Who Really Knows Why The Dying Grandma Shredded All Her Money?

By now we've all heard about the dying 85-year-old Austrian woman who supposedly chopped up $1 million rather than let her relatives inherit it. Headlines describe her as "miserly" "spiteful," and "vengeful." Maybe she is; maybe she's not.

Police say that the unidentified woman died in a retirement home and when the workers were removing her possessions they discovered that she had chopped up 950,000 euros into tiny pieces on her bed. I'm guessing that no one in her family was present at her death or perhaps they would have noticed the scraps of money surrounding her: I'd think that $1 million -- or 950,000 euros -- would make for a lot of little pieces.

Anyway, now her relatives are busy trying to tape together what remains of the bills because bank President Friedrich Hammerschmidt of Oesterreichische Nationalbank said the family will likely be able to recover their inheritance if the heirs can find enough shreds of the money. He told the Kurier newspaper, "If we didn't pay out the money then we would be punishing the wrong people."

Really? Why is that? I'm wondering what Hammerschmidt knows about this woman and her relationship to her family -- or even what her intentions were. He said the bank normally does not replace intentionally destroyed money, but an exception can be made in cases where the person who destroyed the bills may not have been in their right mind. So is he saying that she suffered dementia?

Maybe, just maybe, the woman knew precisely what she was doing. I throw that idea out there because being disinherited is becoming an increasingly common thing -- for various reasons. According to a 2007 survey of high-net-worth Americans by PNC Wealth Management, 40 percent of respondents said they consider the emotional connection they have with an heir in determining how much money to leave that person. So if you have a damaged relationship, you might tighten your purse strings and practice a little tough love.

On one hand, we have those who want their children to be self-sufficient. Last spring, British comedian Lenny Henry said it was entirely appropriate for rich parents to cut their children out of an inheritance so they could learn to "stick up for themselves." The 56-year-old praised other celebrities including pop star Sting and Simon Cowell who have said they will not be leaving vast sums of money to their children. And of course there is Warren Buffett, who opted to give his kids values instead of billions. But in all those cases, the estate would be donated to charities -- not be turned into mattress confetti.

Then there are those elderly parents and grandparents who take all this "second chapter" stuff to heart. They reinvent themselves with new spouses and embark on adventures in their later years. Sometimes the wealth accumulated from their first family embarks with them. We know a woman who initially was thrilled that her 84-year-old father began to date again after four years of widowhood. She became less thrilled when Dad announced his engagement and his intention to leave everything to his new, 10-years-younger wife. "Your mother wanted me to be happy," he offered as way of explanation. Perhaps not that happy.

His daughter is correct as she sees the scenario being played out like this: Dad dies, the new wife gets everything and when she dies, the estate she inherited goes to her children and grandchildren, not his. At least Dad told his daughter of his intentions while he was still alive. Sometimes, it comes as a shock that wills and trusts were changed upon remarriage.

It's no secret that settling an estate is often fraught with surprises and bumps. Relatives come out of the woodwork to stake their claim. Siblings who rivaled for mom's attentions as kids now rival for her money.

As for this money-destroying Austrian grandma, the story feels riddled with holes. How did she get so much cash and didn't it take awhile to cut it all up? Where was the staff while this was occurring -- not to mention where was the family while Grammy was playing with scissors? How fast did it take her family to run to the bank and ask what could be done about it? And perhaps most important, what did the woman's will say about where she wanted her money to go? It was, after all, hers.

Maybe the morale of this story is: Karma can be a bitch.

Also on HuffPost:

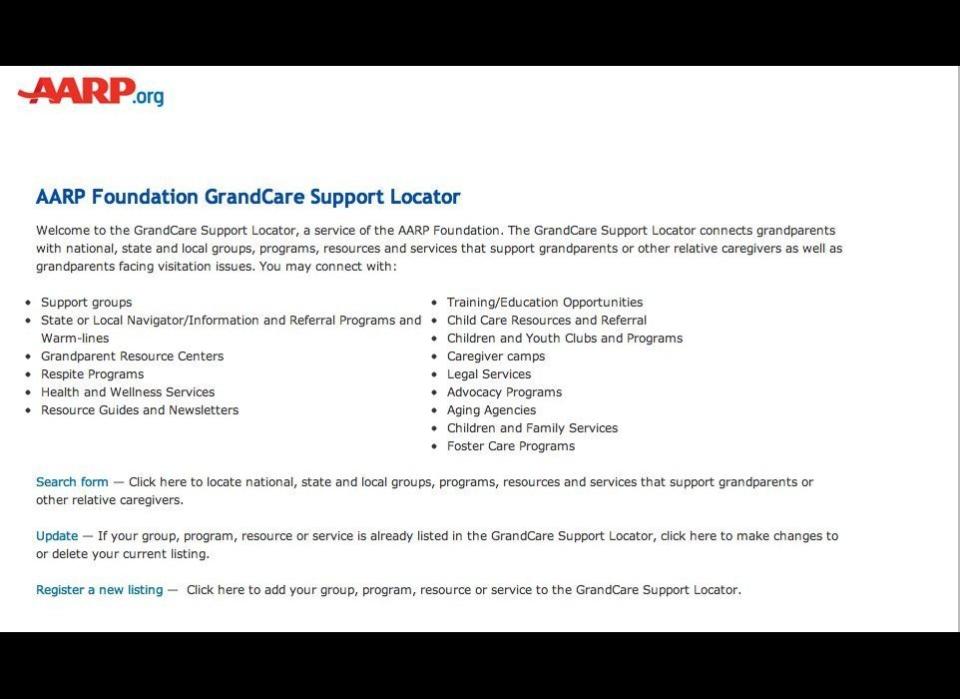

Financial Assistance

Tax Benefits

Health Insurance

Legal Issues

Savvy tip

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost.