Apple earnings beat expectations, iPhone and services sales disappoint

Apple (AAPL) reported its Q3 2019 earnings on Tuesday, beating analysts' expectations on the top and bottom lines. Here's the most important information you need from the report, as well as consensus estimates compiled by Bloomberg.

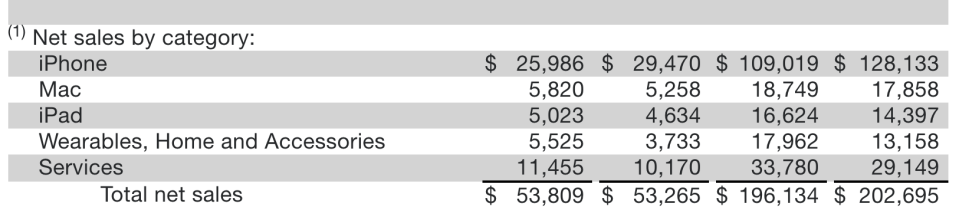

Revenue: $53.8 billion versus $53.4 billion expected.

EPS: $2.18 versus $2.10 expected.

Services revenue: $11.5 billion versus $11.9 billion expected

iPhone revenue: $26 billion versus $26.5 billion

Apple’s stock reached 2019 highs shortly after the announcement.

“This was our biggest June quarter ever — driven by all-time record revenue from services, accelerating growth from wearables, strong performance from iPad and Mac and significant improvement in iPhone trends,” said Apple CEO Tim Cook.

The earnings report comes amid a time of major changes at Apple. In June, Apple design chief Jony Ive announced that he was stepping down from his position at the company to start his own design firm, LoveFrom. He'll still work with Apple, though, as the company will be LoveFrom's first client.

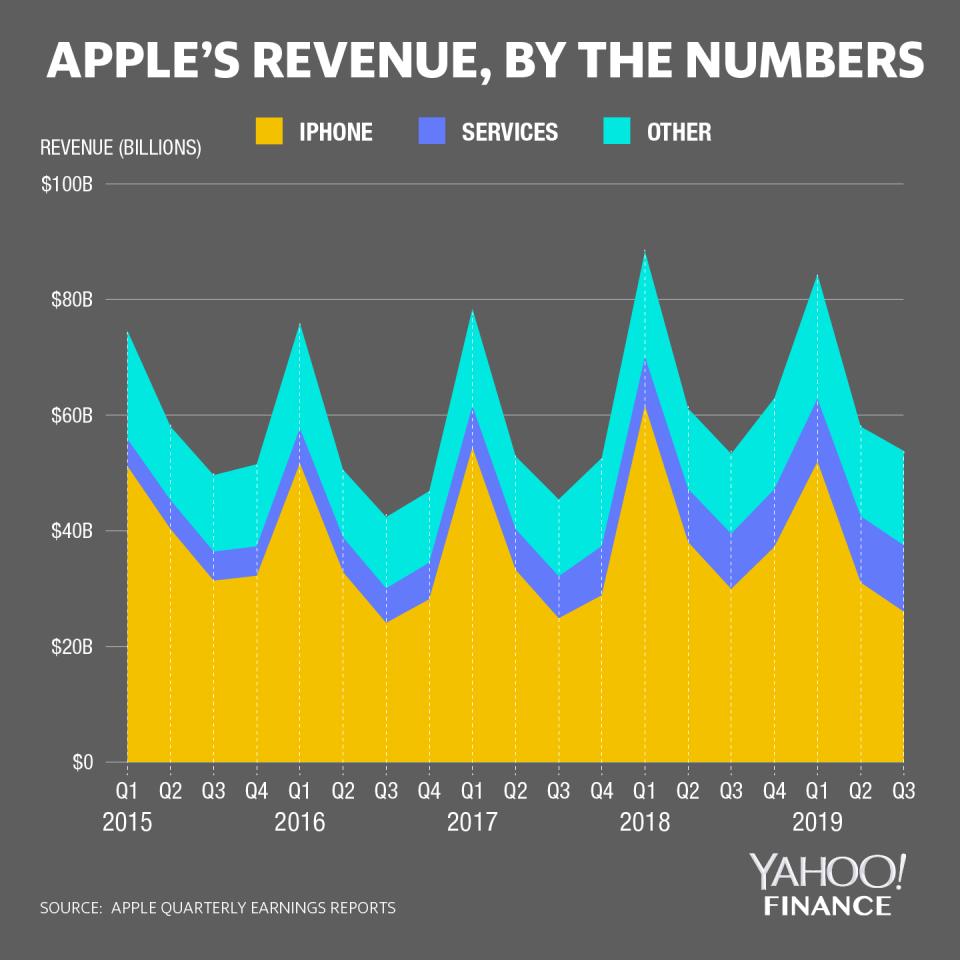

Apple is also attempting to pivot away from its heavy reliance on iPhone sales as its largest source of revenue to focus more on services. The biggest piece of the company's plan, its Apple TV+ streaming service, is expected to debut later this fall.

Apple also recently announced that it is acquiring Intel's (INTC) modem business to allow it to develop its own 5G modems for upcoming iPhone models.

All of this comes against the backdrop of increased scrutiny of major tech companies like Apple, which are being targeted for potential antitrust violations.

Apple, one of the world's most valuable companies, has been a frequent target of Big Tech opponents including the likes of Senator Elizabeth Warren (D-MA), who says that the company, and others like it, should be broken up.

The biggest criticism against Apple is that the company sells its own apps in its App Store, which compete directly with third-party apps listed in the storefront. There's also the matter of the 30% cut Apple takes from the sale of every app purchase from the App Store. Spotify has been particularly vocal in its opposition to Apple's App Store fees.

More recently, President Donald Trump’s announcement that the upcoming Mac Pro won’t be given a waiver protecting it from 25% tariffs imposed on Chinese-made goods entering the U.S. Apple, though, is unlikely to bring production of the Pro to the U.S.

More from Dan:

Intel beats on top and bottom line, sets $1 billion deal with Apple

Facebook beats Q2 expectations, says FTC has opened an antitrust investigation

What is Project JEDI? Amazon and Microsoft are competing for a $10 billion Pentagon program

Email Daniel Howley at dhowley@yahoofinance.com; follow him on Twitter at @DanielHowley.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.