Economist: ‘Depression-magnitude’ job losses coming

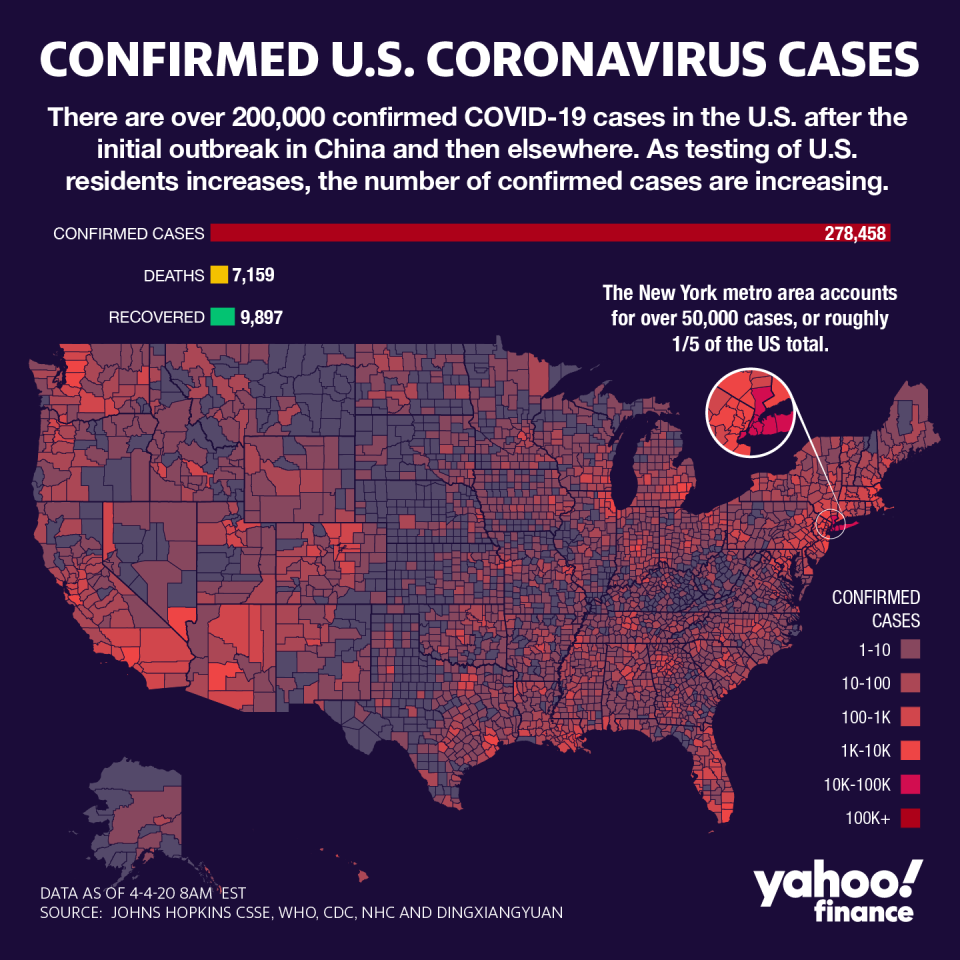

The coronavirus outbreak, or COVID-19, is pushing the U.S. economy further into historic territory.

