Bill Ackman Reduces Lowe's, Agilent Technologies and Hilton Worldwide Holdings

- By Graham Griffin

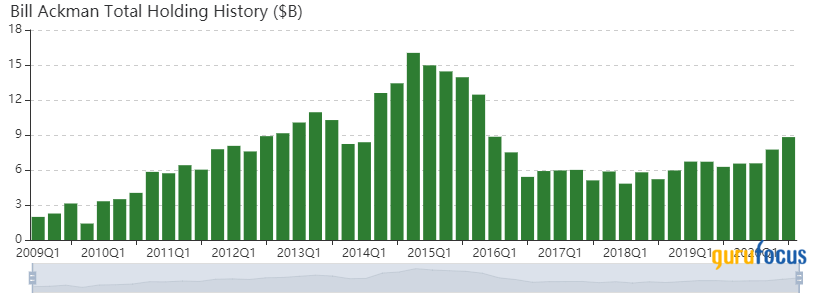

Bill Ackman (Trades, Portfolio), leader of Pershing Square Capital Management, has revealed his portfolio for the third quarter.

The guru's New York-based hedge fund takes large positions in underperforming companies with the intent of pushing management to make changes. This activist strategy allows the hedge fund to unlock value for shareholders.

Portfolio overview

At the end of the quarter, the portfolio contained seven stocks, with no new additions. Overall, it is valued at $8.82 billion and it has seen a turnover rate of zero percent. Top holdings at the end of the quarter include Lowe's Companies Inc. (NYSE:LOW), Chipotle Mexican Grill Inc. (NYSE:CMG) and Restaurant Brands International Inc. (NYSE:QSR).

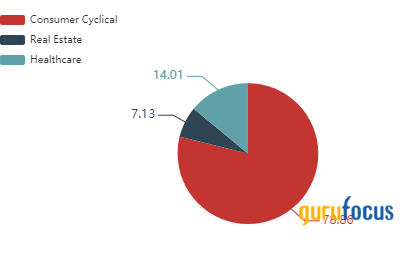

By weight, the top three sectors represented are consumer cyclical (78.86%), health care (14.01%) and real estate (7.13%).

Lowe's Companies

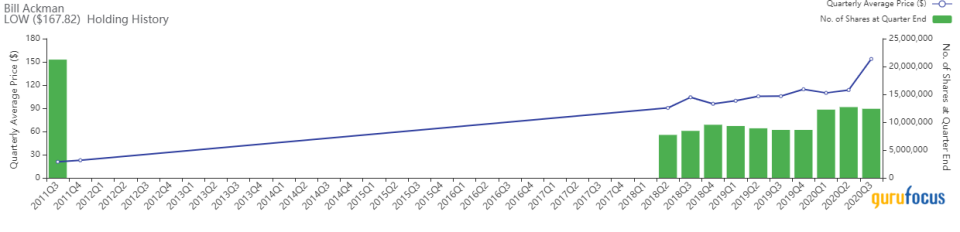

The most impactful of the guru's third-quarter trades was the reduction in the holding of Lowe's by 2.37%. Ackman had bought additional shares the last two quarters, but sold 300,776 shares. The stock traded at an average price of $153.75 during the quarter. The sale had an overall impact of -0.52% on the portfolio and GuruFocus estimates the total gain on the holding at 52.91%.

Lowe's is the second-largest home improvement retailer in the world, operating about 1,970 stores throughout the United States and Canada. The stores offer products and services for home decorating, maintenance, repair and remodeling. Lowe's targets retail do-it-yourself and do-it-for-me customers as well as commercial business clients.

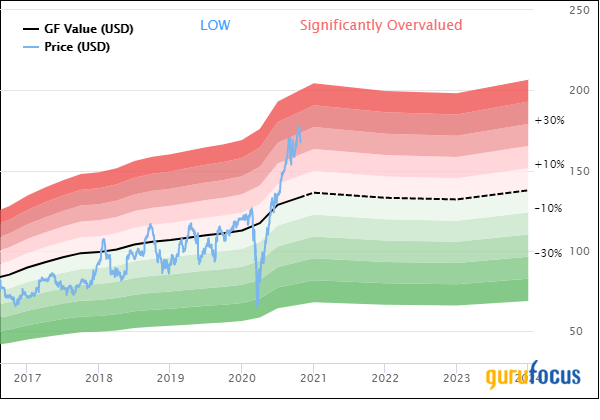

On Oct. 26, the stock was trading at $167.59 with a market cap of $126.88 billion. The GF Value Line shows that the stock is currently trading at a significantly overvalued level.

GuruFocus gives the company a financial strength rating of 5 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 3 out of 10. There are currently two severe warning signs given for declining gross and operating margins. The company has a cash-to-debt ratio of 0.49 that ranks it lower than 50.65% of other companies due to high levels of debt issued in 2020.

Ackman is currently one of the top shareholders with 1.64% of shares outstanding. Other top shareholders include Vanguard Group Inc. (Trades, Portfolio), BlackRock Inc. (Trades, Portfolio), State Street Corp. (Trades, Portfolio) and Bank of America Corp. /DE/ (Trades, Portfolio).

Agilent Technologies

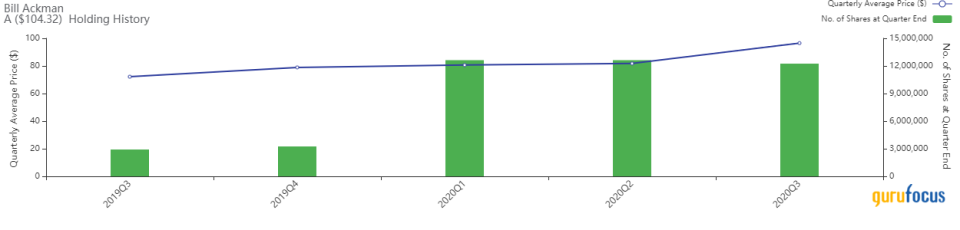

Ackman also reduced his holding of Agilent Technologies Inc. (NYSE:A) for the first time since it was established in the third quarter of 2019. The guru sold 378,079 shares, decreasing the holding by 2.99%. The share traded for an average price of $96.52 during the quarter. The sale had an impact of -0.43% on the portfolio overall and GuruFocus estimates the total gain on the holding at 32.36%.

Originally spun out of Hewlett-Packard in 1999, Agilent has evolved into a leading life sciences and diagnostics company. Today, Agilent's measurement technologies serve a broad base of customers with its three operating segments: life science and applied tools, cross lab and diagnostics and genomics. Just over half of its sales are generated from the biopharmaceutical, chemical and energy end markets, but it also supports clinical lab, environmental, forensics, food, academic and government-related organizations.

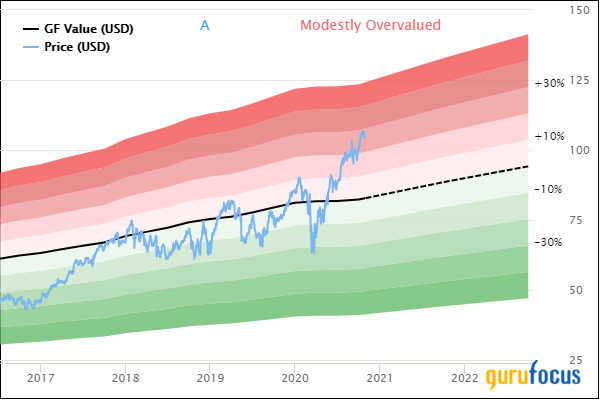

As of Oct. 26, the stock was trading at $104.41 with a market cap of $32.17 billion. The GF Value Line shows that the company is currently trading at a modestly overvalued level.

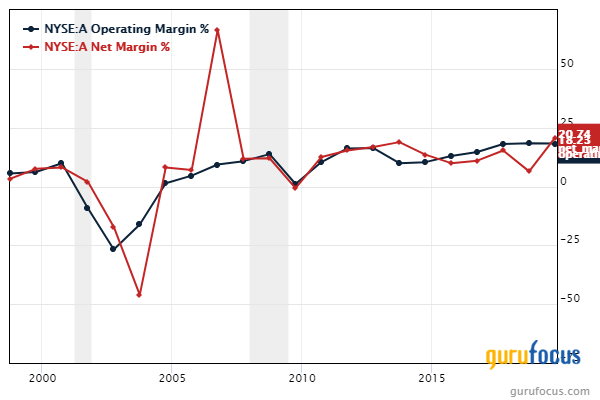

GuruFocus gives the company a financial strength rating of 6 out of 10, a profitability rank of 8 out of 10 and a valuation rank of 2 out of 10. The company has been increasing cash flows relatively consistently since 2016 and has solidified strong operating and net margin percentages.

Ackman currently holds 3.97% of shares outstanding. Other top shareholders include Vanguard Group, BlackRock , T Rowe Price Associates Inc. /MD/ (Trades, Portfolio) and State Street.

Hilton Worldwide Holdings

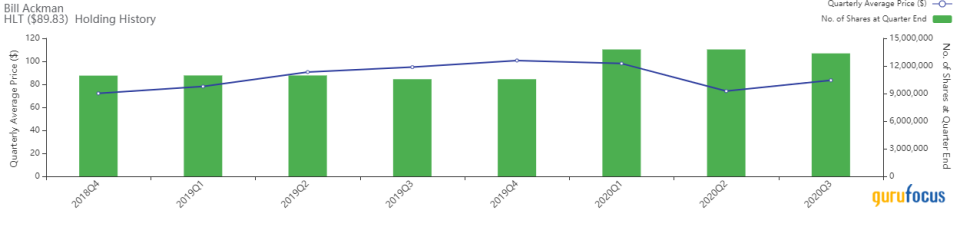

Ackman's final portfolio change of the quarter was the reduction of his holding in Hilton Worldwide Holdings Inc. (NYSE:HLT) by 3.09%. The guru sold 426,578 shares. The stock traded for an average price of $83.54 per share during the quarter. The sale had an overall impact on the portfolio of -0.40% and GuruFocus estimates the total gain on the holding at 15.07%.

Hilton operates 983,000 rooms across 18 brands addressing the midscale through luxury segments as of June 30. Hampton and Hilton are the two largest brands by total room count at 28% and 22%, respectively, as of June 30. Recent brands launched over the last few years include Home2, Curio, Canopy, Tru and Tempo. Managed and franchised represent the vast majority of adjusted Ebitda, predominantly from the Americas regions.

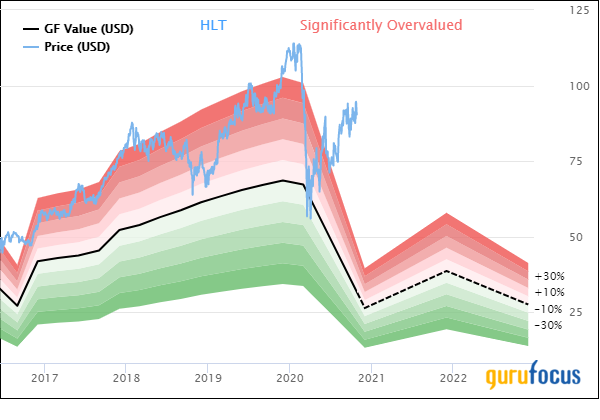

On Oct. 26, the stock was trading at $90.38 with a market cap of $25.06 billion. The GF Value Line shows that the company is trading at a significantly overvalued level.

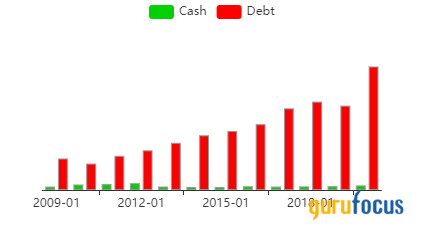

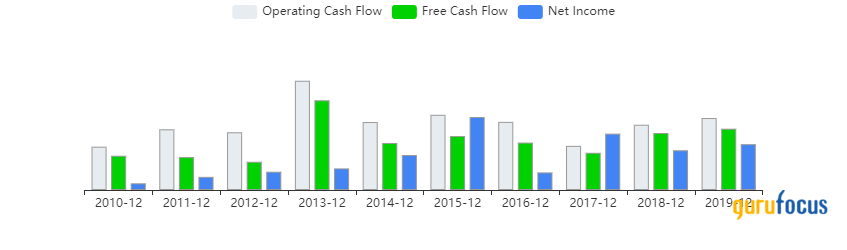

GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rank of 7 out of 10. There are currently three severe warning signs issued for poor financial strength, an Altman Z-Score of 1.03 placing the company in the distress column and new long-term debt. Prior to 2017, the company had been consistently decreasing its debt, yet has been issuing new debt over the last three years. Cash flows have remained consistent since 2018.

Ackman is currently the fourth-largest shareholder with 4.82% of shares outstanding. Other top shareholders included T Rowe Price Associates, Vanguard, BlackRock and Harris Associates LP (Trades, Portfolio).

Disclosure: Author owns no stocks mentioned.

Read more here:

Mercedes-Benz Parent Daimler Reports Solid 3rd-Quarter Earnings Despite Sales Slump

AT&T Rises Above Revenue Predictions Despite Pandemic Struggles

Value Investing Live Recap: David Dietze

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.