EDITED’s Latest Report Looks Into the Future of Sustainability

The below stats and insights are pulled from EDITED’s latest report: “Has Fashion Hit Peak Sustainability?” To download the full report with many more facts, figures and data points, please click here.

Australia endured the hottest summer in history in 2023. Earlier this year, the Great Barrier Reef experienced another mass coral bleaching event. Deforestation in the Brazilian Amazon increased over 20 percent last year, reaching the highest levels since 2008.

More from Sourcing Journal

Is Mycelium All Hype, No Hope? Experts Weigh In During Earth Day Panel

Supplier Perspective Will Prove Crucial for Scaling Sustainable Innovations

The climate crisis is here. In spite of this, sustainability initiatives in the fashion industry have suffered setbacks. Renewcell filed for bankruptcy, while Spinnova reported sinking sales and restructuring ahead. Fast fashion stock is up 43 percent against 2022, while Shein’s revenue soared 40 percent year over year.

EDITED’s latest report, “Has Fashion Hit Peak Sustainability?” digs into these challenges—among others—and offers insights and ideas for overcoming them as well as real-world industry responses.

“Sustainability has undergone a transformation within the fashion industry. In 2019, we saw the term really skyrocket as a buzzword,” Kayla Marci, EDITED’s senior fashion and retail analyst, told Sourcing Journal. “‘Conscious,’ ‘recycled’ and ‘green’ collections started becoming the norm for retailers to advertise without any regulations, and brands began setting lofty environmental targets to minimize their impact without third parties holding them accountable. However, consumers now demand a more authentic approach to sustainability, and public and government bodies are cracking down on greenwashing.”

Mounting Production Levels

The Problem

The retail supply chain accounts for 25 percent of global greenhouse gas (GHG) emissions, per data from Deloitte—and the fashion industry’s emissions are projected to increase by more than 50 percent by 2030, according to the World Bank.

But these numbers aren’t stopping brands from churning out more (and more) products at “breakneck” speeds.

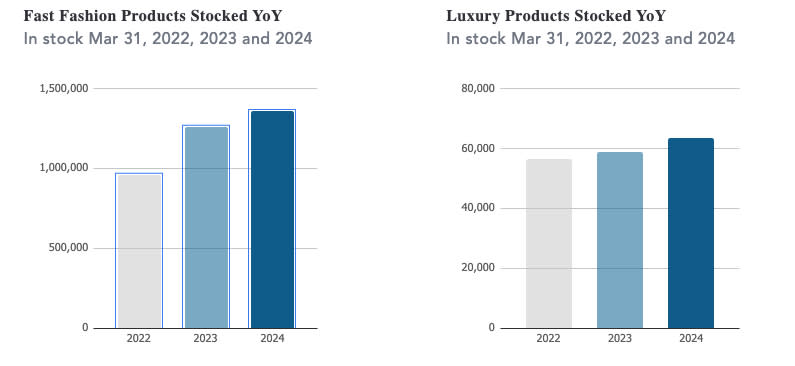

While fast fashion brands get the worst rep for overproduction—and rightfully so, considering the number of items stocked online sits at a two-year high—luxury players aren’t blameless. Both LVMH and Kering reported roughly $3.4 billion and $1.6 billion, respectively, of unsold inventory last year, adding to the 92 million tons of waste in landfills annually impacting the Global South.

EDITED data backs these figures up, noting luxury stocks have risen over the past two years, up 8 percent year over year and 12 percent versus 2022. The retail intelligence platform pointed out that this data “doesn’t even consider sizes or stock levels, highlighting just how astronomical retail production levels are.”

“This trend underscores the substantial volume of merchandise produced by both fast fashion and luxury brands. Supply chain disruptions may have also contributed to this rise, leading to order backlogs,” Marci said. “Retailers may have overproduced in anticipation of post-pandemic spending and experienced that demand did not meet supply with tightened consumer budgets, causing inventory levels to pile up.”

The Solution

“Brands don’t need to produce countless goods to generate sales,” EDITED wrote. “Minimizing the number of new styles delivered won’t negatively impact profits. Don’t believe it? Look to Uniqlo’s parent company. Fast Retailing saw a 25 percent jump in first-quarter operating profit for the first three-month period through to Nov. 2023 and a third year in a row of record earnings. Uniqlo contracted its newness output in 2023 in the U.S. and the UK by 29 percent and 19 percent, respectively, EDITED found.

“The number of new styles introduced at Uniqlo has dropped YoY, signifying that retailers don’t need to rely on constant newness to boost sales,” Marci explained.

With that in mind, the platform recommends that retailers take a “surgical approach” to determine where to give and where to take, thus avoiding the environmental and financial costs of unsold goods.

“Retailers frequently make decisions without sufficient data, underscoring the importance of retail intelligence in navigating the industry’s environmental and economic challenges,” Marci said. “By leveraging EDITED, retailers can pinpoint the optimal products and pricing for their assortment. The technology can help mitigate the need for steep discounts and ultimately lower the volume of unsold inventory at the end of each season, helping retailers reduce overproduction.”

The Response

France’s National Assembly unanimously passed a bill imposing a 10 euro (roughly $10) per item penalty fee for businesses releasing more than 1,000 new SKUs on the market daily. While the regulation still needs to go through the French Senate to be passed, it would threaten ultra-fast fashion business models—forcing retailers to limit production levels—if approved.

Meanwhile, luxury brands are looking at artificial intelligence (AI) to “improve sales forecasts and limit the quantity of unsold goods at the end of each season,” EDITED reported. Kering, for example, said it successfully “improved the accuracy of its inventory predictions” by over 20 percent last year.

And brands, like the independent label Cawley Studio, are utilizing pre-orders to gauge consumer demand—minimizing unsold inventory as well as shifting consumer mindsets away from the instant gratification of a two-day delivery in the process.

Underfunding the Materials Revolution

The Problem

While a new material innovation startup emerges quite regularly, the majority have failed to scale meaningfully. After failing to raise enough capital, Bolt Threads halted production of its Mylo mushroom leather in 2023. Textile recycling companies like Renewcell and Spinnova have called it quits and planned for restructuring, respectively.

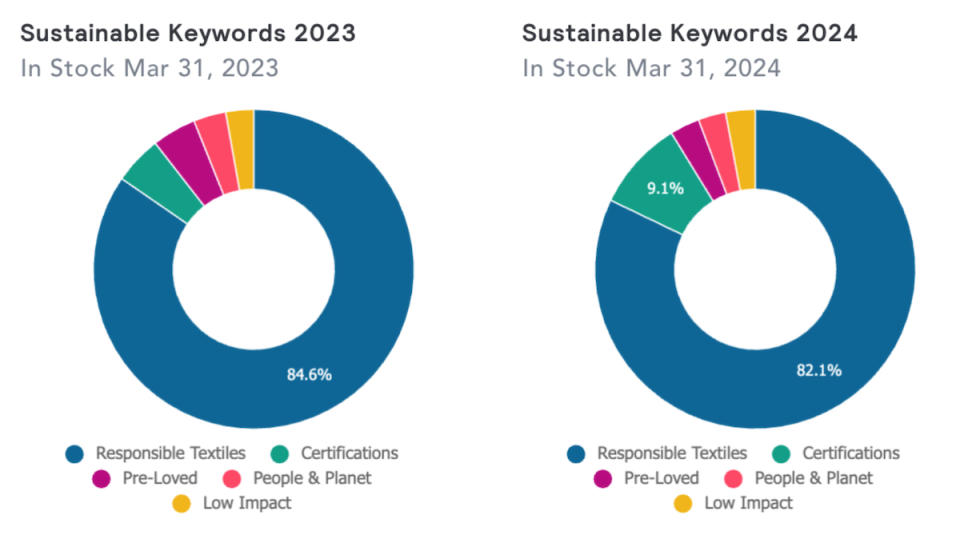

“Once touted as the future of sustainable fashion, plant-based alternatives have fallen off the radar,” EDITED wrote. In analyzing 200,000 products from top U.S. and UK-based mass market retailers, the retail intelligence platform found that products described using sustainable keywords equal 34 percent of ranges, up from 28 percent in 2023. EDITED also found that retailers primarily invest in responsible textiles (82 percent) and certifications from third-party companies (9 percent) to help build consumers’ trust in brands.

