How To Save For Retirement When Your Job Doesn't Offer A 401(k) Plan

When it comes to saving for retirement, putting your money in a low-interest savings account is akin to shoving your money under a mattress. Ideally, you’d invest your money for bigger gains over time while reaping a few tax benefits instead. In other words, you’d contribute to your employer’s 401(k) plan.

So, what if you don’t have one?

More than a third of all private-sector workers over the age of 22 don’t work for a company that offers a retirement plan, according to data analyzed by The Pew Charitable Trusts. That number jumps to 41 percent for millennials.

Fortunately, if you don’t have access to a 401(k) or another employer-sponsored retirement plan, you’re not out of luck. Whether you work for a company or for yourself, here are six types of accounts that can help you reach your retirement savings goals.

1. Traditional IRA

Best for: Just about anyone.

How it works: An individual retirement account, or IRA, is a type of tax-advantaged retirement savings account. It’s similar to a 401(k) except you don’t have to open one through your employer. “It’s common for people to change employers frequently, and the great thing about an IRA is that it’s employer-independent,” said Lyn Alden, the founder of Lyn Alden Investment Strategy. “You can keep the same account open and keep contributing to it year after year, regardless of who you work for.”

An IRA lets you contribute pre-tax dollars, which grow tax-deferred. You only pay taxes on the investment gains when you make withdrawals in retirement. One of the biggest benefits to contributing to a traditional IRA is that it’s easier to make larger contributions since you don’t have to pay taxes on the money. That lets you take full advantage of compounding returns while you’re young. Plus, if you don’t contribute to a retirement plan through work, you can deduct your IRA contributions on your taxes.

The downside is that the contribution limits for IRAs are much lower than for 401(k)s. For 2019, you can contribute a total of $6,000 across all your IRA accounts ($7,000 if you’re age 50 or older) or your taxable income for the year, whichever is smaller. You’re allowed to begin making penalty-free withdrawals when you turn 59½. Once you reach 70½, you can no longer contribute and must start making required minimum distributions instead.

2. Roth IRA

Best for: Lower-earning employees who expect to be in a higher tax bracket during retirement.

How it works: A Roth IRA is similar to a traditional IRA with a few exceptions. The first is the way your money is taxed: Rather than contributing pre-tax money, you contribute funds after taxes have already been taken out. “That money is never subject to capital gains taxes or dividend taxes from that point on,” Alden said. In other words, your withdrawals in retirement are made tax-free.

This can be a major benefit to workers who don’t earn a lot now but expect to increase their income significantly in the future. For example, maybe you just graduated from medical school and are in your first year of residency. Eventually, you plan to open your own private practice. In this case, you will likely save money on taxes by paying them now while your income is relatively low instead of at retirement. “Tax-deferred compounded growth over decades can really make a big impact to one’s retirement nest egg, in addition to being able to have tax-free income later on during retirement,” said Celeste Hernandez Revelli, a certified financial planner and director of financial planning at eMoney Advisor.

Another major benefit? “You can also withdraw your principal at any time without penalty if you need to, so it’s one of the more flexible types of accounts for retirement and general investing,” Alden said. Keep in mind this applies to principal only and not investment earnings.

The downside is there is a cap on how much you can earn in order to be eligible for a Roth IRA. The income limit for single filers in 2019 is $122,000–$137,000, depending on the contribution amount. Roth IRA contribution limits are the same as traditional IRAs. And despite the benefits, there are a few other reasons why you might want to think twice about contributing to a Roth IRA.

3. SEP-IRA

Best for: People who are self-employed.

How it works: The “SEP” in SEP-IRA stands for simplified employee pension. Contributions to this type of retirement plan are made by the employer on the employee’s behalf. The good news is that any employer with one or more employees can create a SEP plan. So if you’re self-employed ― for instance, you own a small business or are a freelancer ― you are both the employer and employee. Contributions are also tax-deductible for the business, and the money isn’t taxed until it’s withdrawn in retirement.

Contributions made in 2019 to an employee’s SEP-IRA can’t exceed 25 percent of compensation or $56,000, whichever is less. The nice thing about the SEP-IRA is that your contributions to any personal IRAs don’t affect the limits for the SEP employer contributions. That means you could max out both plans if you wanted. However, participating in a SEP plan could affect your ability to deduct traditional or Roth IRA contributions, since the IRS doesn’t allow you to deduct as both employer and employee.

4. Solo 401(k)

Best for: Self-employed individuals who want higher contribution limits.

How it works: Another option for freelancers, small business owners and other self-employed individuals is the one-participant 401(k) plan, also known as a solo 401(k). This account has the same rules and requirements as a traditional 401(k) you’d contribute to through an employer except that it’s designed for the self-employed.

According to IRS rules, you must be a business owner to contribute to a solo 401(k), but you can’t have employees. The good news is that the plan can cover both you and a spouse.

So why would you choose a solo 401(k) over a SEP-IRA? The contribution limits, namely. It’s possible to make contributions to a solo 401(k) as both an employer and an employee. In 2019, the contribution limit for employees is $19,000, or $25,000 for those 50 and older. As an employer, you can contribute up to an additional 25 percent of compensation, or up to $56,000 in total contributions. You can choose to make traditional or Roth contributions.

5. Health Savings Account

Best for: Individuals with high-deductible health insurance plans.

How it works: If you have a high-deductible health plan, you might qualify to contribute to a health savings account.

Though an HSA is technically not a retirement savings account, it’s as good ― if not better ― than a 401(k) because the contributions are triple tax-exempt, according to Megan Gorman, a managing partner at Chequers Financial Management.

“What that means is you fund the account and get an above-the-line deduction on your tax return. The money grows tax-deferred, and if you take it out for qualified medical expenses, it is a tax-free distribution,” Gorman said. In 2019, an individual with family coverage under an HDHP can contribute up to $7,000 for the year, which can be used to cover certain medical expense.

After age 65, you can withdraw the funds tax-free to cover health insurance premiums in addition to other qualified medical expenses. You can also use the money for non-medical expenses without paying a penalty; you just have to pay taxes on the withdrawals.

About 35 percent of employer-sponsored health plans offer HSAs. However, you can open your own HSA through most financial institutions even if your employer doesn’t offer one, as long as you meet all eligibility requirements.

6. Brokerage Account

Best for: Investors who want flexibility and the ability to invest beyond their annual contribution limits.

How it works: If you want more flexibility beyond what the above tax-advantaged accounts offer, consider opening an investment account through a brick-and-mortar or online brokerage, such as Charles Schwab, Fidelity, Etrade or Ally.

“While you won’t receive tax benefits, you can contribute to this investment account with your retirement goal in mind,” explained Alissa Todd, wealth adviser at The Wealth Consulting Group. For example, you can contribute more than the annual limits on other retirement savings vehicles, making it possible to reach your goals faster.

In fact, you might find that your best strategy is to contribute to a variety of account types in order to maximize your earning and tax savings opportunities.

“Even if you have access to a 401(k) or other employer-sponsored plan, it is best to consider saving into other types of investment accounts because each has their own unique benefits and characteristics,” Revelli said. “There are many other savings options out there that give you full control of your assets, have more flexibility in distributions and have more investment choices.”

Whichever plan you choose, the most important thing is that you do have a plan. Not everyone has the means to max out their retirement accounts every year, but saving something is always better than saving nothing. Your future self will wholeheartedly agree.

Related Coverage

I Call BS On Needing $1 Million To Retire (And Other Bad Retirement 'Rules')

Didn't Save Enough For Retirement? Here Are 7 Things You Can Do.