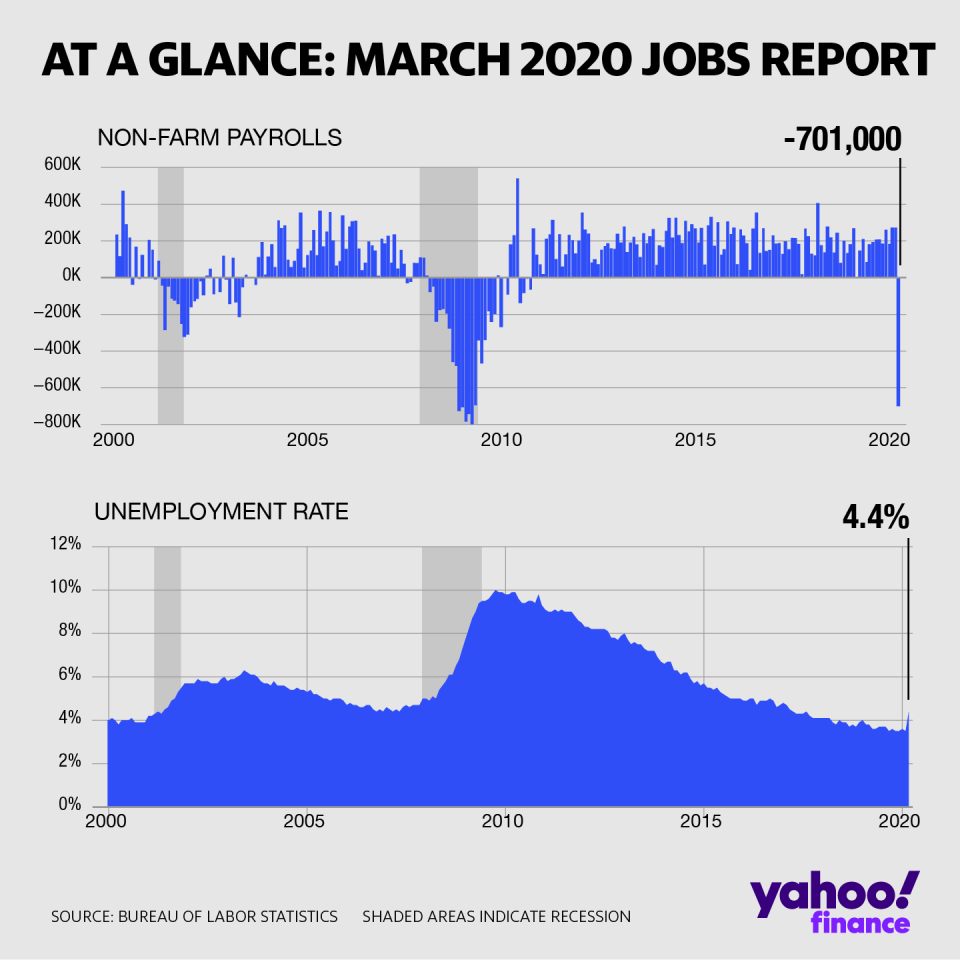

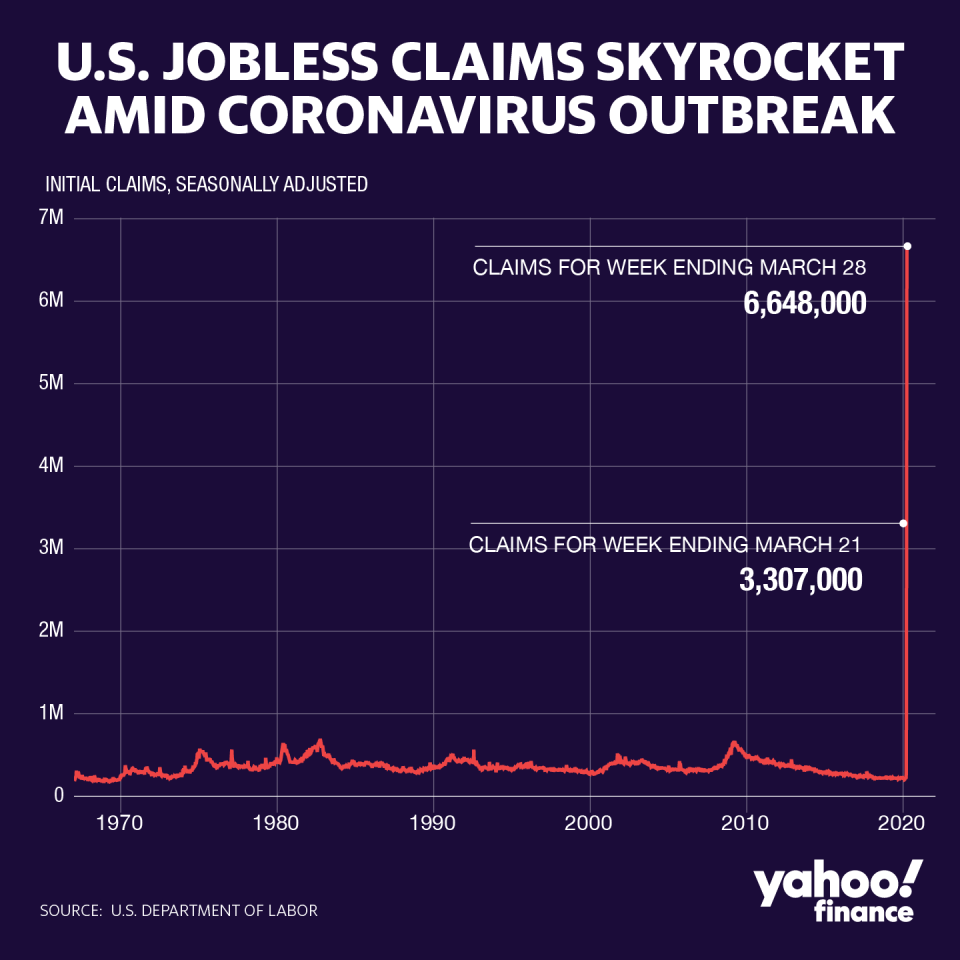

The economy saw an unprecedented 6.648 million people applying for unemployment claims for the week ending March 28 when initial jobless claims came out on Thursday. On Friday the March jobs reports showed that the economy shed 701,000 jobs when economists were expecting a decline of 100,000.

“The monthly payroll jobs report has been upstaged by the last two weeks of unemployment claims applications totaling nearly ten million,” Chris Rupkey, MUFG managing director and chief financial economist, wrote in a note on Friday. “The 701 thousand lost payroll jobs is just a down payment on the immense losses that are already here and have yet to be counted. What is next month's figure going to be? Down 9 million? Down 15 million... The country is literally shutting down.”

Markets ended down on Friday, with the Dow down 1.69%, the S&P 500 down 1.51% and the Nasdaq 1.53%.

And the March reports are just a sign of the times to come.

“The month of April will have the first depression-magnitude job losses the country has seen since the 1930s,” Rupkey wrote. “The unemployment rate moved up from 3.5% in February to 4.4% in March, but the labor market could easily become depression-like very quickly where one out of four of your neighbors is no longer getting a paycheck. Stay tuned. The worst is yet to come.”

Highlight: “It’s even worse,” @KPMG's Constance Hunter says about comparing today’s recession to the Great Depression. “Because during the Great Depression we didn’t have a sudden drop off the cliff like this… this is way worse than anything we saw in the Great Depression.” pic.twitter.com/zDuNM4TcRY

— Yahoo Finance (@YahooFinance) April 3, 2020

The unemployment numbers for the week ending March 21 saw 3.307 million claims were filed before this week’s claims doubled that. And prior to the coronavirus-induced economic shock, the previous record was 695,000 claims filed the week that ended October 2, 1982.

“Net, net, job layoffs are soaring faster than any time in recorded history,” Rupkey previously wrote in a note on Thursday morning. “This looks bad and it is bad. The worst jobless claims in U.S. history means the economy has fallen into the abyss. Stay tuned. Story developing.”

‘American workers have nowhere to hide’

