How Joe Biden Can Cut Off The Fossil Fuel Industry’s Federal Funding

- Oops!Something went wrong.Please try again later.

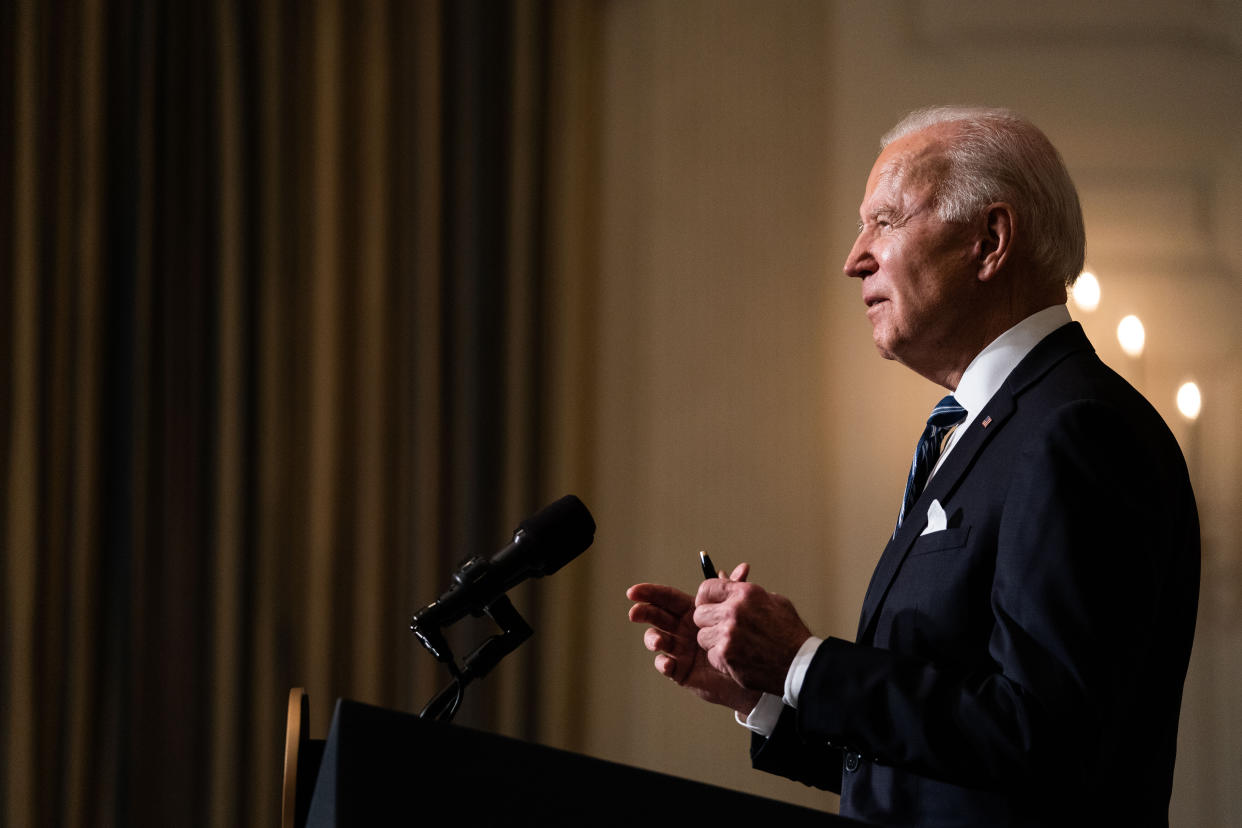

As part of his sweep of executive orders on climate change Wednesday, President Joe Biden directed his federal agencies to “eliminate fossil fuel subsidies as consistent with applicable law.”

The mandate made good on a campaign promise to cut off the bountiful federal benefits oil, gas and coal companies have received for generations, topping $15 billion a year alone in direct subsidies and tax incentives to fossil fuel producers.

Or, at least, it started to make good on that promise. If Biden wants to seriously halt the flow of taxpayer money to fossil fuel company coffers, he could take more aggressive steps to stop aiding producers and lobby Congress for new laws consistent with his administration’s climate goals.

Such steps are laid out in a new proposal from Evergreen Action, the climate policy shop founded last year by alumni from Washington Gov. Jay Inslee’s ill-fated but influential bid for the Democratic presidential nomination. The memo is likely to find an audience with the new administration. The group’s former political director, Maggie Thomas, was just named chief of staff to Biden’s newly formed Office of Domestic Climate Policy.

“The United States should definitely eliminate fossil fuel subsidies,” said Daniel Bresette, executive director of the nonprofit Environmental and Energy Study Institute, which was not involved in the report but called it a “welcome” listing of “steps that could be taken.” “As with most of our choices when it comes to climate change, we should look at this as a trade-up, not a trade-off.”