The Solution

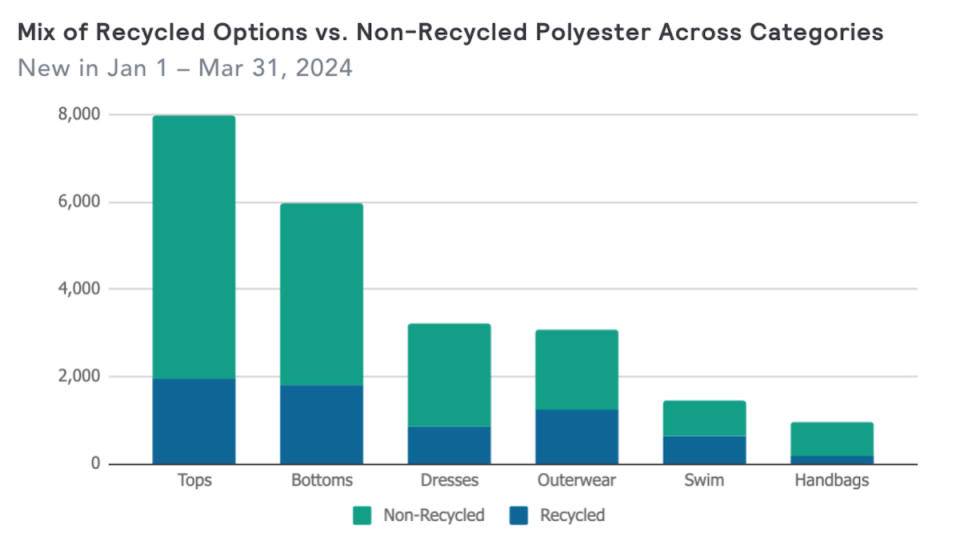

“Fabrics containing recycled components comprise the bulk of the responsible textiles retailers use in assortments, as recycled polyester (or rPET) is often viewed as an entry point for sustainability,” EDITED said. “Despite the levels of overproduction and textile waste, most recycled polyester in the market comes from polyethylene terephthalate (PET) bottles, not recycled garments. These have been critiqued as they can’t be recycled at scale and contribute to microfiber pollution, and retailers continue to use them alongside petroleum-derived versions.”

Upon analyzing new polyester arrivals for the first quarter of 2024, EDITED found that traditional polyester continues to “overpower” assortments. Recycled alternatives account for less than 25 percent of tops, handbags and dresses.

“Solely swapping polyester for recycled won’t benefit retailers or consumers in the long run,” EDITED wrote.

The Response

Everlane recently launched its first designer collaboration with London-based design duo Marques’ Almeida to reimagine the San Francisco-based brand’s best sellers, including the Utility Barrel Pant and Way High Jeans, entirely using surplus fabrics. And Evrnu launched its first direct-to-consumer (DTC) product, the 360 Hoodie, made from NuCycl, a 100 percent recyclable lyocell material made entirely from cotton textile waste.

Meanwhile, H&M Group pledged $600 million over seven years in support of a new textile-to-textile recycling project dubbed Syre. Initiated by the Swedish retailer and investor Vargas Holding, with backing by TPG Rise Climate, Syre aims to “decarbonize and dewaste” the textile industry through textile-to-textile recycling at “hyperscale,” beginning with polyester.

For more on this report, click this link.