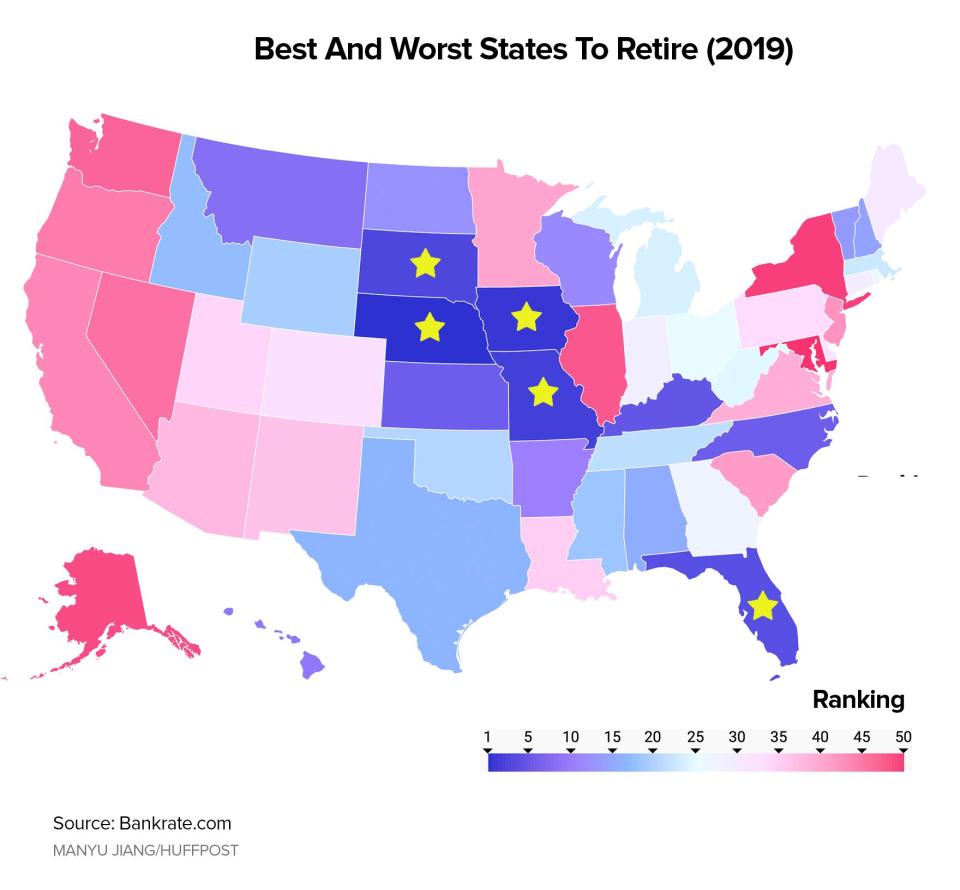

This Map Shows The Best And Worst States For Retirement In 2019

We’ve all fantasized about the day we quit working for good. But have you given serious thought to where you’ll live in retirement? The idea of spending life as a retiree in a quaint New England cottage or sunny California condo might seem appealing, but that might not be your best option, according to the results of personal finance website Bankrate’s latest rankings.

The Best Place To Retire? America’s Heartland.

Bankrate recently updated its ranking of the best and worst states to retire for 2019. To come up with the ranking, it considered five major categories related to the life of a retiree, and weighted them according to importance: affordability (40%), wellness (25%), weather (15%), culture (15%) and crime (5%). These factors and their weightings were chosen based on a separate survey, which asked participants to rank what they care most about in retirement (the top answer was friends and family).

According to the rankings, Nebraska is the best state to retire to. The Cornhusker State ranked within the top 15 for factors such as wellness (8th) and affordability (14th), and in the top half for crime (19th) and culture (21st). The only factor where it didn’t fare so well was weather (30th).

Rounding out the top five were Iowa, Missouri, South Dakota and Florida.