The jobless claims number is likely to increase further in the coming weeks, according to Rupkey.

“We knew that massive job losses were coming because of reports that many workers were unable to file a claim for benefits even after waiting on line for hours,” he wrote.

This is perhaps an indication that U.S. economy has “skipped recession and has already moved deep into the depression zone,” he added. “American workers have nowhere to hide as the job layoffs are going to go global as world trade collapses.”

Economists, though not fully prepared for the extent of the unemployment claims figures as evidenced by all major consensus estimates being lower than the latest jobless claims, were at least mentally prepared for whatever is in store in the upcoming weeks and months.

“Economic data in the near future will be not just bad, but unrecognizable,” Credit Suisse economists led by James Sweeney wrote last week. “Anomalies will be ubiquitous and old statistical relationships within economic data or between market and macro data might not always hold... There is no blueprint for the current shock, and uncertainty about the extent of contagion and the economic consequences is overwhelming.”

Economists at Goldman Sachs warned that U.S. GDP would collapse 34% in Q2, which would be more than triple the record 10% drop seen in 1958.

In their latest note, Goldman analysts explained that “the anecdotal evidence and the sky-high jobless claims numbers show an even bigger output and (especially) labor market collapse than we had anticipated. This not only means deeper negatives in the very near term but also raises the specter of more adverse second-round effects on income and spending a bit further down the road.”

Millions of Americans are at risk

While the virus continues to spread, experts warn that the desire to rush a re-opening of the economy is incredibly ill-advised.

“With a further spread of the virus and repeated lock-downs, we also see more scarring from this scenario, with growth returning to only slightly positive in Q4 and only slowly normalizes in 2021,” Deutsche Bank analysts wrote in a note. “For the year, the economy contracts 7.8% in 2020 under this profile (-10.9% Q4/ Q4), and the rebound is more subdued in 2021, with activity rising only 2.0% (6.4% Q4/Q4).”

