How cryptocurrency exchange Binance prevents employee insider trading

Wall Street may have a mixed attitude towards cryptocurrency, but those who work in the crypto Wild West are learning from the old school.

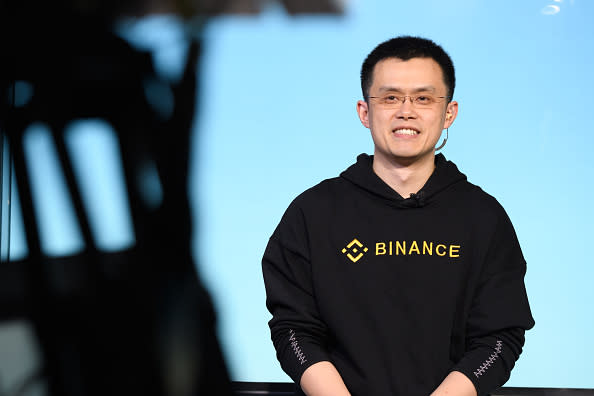

Binance, the world’s largest cryptocurrency exchange by trading volume, has implemented trading restrictions on its employee that its CEO says he learned from big investment banks.

“We allow our employees to hold cryptocurrency because we believe in its future, which will be more valuable than fiat money,” Binance CEO Changpeng Zhao tells Yahoo Finance. “But everyone has to get preclearance if they want to trade any kind of cryptocurrency, and they have to wait for at least 30 days to make another trade.” Zhao says the trading restriction actually helps employees make more money, because it forces them to hold longer despite short-term volatility. “I’m never a fan of day trading,” he says.

The rule has been in effect at Binance since its launch last September, as a measure to avoid any possibility of insider trading. With knowledge of advanced market actions like new coin listings, employees at cryptocurrency exchanges are likely to gain unfair advantages in trading — especially now that some exchanges are also launching their own tokens.

Binance, for example, issued Binance Coin (BNB), which gives users a 50% discount on transaction fees when they use Binance Coin in trades. The price of Binance Coin has skyrocketed 2,700% in the three months since its launch; after last week’s announcement of Binance building a new decentralized exchange, Binance Chain, the token’s price jumped another 25%.

As a major holder of Binance Coin, Zhao was named a “crypto billionaire” on the cover of Forbes in February; the magazine estimates his net worth between $1.1 billion and $2 billion. He doesn’t see any conflict of interest in personally holding a large supply of Binance Coins. “I don’t plan to sell any of my coins for a couple years, so I am going very long,” he says. “I have more than enough spending money, even without the $1 billion valuation, so I’m not in a hurry.”

Coinbase added to concerns about employee insider trading in December

SEC trading restrictions on employees of a brokerage are commonplace in the traditional financial industry. Bank and hedge fund employees follow strict rules on trading blackout periods and preclearance procedures. If people get caught with an account that they fail to report or a trade that they don’t preclear, they are likely to get fired.

But in the cryptocurrency world, the SEC is still pondering policy, and self-regulation fills the void. Many in the industry say it’s not good enough, and welcome formal government regulation, while others dread it.

Coinbase, the most popular cryptocurrency exchange in the U.S., prohibits its employees and contractors from trading on “material nonpublic information” and communicating information outside the company.

Nonetheless, in December, the price of the cryptocurrency bitcoin cash (BCH) skyrocketed hours before Coinbase announced it would add bitcoin cash to its site. Industry insiders largely concluded that some people (friends of employees, for example) knew Coinbase would be adding bitcoin cash and bought it up in advance, expecting the price would spike after Coinbase’s announcement. Despite prohibiting employees from trading bitcoin cash one month before adding it to the platform, Coinbase was still widely accused of insider trading.

Coinbase says it is still investigating the matter. “If we find evidence of any employee or contractor violating our policies — directly or indirectly — I will not hesitate to terminate the employee immediately and take appropriate legal action,” CEO Brian Armstrong wrote in a blog post. A Coinbase spokesperson said the company doesn’t have new information to share at the moment.

OKEx, another major cryptocurrency exchange, declined to share the trading rules that govern its employees in response to a Yahoo Finance inquiry, saying that such rules are, “strictly confidential and for internal use only.”

For now, without formal government regulations, the companies must self-police. And that’s one element of the crypto world that turns off potential newcomers.

Krystal Hu is a reporter at Yahoo Finance. Follow her on Twitter

Read more:

Bitcoin miner: ‘I haven’t paid for heat in three years’

How Chinese bitcoin buyers are getting around the government ban