Why stock markets are panicking about coronavirus

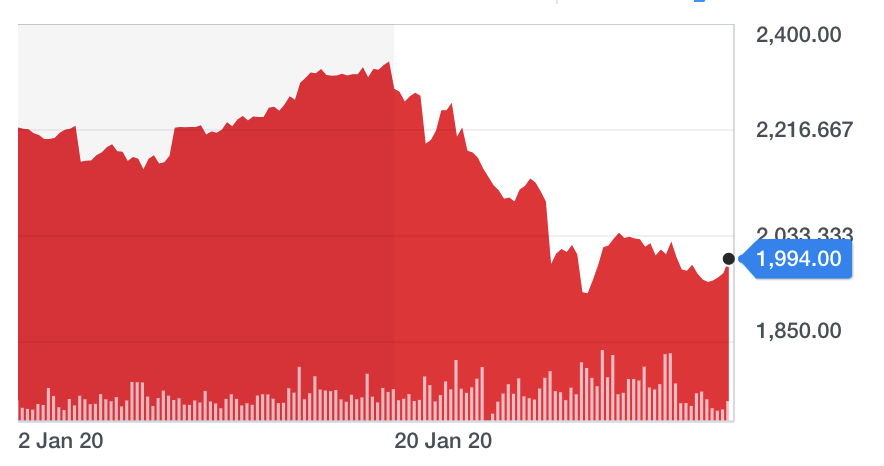

Chinese stocks had their worst day in nearly five years on Monday, even after the People’s Bank of China tried to ease fears by pumping a mammoth $171bn (£130bn) into the country’s financial system.

The sell-off was driven by growing anxiety about the coronavirus epidemic. While primarily a public health crisis, the outbreak is having an economic impact too.

“In the short term, [it’s] likely to bring some slowdown,” Kristalina Georgieva, the managing director of the International Monetary Fund, said last week. “In the long term, we don't know.”

While the full impact is still up in the air, economists already expect a significant hit to global GDP growth.

Investment banks Goldman Sachs (GS), UBS (UBS), and Jefferies (JEF) have all warned about the economic impact of coronavirus in recent days.

A blow to China is a blow to the global economy

Economists are looking to the 2003 SARS epidemic to put coronavirus in context.

SARS, which is similar to coronavirus, knocked two full percentage points off China’s economic growth in the quarter before the virus was contained; 8,100 people were infected with the virus over the course of eight months.

There have now been well over 17,000 confirmed cases of coronavirus worldwide, less than two months after the first cases emerged. There is no indication that infections are slowing.

Not only is the coronavirus outbreak larger, but China is far more dominant in the global economy than it was in 2003 when SARS broke out.

“As a share of global GDP, Chinese goods imports are three times as large as they were in 2003. And Chinese tourists’ spending abroad is about eight times as large,” Jan Hatzius, the chief economist of Goldman Sachs, told clients on a call on Monday.

READ MORE: Coronavirus sparks biggest Chinese stock crash since 2015

Chinese equities play a much larger role in markets too. In dollar-value terms, Chinese stocks accounted for just 5% of Asian equities in 2003. Now, they account for 33%, meaning a sell-off in China ricochets across an entire continent.

Adding to China’s economic significance is its status as the world’s biggest oil importer. Wuhan, the centre of the outbreak, is one of the country’s oil and gas hubs.

“The coronavirus will have a much more meaningful impact on GDP [than SARS],” analysts at Jefferies said on Monday.

Goldman Sachs predicted the epidemic would shave two percentage points off Chinese economic growth in the first quarter, assuming the virus is contained within the next two months.

That would take China’s annual GDP growth to 5.5% in 2020 — the slowest pace of expansion in 30 years.

Goldman warned global growth could be cut by two percentage points in the first quarter, as a result of the slowdown in China and spillover effects internationally. China is the European Union’s second-largest trading partner and Germany sends more goods to China than anywhere else.

UBS and Jefferies have predicted similar blows to global GDP growth.

Retail and travel stocks feel the heat

The economic impact of epidemics is typically linked to efforts to contain outbreaks.

Travel in China has been severely restricted, factories have been shut down, and major retailers like Apple, Starbucks and McDonald’s have shuttered stores across the country. Most consumers are hunkered down at home.

All of that means less demand for imported goods, air fares, and potential supply chain problems for companies. It translates to lower profit expectations at many companies, which is what’s driving investors to sell shares.

One of the worst-hit sectors has been luxury goods, which relies heavily on affluent Chinese shoppers. Shares in Burberry (BRBY.L), for example, have lost more than 10% of their value since the beginning of the year.

‘We don’t know the scale of the crisis’

Economists are now focused on figuring out just how long the coronavirus outbreak will continue.

“The key issue is how long these [restrictions] stay in place and whether you start seeing these kinds of restrictions in other countries,” Andrew Tilton, chief Asia economist at Goldman Sachs, said on Monday.

READ MORE: How coronavirus outbreak is hitting companies around the world

Tilton said epidemics typically trigger a “one- to three-month slowdown in the economy, which often cuts several percentage points at an annual rate off GDP growth for one quarter in the worst-hit economies.”

But he warned annual Chinese GDP growth could fall below the 5% mark if the virus is not contained by the start of the second quarter.

We are still in a period of “high uncertainty,” said Zach Pandl, co-head of global FX at Goldman Sachs.

“We don't really know what exactly the scale of the crisis we have here is,” he said.