What Biden Would Need Congress To Do

The 11-page Evergreen Action memo highlights the limits of what the Biden administration can do unilaterally. At least a dozen ideas proposed in the document require Congress to act, including nearly all steps to cut off financial benefits to fossil fuel producers.

There’s the intangible drilling deduction, which lets oil companies deduct the cost of drilling new wells from their year-end tax bills, valued at $1.59 billion annually or $13 billion over the next 10 years. There are roughly $530 million in deductions for royalty payments to foreign governments for drilling overseas, and as much as $8.8 billion over the next 10 years in incentives for using captured carbon emissions to extract the dregs from oil wells. Then there’s the “first out, last in” accounting trick that allows companies to reduce their tax bills by selling off the most expensive fossil fuel reserves first, artificially reducing the inventory on which they pay taxes by an estimated $1.7 billion per year. All that would require lawmakers to enact new statutes.

So, too, would blocking oil and gas companies from using a tax structure known as Master Limited Partnership, or MLPs, which are exempt from corporate income tax. Nearly three-quarters of MLPs were fossil fuel companies as of 2016, according to data from the nonprofit Oil Change International, representing some $1.6 billion in lost annual tax revenue.

Congress would also need to give Biden the authority to yank existing drilling leases on federal lands, though the president’s advisers ― either recognizing their limitations or tempering activists’ expectations ― showed little appetite for that on Wednesday.

“The opportunity for states to continue to accrue royalties from coal and natural gas that’s properly done on federal lands can continue,” Gina McCarthy, Biden’s national climate adviser, said during a White House press briefing.

That doesn’t mean there’s no hope for legislation. Rep. Ilhan Omar (D-Minn.) and Sen. Bernie Sanders (I-Vt.) proposed a bill last year to strip fossil fuel companies of subsidies. The Evergreen Action memo calls on Biden to champion some version of that proposal.

“At a time when millions of Americans are out of work and many are struggling to put food on the table, there is no reason we should continue to dole out giveaways to some of the wealthiest corporations in the world,” Omar said in an email to HuffPost. “This is not a radical idea. It is the bare minimum necessary to confront the existential threat of the climate crisis.”

With Democrats in control of both chambers of Congress, Biden could also press allies to pass the bill Sen. Jeff Merkley (D-Ore.) and Rep. Nanette Barragán (D-Calif.) introduced last spring to permanently block the federal government from aiding fossil fuel companies during a crisis like the coronavirus pandemic by taking steps such as slashing royalty rates owed for drilling on public lands.

What Biden Could Do Himself

Some of the steps in the memo that the White House could take by itself are ones Biden has already done in some form. Among the executive orders Wednesday was a directive to agency heads to “identify steps” to “promote ending international financing of carbon-intensive fossil fuel-based energy” through the U.S. Export-Import Bank, the federal government’s main overseas financing arm. That language seems to leave open the door to natural gas projects and other lower-carbon fossil fuel infrastructure.

Evergreen Action’s proposal goes further, calling for an end to all fossil fuel financing.

The group urges Biden to “examine appropriate repayment from oil corporations for the costs to the U.S. Treasury for protecting their shipping lanes ― and thus their profits,” pointing to the $81 billion per year the nonprofit Securing America’s Future Energy estimates the military spends defending global oil supplies.

Another seldom-discussed benefit oil companies receive are federal icebreaking ships and other Arctic equipment the federal government lends to drilling operations, according to a Cambridge University paper by subsidy researcher Doug Koplow.

Contested Definitions Of ‘Subsidy’

The memo’s broad definition of subsidies frustrated some policy wonks who see precision as key to ending direct loans and tax credits. Groups like the International Monetary Fund have produced estimates of annual U.S. fossil fuel subsidies exceeding $649 billion.

But roughly 30% of that eye-popping figure represents consumption-side subsidies for driving that would remain in effect even if all vehicles on the road were electric, said Ronald Steenblik, the former special counselor for fossil fuel subsidy reform at the Organization for Economic Cooperation and Development, the 37-nation club of rich capitalist democracies.

“It confuses the narrative to call the numbers ‘subsidies,’ to divorce the term from popular understanding of the term and their connection with public policy,” Steenblik said. “Externalities from combustion are a major problem, but they are neither subsidies to producers nor addressed through what the majority of economists and politicians mean when they speak of ‘subsidy reform.’”

But Becca Ellison, the new policy manager at Evergreen Action, pushed back.

“Any expenditure of public resources should be considered a subsidy because, at the end of the day, that’s money that a fossil fuel corporation did not have to spend,” she said. “The federal government should not be participating in poisoning its people, especially when the costs of that are extremely high.”

This article originally appeared on HuffPost and has been updated.