Boeing Wants a Bailout After Years of Bad Corporate Governance—and Without Giving Taxpayers Anything in Return

Boeing is among the world's largest aerospace companies and defense contractors. It secures more in government contracts every year than almost any other firm. In 2017, for instance, Boeing pulled down $23.4 billion in taxpayer cash, second only to Lockheed Martin's $50 billion. That looks like a steal when you look at what we get for that Lockheed money—namely, the F-35 Flying Dunce Cap—but it's just one segment of Boeing's business. It also has contracts with airlines foreign and domestic, which helped it bring in $100 billion in total revenue that year. That's also part of why Boeing is in a whole lot of trouble now: air travel is down as much as 95 percent in the United States, which is killing airlines that, in turn, may pull the plug on some deals they may have had with Boeing.

On Wednesday morning, the firm announced a $641 million loss in the first quarter of 2020, CNBC reports, and said it has burned through $4.3 billion in cash. Revenue dropped 26 percent from the first quarter of last year, to just shy of $17 billion. It will cut payroll by 10 percent, through "voluntary measures" and layoffs in its 160,000-person workforce. In yet another signal that the stock market has zero remaining connection to economic reality, both the Dow Jones Industrial Average—of which Boeing is a constituent stock—and the company's own shares are up this morning. But it still looks like a bad situation beyond the immediate present, and the firm is seeking $60 billion in government aid "for itself and its supply chain."

On the face of it, a government intervention at this scale could be justified. Like many thousands of American firms, the company's health has been damaged by factors beyond its control: an overall economic freeze thanks to the coronavirus pandemic, and one that hit air travel particularly hard. But it's not really that simple.

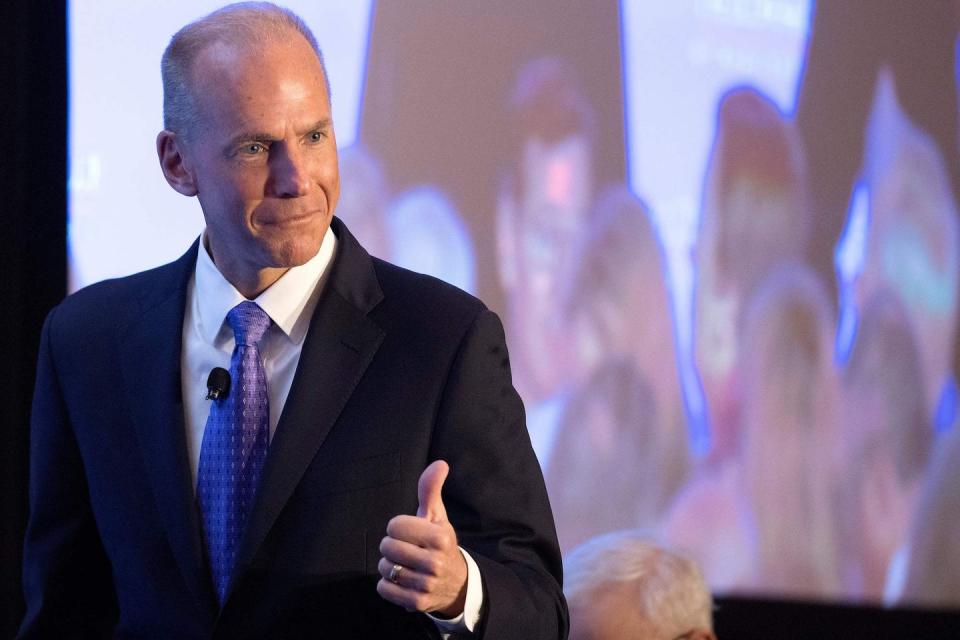

For one thing, this is not Boeing's worst quarter in recent years, as a CNBC graph shows: that was the second quarter of 2019, after two separate Boeing 737 Max planes crashed in a five-month period, and the model—the company's newest—was grounded indefinitely. It remains so, because investigations into the incidents pointed to major design flaws with the aircraft, in addition to problems with pilot training and experience standards in some areas it was operated. Subsequently, we learned that part of the issue is that, under the Trump administration, the FAA forked over a lot of its safety certification work to Boeing. This left the company to say its own plane was safe, a fairly brazen example of regulatory capture—not to mention a conflict of interest—that surely had nothing to do with then-Boeing CEO Dennis Muilenberg's cozy relationship with the administration. Then Bloomberg got hold of some internal emails showing Boeing employees had little faith in the design but worked to deceive regulators anyway.

The 737 Max disaster is a big part of the firm's continued financial difficulties, and in the kind of rugged free-market economy the United States pretends to be, Boeing would be appropriately punished by the Darwinian realities of raw capitalism. The United States is not any of that, but it is a place where monopolistic forces have gravely distorted those same markets and captured much of the government. This has led not just to the kind of farcical deregulation noted above, but also to the Republican Tax Breaks for Corporations and the Rich bill in 2017. Boeing benefited there, but even before that it was using all the tools at its disposal as a multinational corporation to often pay a single-digit federal income tax rate in the United States of America. Some years, it paid negative rates. Boeing took home an extra $1.1 billion thanks to the 2017 bill.

This left the company with a lot of cash on hand in the feast times. Did it use that for research and development? Expanding operations and hiring workers? Creating a rainy-day fund? Maybe a bit, but it also spent $11.7 billion over the last two years on stock buybacks. That's where the company buys up its own stock to boost the share price for stockholders. Conveniently, this also may boost the CEO's pay if his contract includes bonuses tied to a rise in stock price over the short term. In fact, stock price has become not just the core but almost the sole pillar of corporate governance since this country was remade in the image of Ronald Reagan and Milton Friedman.

Boeing's 160,000 workers will probably be a cornerstone of the company's rhetoric in its campaign to secure a taxpayer bailout, even if it could have just saved some of the many billions of cash it had on hand over the last decade, and even if ordinary people and small businesses who mismanage their finances have no such luxury. Thanks to their relentless representation in government by Republicans and some corporate Democrats—and the inability or unwillingness of Democratic leadership to prevent it in the various pandemic relief bills—they might just secure their taxpayer money with very few strings attached. While the Paycheck Protection Program, meant for small business, also helped a lot of Bigger Business because Congress and the White House chose to route the money through big banks, the Washington Post reports on a newer, even-less-transparent initiative.

A Federal Reserve program expected to begin within weeks will provide hundreds of billions in emergency aid to large American corporations without requiring them to save jobs or limit payments to executives and shareholders. Under the program, the central bank will buy up to $500 billion in bonds issued by large companies. The companies will use the influx of cash as a financial lifeline but are required to pay it back with interest.

Unlike other portions of the relief for American businesses, however, this aid will be exempt from rules passed by Congress requiring recipients to limit dividends, executive compensation and stock buybacks and does not direct the companies to maintain certain employment levels. Critics say the program could allow large companies that take the federal help to reward shareholders and executives without saving any jobs. The program was set up jointly by the Federal Reserve and the Treasury Department.

Not great, Bob. Based on past behavior, are we to believe Boeing will take this money and put it towards saving jobs? Or will it disproportionately go towards buybacks and political influence and executive compensation? If we've learned anything about America By Reagan, it's that multinational corporations should not be left to their own devices. And this is yet another big sack of money put in the hands of one Steven Mnuchin, Foreclosure King-turned-Secretary of the Treasury.

But perhaps the most insulting bit of all this is Boeing's most steadfast commitment of all: the firm is determined to get hold of some taxpayer cash, but even more determined not to give the American taxpayer anything back. The company that often did not pay taxes, and used its spare cash to juice its stock price, has declared it will not under any circumstances give taxpayers a stake in the company in exchange for their money. We are expected to give them something for nothing. Even the banks couldn't escape giving up some equity when we bailed them out in 2009. The new chief executive, Dave Calhoun—who replaced Muilenberg after the 737 MAX fiasco—dismissed the idea of the U.S. government taking a stake last month: "I don’t have a need for an equity stake," he said on the Fox Business Network. "If they forced it, we’d just look at all the other options, and we have got plenty."

What are the other options, Dave? Presumably, to milk their political connections until they get the cash for nothing. America, the beautiful.

You Might Also Like