There are 14 key event risk dates until Brexit day

There are less than eight months to go until Britain leaves the European Union.

Despite the short time frame, the risk of a no-deal Brexit, also known as a hard Brexit, is increasing, according to a range of the most powerful people in the UK, from the Bank of England (BOE) to government officials. Bank analysts are more optimistic, saying that it’s less likely that Britain will crash out of the remaining 27-nation bloc when it comes to 29 March, 2019. Some predict that it’s more likely that the UK government will forge a deal at the last minute.

Japanese investment bank Nomura (NMR) recently released a note to clients that outlined their expectations and outlined 14 key dates that investors need to watch out for.

The first on Nomura’s event risk timeline is between 3-5 September when UK PMIs come out. This will be key to looking at the economic health of manufacturing and services sectors in Britain. Considering the services economy makes up around 80% of UK GDP, it could inform some decision making when it comes to negotiating a deal, especially if it shows a slowdown due to the lack of confidence of a deal being likely.

Later on 4 September, UK parliament returns from recess and a second reading of the taxation bill, to regulate and impose a duty of customs, will be read in the House of Lords. On 11 September, there will also be a second reading a trade bill in the House of Lords.

On 13 September, the BOE will publish its monetary policy meeting minutes and summary and could further outline how it sees the economy faring during and after the last leg of Brexit negotiations. BOE governor Mark Carney already caused a stir when he said there was an “uncomfortably high” risk of a no-deal Brexit, which subsequently led to a tumble in the pound (GBP/USD). More details on how the Monetary Policy Committee came to their interest rate hike will be important for policy makers and investors alike.

The EU article 50 council will meet 18 September and give recommendations to leaders. Meanwhile, only two days later, an informal meeting with EU leaders in Austria will provide another steer on how talks are progressing and what bloc officials are prepping for.

Political party conferences

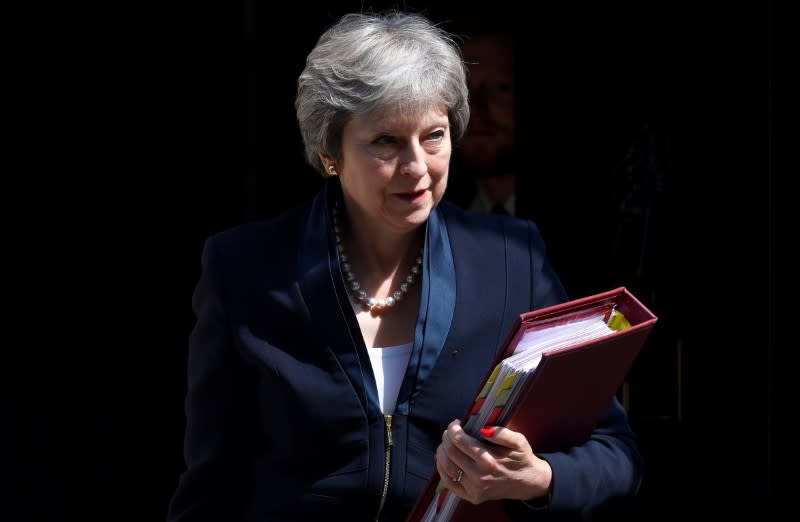

Between 23-26 September, UK opposition party Labour will hold its party conference and it could indicate a change in Brexit policy, says Nomura. On 30 September, the Conservative party will hold its own conference, which will be the most prudent due to the UK government being led by Tory Theresa May and her front cabinet. All eyes will be on the kind of deal she is trying to push out. It’ll also indicate what kind of support she receives and if it’s looking like another Conservative leader, and thus new prime minister, race is on the cards.

October provides another round of risk factors. Nomura identifies another EU article 50 council meeting on 16 October and the EU council summit on 18 October as two key dates, with the latter potentially delivering a rough deadline for the deal.

The BOE is back in action on 1 November as the central bank will publish its inflation report. However, as Nomura has noted as well as others, it’s unlikely hike rates again after pushing up the benchmark up to 0.75%.

On 11 December, the EU article 50 council meets again. But it’s the EU council summit on 13 December that will likely provide the biggest revelation, if any, on how Brexit talks are going or if a provisional deal will be announced.

It isn’t until 21-22 March that Nomura forecasts the next big risk event date—mainly because that’s just one week before Brexit happens. It says that if there is an extremely last minute Brexit deal, it’ll be announced during that EU council summit.

Nomura’s analysts also warn that while a “fully-fledged hard Brexit with no transition period… is unlikely to be approved, with parliament clearly having a majority against a hard Brexit,” but “it could instead lead to calls for a second referendum/general election instead.”