'Playing with fire': Democrats, Republicans on a collision course over debt limit, spending

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

WASHINGTON – The Senate is on a collision course with the House over funding the federal government and increasing the country's ability to borrow, with the deadline for a funding decision a little over a week away.

Republican and Democratic congressional leaders are feuding over potentially "cataclysmic" and "irreparable" harm from failing to increase the debt limit.

House Speaker Nancy Pelosi, D-Calif., called Republicans irresponsible for refusing to help cover spending approved during the Trump administration.

But Senate Minority Leader Mitch McConnell, R-Ky., argued that Democrats are pursuing trillions of dollars in reckless taxing and spending while controlling the White House, House and Senate, so they can raise the debt limit on their own, too.

"My advice to this Democratic government: Don't play Russian roulette with our economy," McConnell said Wednesday.

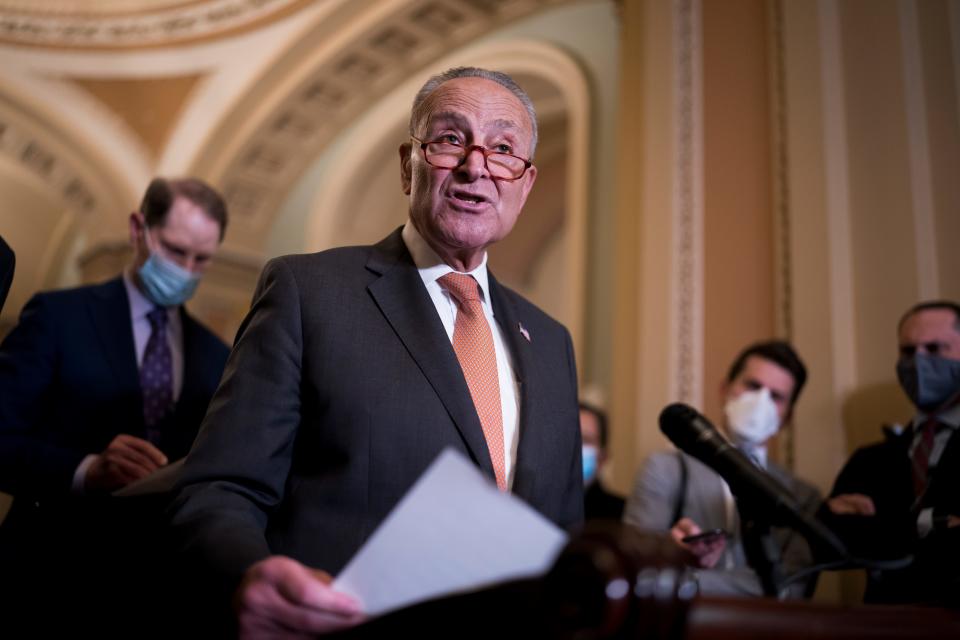

Congress: Schumer, McConnell clash over raising debt limit as Democrats put forth plan to fund government, increase borrowing

In a straight party-line vote, House Democrats voted 220-211 on Tuesday to extend federal funding to Dec. 3, to give lawmakers more time to negotiate funding for the entire fiscal year. The bill would also provide $28.6 billion for disaster assistance and $6.3 billion for Afghan refugee assistance.

Senate Republicans said they would support those provisions. But the legislation also sought to suspend the limit on how much the country can borrow until December 2022, which Republicans oppose and said Democrats must do on their own.

Without an increase, Treasury Secretary Janet Yellen has warned the country will be unable to borrow sometime in mid-October, which could lead to a worldwide economic catastrophe.

Pelosi and Senate Majority Leader Chuck Schumer, D-N.Y., have said Republicans are being irresponsible after Democrats helped raise the debt limit three times during the Trump administration.

"This is playing with fire," Schumer said Tuesday.

McConnell agreed that the debt limit must be increased. But he said because Democrats have refused to negotiate spending decisions such as the $3.5 trillion budget package of President Joe Biden's domestic priorities, they can deal with the debt themselves.

"America must never default," said McConnell, who noted the previous increase in debt was negotiated with a bipartisan cap on spending. "This one is not being negotiated on a bipartisan basis because obviously, we're not involved in any bipartisan discussion regarding the reckless taxing and spending legislation that they are having."

Issues for Congress piling up: Congress returns to work facing major decisions on Biden's agenda and infrastructure

In the evenly divided Senate, Democrats could approve the legislation on their own. But if some Republicans filibuster the legislation, Democrats would need 10 Republicans to join them in overcoming the hurdle to approve the bill.

The White House supported the legislation for both the funding and debt limit.

"This is a bipartisan responsibility that must be met in a timely fashion, just as it was three times under the prior administration, and almost 80 times in the last 60 years under administrations from both parties," the White House said in a statement. "The Administration looks forward to working with the Congress to pass full-year appropriations bills in December that make bold, forward-looking investments in our future."

'Irreparable harm' for failing to act

The failure to either extend federal government funding or increase the debt limit would hurt nearly every American, according to government officials.

Government shutdowns, such as one for 35 days in late 2018 and early 2019, and for 16 days in 2013, furloughed hundreds of thousands of federal workers and shuttered many federal agencies.

If no agreement is reached on spending, crucial parts of government such as the Pentagon and the Federal Aviation Administration would continue to function. But discretionary agencies such as the National Park Service would temporarily shut down.

Defaulting on the national debt, which has never happened before, would have longer-lasting implications because it would forever tarnish the country's reputation for paying its bills.

Lenders could demand higher interest and federal funding could dry up. Schumer warned that mortgages and car loans could get more expensive, and that payments for Social Security and veterans benefits could be delayed.

"Playing games with the debt ceiling is playing with fire and putting it on the back of the American people," Schumer said.

A report Tuesday from Moody’s Analytics warned of “cataclysmic” costs of failing to raise the debt ceiling. The report described a scenario “comparable to that suffered during the financial crisis” of 2008, with the American economy losing an estimated 6 million jobs and $15 trillion in household wealth, and the unemployment rate soaring to nearly 9%.

What is the debt ceiling?: What does raising the debt ceiling mean? Showdown returns to Congress on paying US bills

To stave off the problem, the Treasury has already suspended investments in civil service and Postal Service retirement funds. But Yellen warned Congress that once those sorts of emergency measures are exhausted, the country will be unable to meet its obligations for the first time in history.

"We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States," Yellen said in a Sept. 8 letter. "A delay that calls into question the federal government’s ability to meet all its obligations would likely cause irreparable damage to the U.S. economy and global financial markets."

This article originally appeared on USA TODAY: Congress on collision course over funding government, debt ceiling