“Generally speaking, we have this area and the heartland that does really well,” said Adrian Garcia, a data analyst for Bankrate. He noted that given their proximity, most of the top states have similar weather patterns. “But they also do pretty well in wellness overall. The other key thing ― because affordability was the biggest weight in our survey ― is these areas that ranked well tend to be more affordable,” Garcia said. In fact, Missouri ranked No. 1 for affordability.

The Worst States For Retirement

On the other hand, Maryland ranked as the worst state to retire. It fell within the bottom 15 for affordability (4th worst), culture (9th worst) and wellness (13th worst), while also underperforming in the area of crime (18th worst). The only factor that fell within the top half of rankings was its weather (18th best).

Also included in the five worst states to retire were New York (which ranked last for affordability), Alaska (worst for weather and tied for worst crime), Illinois and Washington.

See The Full Ranking

Curious how your state stacks up? Here’s a look at Bankrate’s full ranking of best and worst states for retirement.

1. Nebraska

2. Iowa

3. Missouri

4. South Dakota

5. Florida

6. Kentucky

7. Kansas

8. North Carolina

9. Montana

10. Hawaii

11. Arkansas

12. Wisconsin

13. North Dakota

14. Vermont

15. New Hampshire

16. Alabama

17. Texas

18. Idaho

19. Mississippi

20. Wyoming

21. Oklahoma

22. Tennessee

23. Massachusetts

24. Michigan

25. West Virginia

26. Ohio

27. Rhode Island

28. Georgia

29. Indiana

30. Connecticut

31. Maine

32. Delaware

33. Colorado

34. Pennsylvania

35. Utah

36. Louisiana

37. New Mexico

38. Arizona

39. Virginia

40. Minnesota

41. South Carolina

42. New Jersey

43. California

44. Oregon

45. Nevada

46. Washington

47. Illinois

48. Alaska

49. New York

50. Maryland

If you want to drill down and see how a particular state ranks in all five categories, select it from the dropdown below:

Relocating In Retirement: A Personal Decision

So, given these rankings, should you hightail it to Nebraska once your working days are over? Not necessarily. “Retirement is a very personal decision,” Garcia said. That means the ideal location for living out your golden years might not match up to the numbers.

One thing that is important for most retirees is affordability, which is why it was weighted so heavily. Once you stop working and devote more time to travel, hobbies and maybe even volunteer work, the fact is that you’ll most likely transition to a fixed-income budget. “So you want to make sure you’re living somewhere that works for that budget, whether it’s the town you’re living in, a nearby neighborhood or perhaps a different state,” Garcia said.

When it comes to other factors such as wellness or weather, you might have different preferences. That’s why Bankrate also created a tool that lets you customize the weightings and see which states best match your liking. You can try it out for yourself below.

Garcia explained that the goal of this ranking isn’t to push retirees toward one location or another, but simply to allow people to take a second look at some of the places that aren’t often considered retirement havens. “We often hear about Florida, Hawaii or Arizona, but maybe we should spend some time investigating whether Nebraska or Iowa or somewhere in the middle of the country might be good,” he said.

At the end of the day, however, these rankings can’t replace what most people consider the most important factor in deciding where to retire. “If you’re going to be really far from the people you love and care about, it might not make sense to move,” Garcia said.

Love HuffPost? Become a founding member of HuffPost Plus today.

Related...

Take These 5 Steps Now So You Don't Become A Financial Burden On Your Kids

Here's How Much You Really Need To Save For Early Retirement

This Map Shows The Average Credit Score In Every State

Also on HuffPost

Roll Over Your Old 401(k)

Switch Banks

Negotiate With Your Internet Provider

Complete A Health Assessment

Sign Up For Auto-Pay

Rethink Your Health Insurance

Skim Your Bank Statements

Listen To A Personal Finance Podcast

Switch To A Prepaid Cellphone Plan

Set It And Forget It

This article originally appeared on HuffPost.