem sourcing trips to Europe, the discovery of gems like tanzanite in then hard-to-reach corners of Africa, and pillar collaborations with jet-set European figures like Elsa Peretti, Paloma Picasso and Schlumberger as proof of the company’s international roots.

“We are an American brand with European heritage, and we believe in that expertise and what Europe brought to the table. We manufacture in the U.S., that is part of it, we are a mix — we benefit from the American values of optimism and joy and from European luxury sophistication. I believe Tiffany is that bridge,” Ledru said of his wider outlook.

He remained mum, however, when asked if he wants to spearhead a modern Elsa Peretti-like franchise of his own. “The biggest success at Tiffany is not coming from an external designer or collaborator,” he said. “We want to bring a sophistication and modernize the brand. It’s been a classic approach [until now], we want to bring a bit of heritage so that it’s appreciated by younger generations in the years 2020, 2030 and 2040.”

Tiffany’s signature sterling silver offering, often seen as a rite of passage for young consumers, will be part of that mission through fashionable, experimental product. LVMH has already put in efforts to elevate that offering and released a collaboration with Supreme in November that sold out. Prices of Tiffany sterling classics have also seen steep increases, with its classic heart bracelet and necklace now retailing for $575 and $800, respectively (a Tiffany representative said this is partly due to the rising costs of silver material).

“Sterling is clearly a part of our DNA, almost as ancient as high jewelry — [we] reset the standards of silver,” Ledru said of the category. “It has to be playful and will be a playground for innovations. We can take any risk we want in that space: it’s often for a younger consumer and we will be behind it in a big way.”

Most of Tiffany’s jewelry collection, including sterling, is produced domestically in the U.S. The company operates workshops in Pelham, New York, and Cumberland, Rhode Island, among other locations. According to Ledru, this will not change under LVMH’s watch. “We are going to keep it as is,” he said, emphasizing that U.S. production is part of Tiffany’s DNA.

Weston Wells/WWD

Fine jewelry, which has been a growth vehicle for Tiffany even since before LVMH’s acquisition, is also getting a tune-up. New collections and extensions of existing franchise collections will launch at intervals throughout the year, with some exhibiting a more inclusive aesthetic approach.

“What people want and desire is beauty, and more for everyday — even for high jewelry,” Ledru said of his outlook on the fine jewelry category. “We will have a launch at the end of the year that is more unisex and will answer these needs. It’s not too serious, especially with what’s going on, you want jewelry you can wear on a daily basis.”

While fine jewelry will continue to speak to Tiffany’s heritage, its positioning via marketing and advertising will be geared toward new generations. “It needs to talk to them,” Ledru said.

Tiffany will continue to fine-tune this strategy with an armory of “upcoming talents” who are snagged as brand ambassadors early in their success. Among them are skier (and now Olympic gold medalist) Eileen Gu, rising tennis star and 2021 U.S. Open champion Emma Radacanu and Emmy-nominated actress Anya-Taylor Joy.

They are of course joined by megastars Beyoncé Knowles and Jay-Z, who have been featured in multiple Tiffany campaigns throughout the last year — part of a contract estimated by industry experts to be well into the the seven-figure range.

That deal, along with other celebrity ambassadorships, are being spearheaded by Alexandre Arnault — Tiffany’s executive vice president of product and communication — who oversees the jeweler’s marketing activities and product launches, like the Supreme collaboration. Ledru said the two men work in a quick-paced symbiosis: “Alexandre also moves really fast, we work a lot by instinct.”

When the campaign was revealed in August, Arnault told WWD: “[Beyoncé is] the best singer in the world, and [Jay-Z is] the best rapper in the world, hands down. And we’re the best jewelry company in the world, right? So we kind of had to marry ourselves together to produce this.” He labeled the company’s investment in the project as “impressive.”

Ledru considers the About Love campaign, with a close-up of the Tiffany Diamond on one page and Beyoncé on the other, as an ideal execution of his vision. “On the right side we have brand heritage and on the left side there is the lifestyle approach,” said the executive.

This lifestyle positioning will help spin a revitalized lore over Tiffany and all of its future activities. It’s now a matter of getting people back into the habit of stopping at Tiffany and convincing them to leave with a Blue Box. In his first two years at the helm, Ledru said he will be focused on jewelry. Other categories like watches, gifting, homeware, love and engagement and leather goods will soon follow.

“There is a form of generosity around Tiffany, more so than a traditional European jeweler. You come into a Tiffany store and we really feel like you should leave with a Blue Box because of that broad offering. It’s about, ‘When I come to Tiffany, I feel welcome and at ease,’ that is part of the dream of the brand, that we have this universal approach,” said Ledru.

The playing cards, key chains, cheese knives and baby rattles that had formed the base of Tiffany’s gifting business through the early 2000s have in recent times become less popular. Public opinion that LVMH would abandon these lower-priced products in favor of a high luxury makeover is categorically untrue, according to Ledru.

A first look at Tiffany’s new offering in this space will be unveiled in late 2022, with more to follow in 2023. “We have a strong team of experts who know gifting and home is a big part of what we used to do in the past. We really think about silver accessories is a big space, small leather goods, handbags. We want to preserve the tradition of, if you come to Tiffany, you will leave with a Blue Box,” the executive said.

This, of course, is all contingent upon Tiffany’s retail experience, which Ledru seems to be coming at with a large budget. He plans to renovate some 30 to 50 stores a year with a localized approach that fits within a larger template revealed at a new Tiffany shop-in-shop at Le Bon Marché in Paris, which opened in November.

The store concept sees Tiffany exchanging its classic steely and dark wood embellishments for brighter lights and warm, gold-tone fixtures. The use of Tiffany Blue is reserved for clever art installations — another play on the brand’s heritage while looking toward its future.

“It’s about femininity, about intimacy and storytelling and lifting up, in a subtler way than before, the important Tiffany elements of design. Every store will connect with its own market, it won’t be cookie-cutter. It’s about finding the right radio frequency, there won’t be 300 different designs but it’s going to be a made-to-order approach moving forward,” said Ledru.

This will be seen at its most “exceptional” form at the famed Tiffany Fifth Avenue flagship, which has been under gut renovation since January 2020 and could open by the 2022 holiday season. The renovation was planned before the LVMH deal, with a design by then-artistic director Reed Krakoff, who subsequently departed after the acquisition. The project is now being spearheaded by LVMH favorite Peter Marino, who was waiting to meet with Ledru during the course of this interview. Ledru said the new, Marino-designed Tiffany flagship “will be the ultimate incarnation of the brand.”

“We are an American pop icon, with Audrey Hepburn looking into the windows, [and] it’s a landmark on Fifth Avenue. We know the store traffic numbers and we can compare that — it’s a must-stop for tourists, like the Statue of Liberty,” Ledru said of the importance of the opening, which he cautioned may be pushed to early 2023 if the store is not in perfect form.

Ledru said Asia, particularly China, has been an important market for Tiffany’s diamond positioning — especially in the love and engagement space. He will look to grow the brand’s presence in Europe, with flagship “embassies” in key locations like Paris, Milan and a fully renovated store on London’s Old Bond Street.

But to him, more than betting big on an emerging market, Ledru sees the biggest potential in the U.S. “The best-kept secret is here, whatever resonates in the U.S. usually resonates at a worldwide level,” he said. “I am convinced the amount of engagement we can grow in the U.S. is the biggest one, which may seem counter intuitive.”

These plans are now taking place amid a backdrop of general uncertainty. As part of LVMH’s larger directive, Tiffany has closed its two shops-in-shop in Russia. While the country represents a small share of global sales, its invasion of Ukraine has hampered global luxury stock prices — cutting into stability and gains made after the pandemic. Global affairs experts predict that conflicts and disruptions like the Ukraine war and the COVID-19 pandemic may only accelerate in coming decades.

It’s no secret that luxury, the highest expression of discretionary spending, takes a big hit in times of crisis. When asked about his outlook on the industry, Ledru said: “You cannot control what you cannot control. Over the last few years the only thing you know is that you never know. We are getting prepared. The luxury industry after COVID[-19] is still strong and overcame it. We are always optimistic with what we want to achieve and have a plan B and a plan C because we know the world is highly unstable.”

And with that, Ledru readies for a quick rendezvous with Marino before heading to the airport for business meetings in Paris. Ever moving, his work at Tiffany, he says, is “never-ending…you are never done — when you are, then you are finished.”

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.