Apple, Facebook, and Trump's Fed pick — What you need to know for the week ahead

After a busy week that saw big cap tech names send markets into the weekend with whoosh higher, this week will feature even more earnings news, a crowded economic calendar, and the long-awaited announcement from President Donald Trump on who will be nominated to lead the Federal Reserve.

In an Instagram video posted late Friday, Trump said, “People are anxiously awaiting my decision as to who the next head of the Fed will be.”

Trump added that he has “somebody very specific in mind” for the job “who, hopefully, will do a fantastic job.” Betting site PredictIt currently has current Fed governor Jerome Powell as the odds-on favorite to get the nomination, while reports last week indicated either Powell or Stanford professor John Taylor would be Trump’s pick for the job.

Elsewhere in markets this week we’ll have another rush of earnings with 138 members of the S&P 500 reporting results, including Apple (AAPL), the world’s largest company, and Facebook (FB).

Facebook, along with Twitter (TWTR) and Google (GOOGL), will be spending part of Wednesday on Capitol Hill answering questions from lawmakers regarding their role in potential Russian meddling in the 2016 presidential election.

Other notable earnings this week include Starbucks (SBUX), Under Armour (UAA), Pfizer (PFE), MasterCard (MA), MetLife (MET), Yum Brands (YUM), and Berkshire Hathaway (BRK-A, BRK-B), among many others.

The economic calendar also has the month’s big highlight as Friday will bring markets the October jobs report. After September saw the first decline in job gains since September 2010, economists are looking for a big bounce back in October.

According to estimates from Bloomberg, Wall Street is forecasting nonfarm payroll gains of 300,000 in October with the unemployment rate set to hold steady at 4.2%.

Brett Ryan, an economist at Deutsche Bank, said in a note on Friday that he is expecting job growth to rebound to 250,000 in October due to a “dissipation of hurricane effects; low jobless claims during the survey week; and robust supporting evidence of solid job growth from the ISM employment subcomponents.” Ryan notes, however, that after Hurricane Katrina it took two months until job growth returned to its prior trend.

Elsewhere on the economic calendar, we’ll get data on personal income and spending, consumer confidence, inflation, and manufacturing activity.

Economic calendar

Monday: Personal income, September (+0.4% expected; +0.2% previously); Personal spending, September (+0.8% expected; +0.1% previously); “Core” PCE, year-on-year, September (+1.6% expected; +1.4% previously); Dallas Fed manufacturing index, October (21 expected; 21.3 previously)

Tuesday: Employment cost index, Q3 (+0.7% expected; +0.5% previously); S&P Case-Shiller home price index, August (+0.35% previously); Chicago PMI, October (60 expected; 65.2 previously); Conference Board consumer confidence, October (121 expected; 119.8 previously)

Wednesday: ADP private payrolls, October (200,000 expected; 135,000 previously); Markit manufacturing PMI, October (54.5 expected; 54.5 previously); ISM manufacturing PMI, October (59.5 expected; 60.8 previously); Construction spending, month-on-month, September (-0.3% expected; +0.5% previously); FOMC rate decision (1%-1.25% expected; 1%-1.25% previously); October auto sales (17.4 million vehicle annualized pace expected; 18.5 million previously)

Thursday: Initial jobless claims (235,000 expected; 233,000 previously); Nonfarm worker productivity, third quarter (+2.1% expected; +1.5% previously)

Friday: Nonfarm payroll growth, October (310,000 expected; -33,000 previously); Unemployment rate, October (4.2% expected; 4.2% previously); Average hourly earnings, month-on-month, October (+0.2% expected; +0.5% previously); Average hourly earnings, year-on-year, October (+2.7% expected; +2.9% previously); ISM non-manufacturing PMI, October (58.5 expected; 59.8 previously); Markit services PMI, October (55.9 previously); Factory orders, September (+1.1% expected; +1.2% previously)

Content U.S. consumers

On Friday, we got two key pieces of data about the U.S. economy.

We learned that in the third quarter of 2017 the economy grew at an annualized pace of 3%, better than expected and marking the best two-quarter stretch for the economy since 2014.

Additionally, we saw that consumer confidence remains strong with the University of Michigan’s consumer sentiment survey holding near its best monthly level in 13 years.

In this report we also got a glimpse into the expectations around growth from U.S. consumers. And against the backdrop of an administration arguing that we need corporate tax reform to get more economic and wage growth, it seems that consumers are actually quite content with the current state of affairs.

“Lingering doubts about the near term strength of the national economy were dispelled as more than half of all respondents expected good times during the year ahead and anticipated the expansion to continue uninterrupted over the next five years,” said Richard Curtin, chief economist for the University of Michigan survey.

“Consumers do not anticipate accelerating growth rates but rather a continuation of the slower pace of growth that has characterized this recovery,” Curtin added.

“Low unemployment and low inflation rates have made lower income growth rates more acceptable. Moreover, the Great Recession has caused a fundamental change in assessments of economic risks, with consumers now giving greater preference to economic stability relative to economic growth. This is the essential reason why consumers have voiced such positive economic assessments of such a modest pace of economic growth.”

And so while so much of the post-crisis economic discussion has been about how the economy’s growth trajectory has been slow to accelerate, it seems that consumers have simply adjusted to this “new normal.”

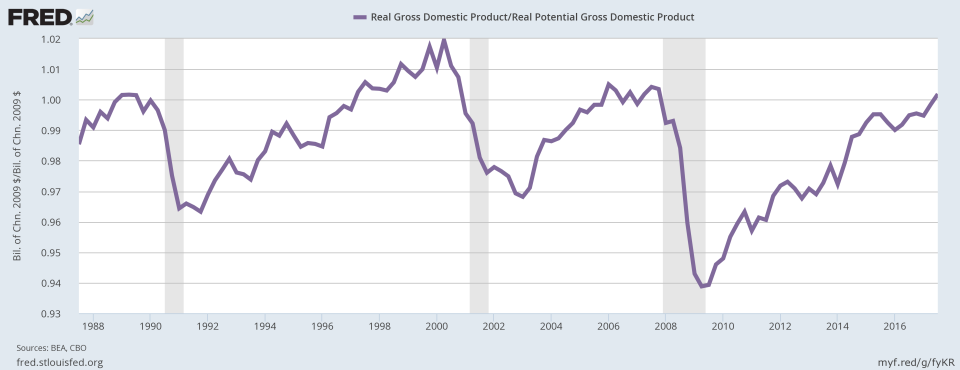

Economist Matt Busigin noted Friday that the third quarter GDP report was the first since the crisis that “filled the output gap,” meaning that actual GDP exceeded potential GDP.

The economy, then, is back to meeting whatever potential power economists estimate we can muster from existing workforce trends. And it seems that consumers are content to meet this potential against a sense of this being relatively sustainable rather than seeing growth shoot higher against a gnawing feeling that the good times might not last.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: