ASML Faces Even Stricter Dutch and U.S. Controls: Report

Late last month, the Dutch government restricted sales of ASML's advanced immersion lithography tools to China. But it looks like ASML is facing further high-tech export constraints from the Dutch and United States governments. The new rules may restrict ASML's ability to service existing production tools in China, according to a Bloomberg report that cites sources familiar with the matter.

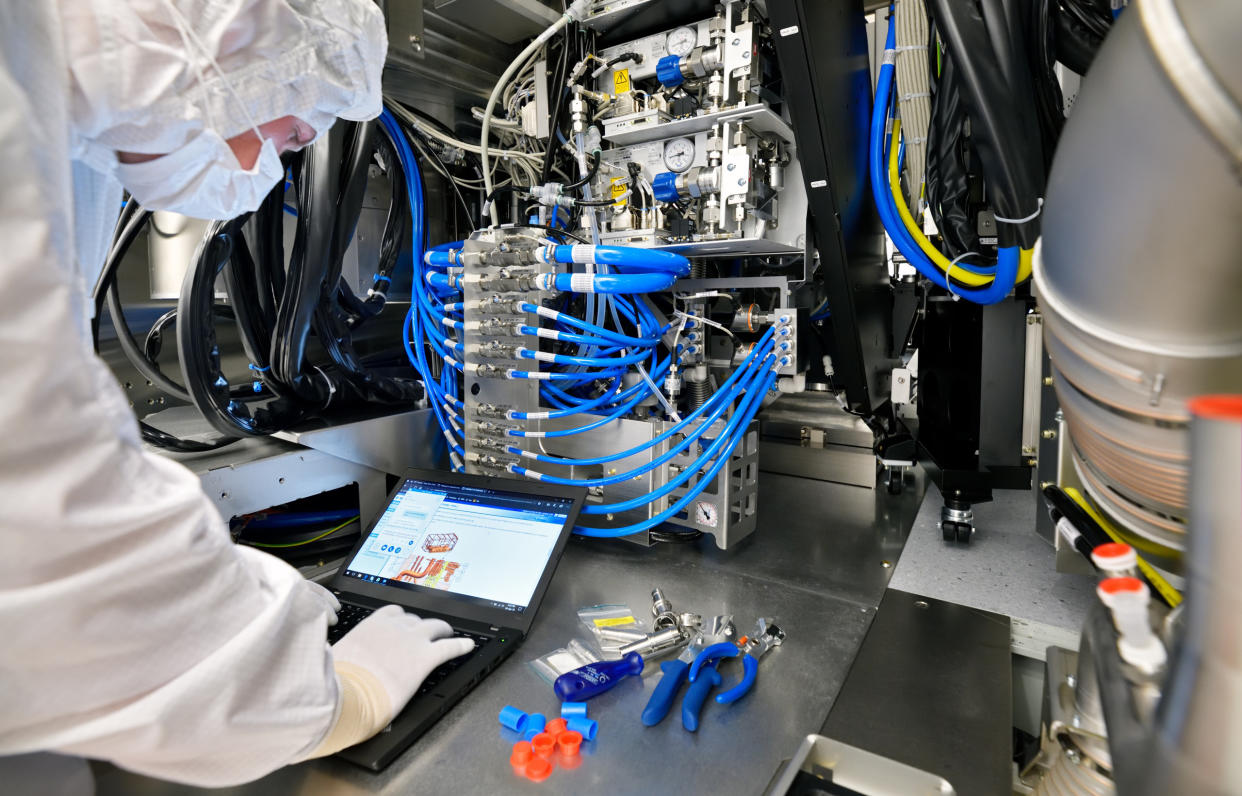

The upcoming Dutch export control rules will require ASML to obtain government authorization to service, repair, and supply parts for its dry and immersion lithography tools that are already used by its customers in China. Services, repairs, and spare parts represent an important source of ASML's income. The company has previously earned some $5.743 billion — 27% of its revenue — servicing its tools in the field.

Without proper servicing and repairs, fab equipment will get out of order, and this could hurt companies like Semiconductor Manufacturing International Corp. (SMIC) even more than the lack of new tools. It's possible they will not be able to fulfill existing orders at all or on time.

In addition, the U.S. is also expected to impose restrictions preventing ASML from selling older versions of its wafer fab equipment to six Chinese fabs without an export license from the U.S. One of the targeted fabs includes a plant run by SMIC, according to Bloomberg. The Biden administration is expected to enforce the new restrictions through the Foreign Direct Product Rule, limiting sales from foreign suppliers if their products contain American components.

These dual restrictions add to the extensive export controls previously imposed by the U.S. government in October 2022, to undermine Chinese semiconductor firms' competencies over time. Later on, the governments of Japan and the Netherlands imposed similar restrictions. Naturally, these curbs also hit makers of wafer fab equipment from the U.S., Japan, and the Netherlands.

The upcoming existing Dutch export regulations, due to take effect on September 1, require acquiring an export license to sell the Twinscan NXT:2000i and more sophisticated scanners to Chinese firms. These scanners utilize deep ultraviolet (DUV) lithography and are capable of fabricating chips using 7nm and 5nm class process technologies. The Chinese government was outraged by the new rules, and for a reason.

"The Dutch regulations are an official stake in the ground that the Netherlands does not want China to be able to produce the most advanced semiconductors," said Dylan Patel, founder of the research group SemiAnalysis. "Without access to these machines, Chinese chip companies will be at a significant disadvantage in the global market for advanced logic and memory chips.

Patel predicts that the new restrictions will significantly affect the future plans of Chinese chip companies, potentially leading to delays or cancellation of certain future leading-edge process technologies.