Here's What Happens To Your 401(k) When You Leave Your Job

Also on HuffPost

Oprah Winfrey: Writing Her Next Chapter

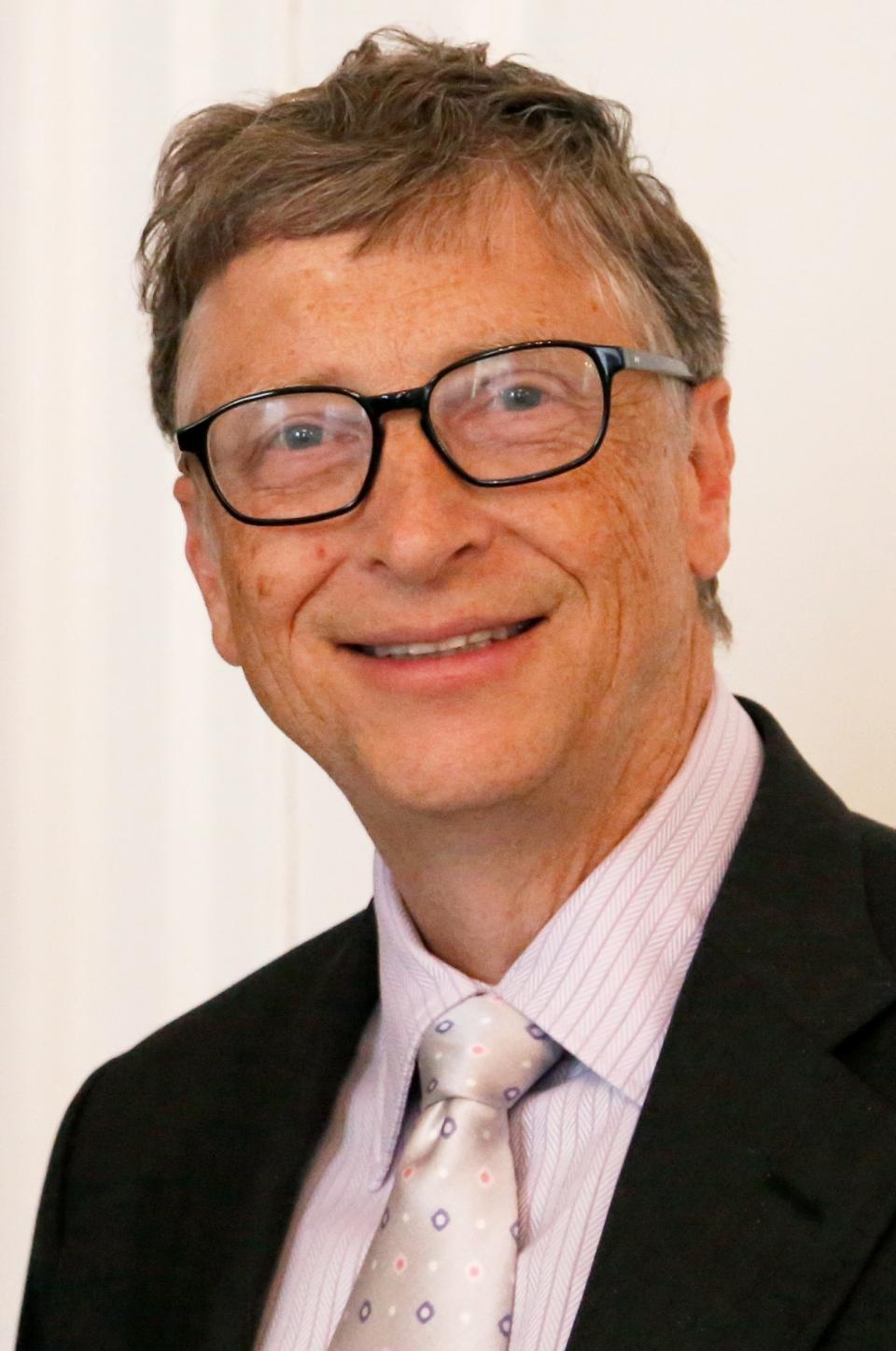

Bill Gates: A Foundation Of Giving

Bill & Hilary Clinton: Making A Difference In Politics And Philanthropy

Jamie Lee Curtis: Lifting The Curtain On Her Second Act

Michael J. Fox: Searching For A Cure

The Mighty Atom Jr.: Continuing A Heroic Legacy

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost.