Amazon stock drops as one-day delivery costs take a bite out of earnings

Amazon (AMZN) reported mixed second quarter results on Thursday, which sent its shares lower as costs associated with its one-day delivery initiative took a bite out of profits, even as revenues surpassed analyst expectations.

The stock traded down 2% in the after-hours session, changing hands around $1973.82.

Here’s what the e-commerce giant reported:

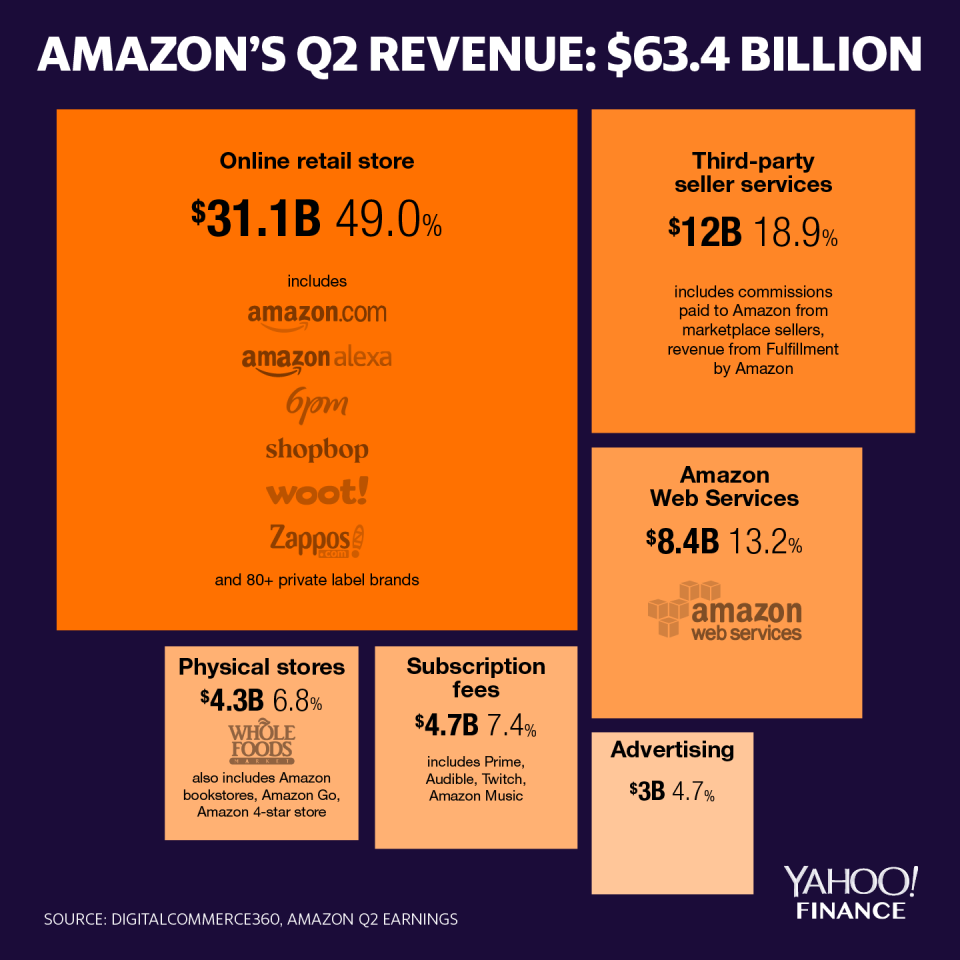

Revenue: $63.4 billion, beating expectation of $62.46 billion

Adjusted earnings: $5.22 per share, lower than consensus estimate of $5.57

Revenue guidance for 3Q: $66 billion to $70 billion, 4% above consensus at the high end

Operating income guidance for 3Q: $2.1 billion to $3.1 billion, 29% below consensus at the high end

One-day delivery is costly

Amazon CFO Brian Olsavsky says the company has spent more than the $800 million it previously forecast on building out Prime’s one-day delivery during the quarter.

He added that the goal won’t be achieved by the next few months, but Amazon is committed to continuing to invest in it in the next few quarters.

“Millions of more one-day packages went out this quarter than last quarter,” he told reporters on Thursday. The company says free one-day delivery is available to Prime members on more than ten million items.

Amazon first announced the initiative during its last earnings call. Olsavsky said customers have already increased purchases due to faster delivery. Online store sales grew by 16%, the fastest rate in two years. Analysts believe the move, while costly, could lift Prime membership subscriptions and offer a competitive advantage.

The second quarter was “negatively impacted by margin compression in North America due to the investments in next day Prime delivery, which we continued to believe is an example of short-term pain for long-term gain,” said Moody’s Amazon Analyst Charlie O’Shea.

The rapid delivery “is a necessary strategy to compete with brick-and-mortar’s speed advantage to the customer,” he added.

The retail giant’s guidance for the third quarter has reflected the stellar results of its fifth annual sales event Prime Day, which was held from July 15-16. Those results won’t show up in Amazon’s earnings until next quarter. Nevertheless, Amazon touted the sale of 175 million units and the addition of more Prime members than any other previous Prime Day.

The highly-profitable segment Amazon Cloud Services (AWS) grew by an impressive 37%, but fell slightly short of expectations. On the physical store side, despite of continued promotions at Whole Foods Stores and new openings of Amazon Go store, the sales have merely changed from one year ago.

Analysts hope the margin expansion of the company’s major profit drivers, including AWS advertising and service fees could offset the heavy spending on one-day delivery.

“The story of Amazon’s past few quarters has been continued supercharged growth in its more profitable business lines like cloud and advertising,” said Andrew Lipsman, eMarketer principal analyst. “However, recent signs of moderating growth rates in these segments — on top of e-commerce growth that’s now only slightly outpacing the overall sector — could weigh on Q2 earnings.”

Antitrust probes

Investors will also be watching the regulatory overhang. The Federal Trade Commission launched antitrust investigations tech giants including Facebook, while the U.S. Department of Justice said it is reviewing “retail services online,” but did not mention Amazon by name.

Earlier this month, the European Commission also began an antitrust investigation into whether Amazon is “abusing” its role as a marketplace provider by using proprietary data aggregated from third-party sellers to compete against them.

Such investigations, which usually take a long time to unravel, could potentially result in formal charges, fines, or required changes to Amazon’s business model. Olsavsky declined to comment on regulatory issues, saying the guidance for the next quarter doesn’t include any penalties or impact from regulations.

“We think Amazon could potentially exit certain categories, or convert suppliers to 3P sellers to mitigate regulatory issues,” analysts at Bank of America Merrill Lynch wrote.

Krystal Hu covers technology and China for Yahoo Finance. Follow her on Twitter.

Read more: