‘Bitcoin dead’ searches hit all-time highs after one of the worst crashes in history

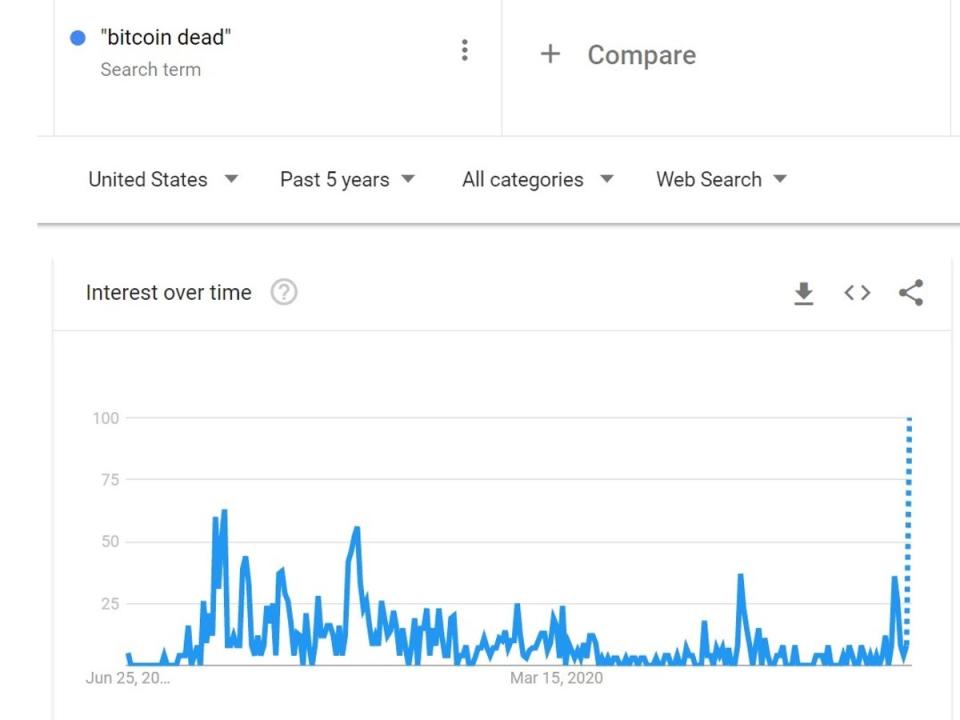

Online searches for the term “bitcoin dead” have surged in recent days following one of the worst price crashes in the cryptocurrency’s history.

Data from Google Trends shows that the spike in searches coincides with bitcoin’s latest price capitulation, which saw it fall from above $30,000 at the start of June to below $20,000 this weekend.

It is the latest severe drop in a series of price falls that began last November when bitcoin was trading at record highs close to $69,000.

Previous price crashes following record-breaking rallies in 2013 and 2017 also saw searches for the term rise in the US and throughout the world, though Google’s publicly-available data is not detailed enough yet to see whether the number of searches was comparable.

The trend, first spotted by trader Alex Krüger, follows pronouncements from prominent bitcoin skeptics like Peter Schiff that “bitcoin will not recover”.

One website that tracks the number of times the death of bitcoin has been pronounced by the media also saw a flurry of reports during the latest downturn.

The site 99 Bitcoins has registered more than 455 obituaries since bitcoin’s inception in 2009.

In its 13-year history, bitcoin has seen record-breaking price rallies roughly every four years, with its latest all-time high hit on 8 November 2021.

This weekend, when bitcoin fell below the 2017 all-time high of $20,000, it marked the first time the cryptocurrency’s price had fallen below the all-time high of a previous cycle. Falling below this level means a key psychological level of support no longer exists.

The extent of previous price capitulations following all-time highs in 2013 and 2017 have also spooked investors, with both corrections seeing losses of more than 80 per cent. After dropping below $20,000, bitcoin is currently only down by just over 70 per cent from its 2021 high.

Crypto market analysts have attributed the latest downturn to rising inflation and interest rates, which have resulted in investors selling off riskier assets like cryptocurrencies and tech stocks.

“The current market conditions don’t provide much room for optimism,” said Simon Peters, an analyst at the online trading platform eToro.

“Valuations are severely depressed after a buoyant performance in the past 18 months. We’re now back in the region of valuations as they were in 2020, but prices are still moving above levels we saw just 18 months ago.

“While pointing out the long-term perspective on any asset isn’t always easy reading for investors who bought in at higher levels, what is critical here is that any long-term investment case made for the cryptoasset should remain when the underlying ideas are considered and historic price trends are factored in.”