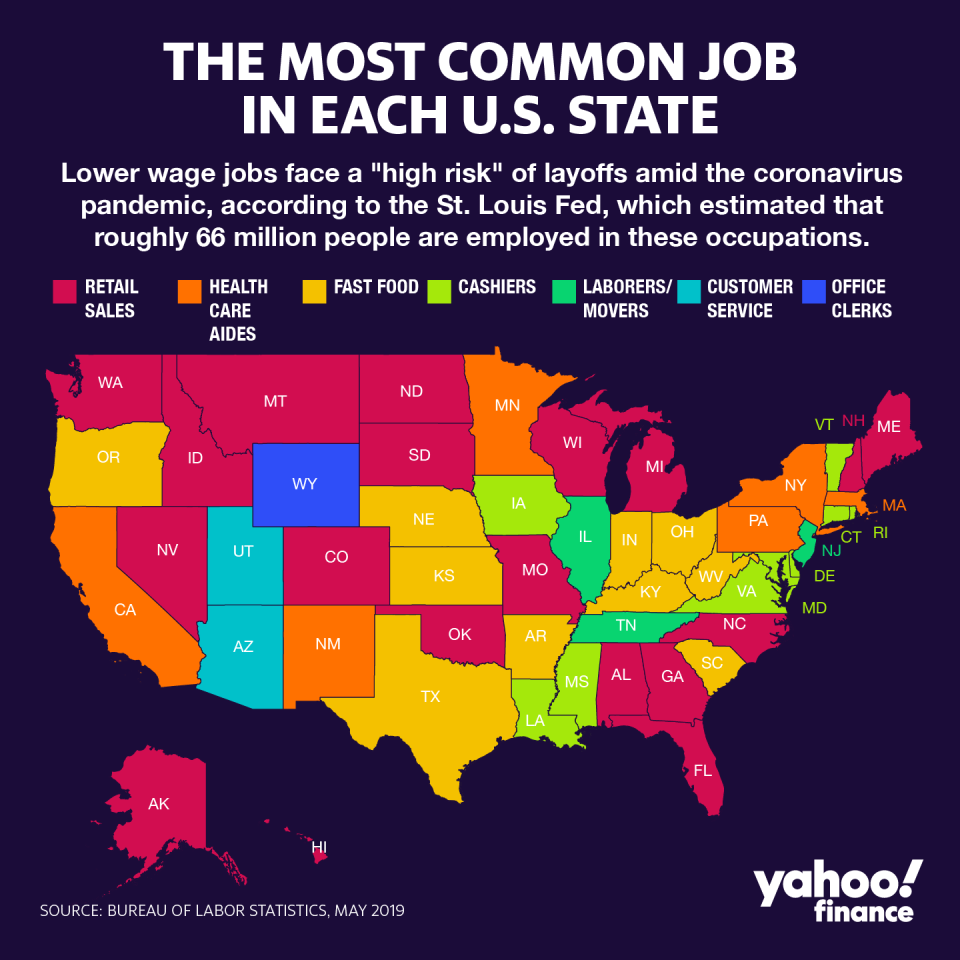

Overall, more than 66 million jobs across sales, production, and food preparation services are at “high risk” of layoffs, according to a St. Louis Federal Reserve economist earlier this month.

Using 2018 occupational data from the Bureau of Labor Statistics (BLS) detailing 808 occupations, the St. Louis Fed’s Charles Gascon found that 66.8 million people — 46% of working Americans — are employed in these occupations that are at “high risk” of layoffs.

These included people involved in food preparation and serving-related occupations as well as those in sales, production, installation, maintenance, and repair jobs.

The Economic Policy Institute estimates that nearly 20 million workers will be laid off or furloughed by July.

Good news: Trade deficit narrows

Rupkey did note a silver lining among the depressed consumer spending outlook.

“The trade deficit in February is narrowing and that's a good thing as it will add to GDP growth and right now there is limited growth ahead so any sector of the economy that can lend a hand is welcome,” he stated. “Americans buy less imported goods in a recession, that's a fact, an ironic fact that reduced imports add to GDP growth.”

—

Aarthi is a reporter for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

More than 66 million U.S. jobs are at 'high risk' of layoffs amid coronavirus, St. Louis Fed finds

Coronavirus stimulus bill: 7 ways student loan borrowers benefit

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.