Once Upon A Time White Collar Criminals Did This..

If you're angry that Enron's ex-CEO might get out of jail early, keep this in mind: At least he went to jail.

The decade-old Enron scandal returned to the headlines on Wednesday with the news that federal prosecutors and former Enron CEO Jeffrey Skilling had struck a deal that could let him out of prison as early as 2017, instead of 2028. It could be seen as yet another craven move by a weak-willed Justice Department, letting one of history's most corrupt corporate leaders walk in order to end years of legal wrangling. But it is also a reminder that, once upon a time, financial misdeeds had real consequences.

Skilling was convicted and sent to prison in 2006 on several counts, including charges that he had lied to investors and regulators about the financial viability of the once high-flying energy company Enron. The deal with prosecutors means Skilling could still spend 11 years in prison, more than any other Enron executive (founder Kenneth Lay died in 2006, just before his sentencing -- OR DID HE?)

The Enron conspirators were quickly charged, convicted and sent to prison for years for their crimes. So were the perpetrators of other financial frauds of the era, including WorldCom's Bernie Ebbers, Tyco's Dennis Kozlowski and many other former titans of industry. Congress moved quickly to enact the Sarbanes-Oxley Act of 2002 to prevent future accounting scandals. The former Big Five accounting firm Arthur Andersen was charged, tried and convicted of a crime, resulting in its destruction as a going concern.

Love HuffPost? Become a founding member of HuffPost Plus today.

The memory of Arthur Andersen is often cited as one reason why prosecutors have been afraid to charge banks with any crimes in connection with the financial crisis or the Libor market-manipulation scandal: Prosecutors don't want to cost innocent people their jobs by destroying an entire company over the misdeeds of a few. And in the case of the too-big-to-fail banks, the innocent victims of a criminal charge could include entire economies, frets Attorney General Eric Holder.

So instead, banks walk, and so do bankers. No one has been convicted of a crime arising from the financial crisis, and no one likely will, as the infuriating Frontline documentary "The Untouchables" showed recently. Bankers involved in crafting and selling toxic subprime mortgage securities have moved on to new lucrative jobs. A few traders have been charged with crimes in the Libor scandal, but top executives will almost certainly dodge any responsibility.

Meanwhile, in contrast to Sarbanes-Oxley, the Dodd-Frank financial reform law has been lobbied into submission in the years since the financial crisis. Less than half of its rules have been implemented. While Enron and other lawbreaking companies were laid waste after their scandals -- and these were some very big companies, recall -- the banks go on making record profits, helped along by the knowledge that the government will never let them fail. The biggest U.S. bank, JPMorgan Chase, has even been accused by the Federal Energy Regulatory Commission of engaging in Enron-like energy market manipulation, a charge the bank denies.

The frauds of a decade ago were arguably easier to spot and explain to a jury than the frauds of the financial crisis or Libor. Many have argued that bankers committed no crimes at all ahead of the crisis, or in the Libor scandal. The regulatory solutions were probably simpler, too.

Still, the stark contrast between outcomes in the two eras helps explain why so many people are still so angry about the financial crisis and its repercussions. We may also look back to this contrast when we go looking for the causes of the next round of financial scandals.

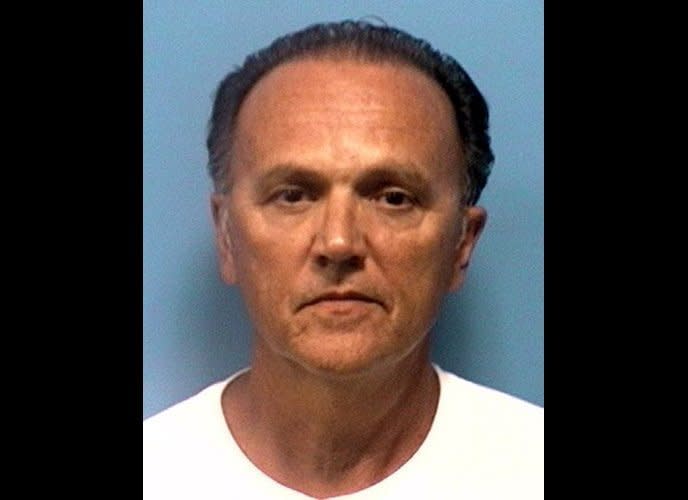

1. Martin L. Grass

> Current status of the company: Still active

In 1999, Rite-Aid (NYSE: RAD) CEO Martin L. Grass, the son of company founder Alex Grass, was forced to resign from the post he had held for just four years. Grass was formally indicted in 2002, along with several other high-ranking executives at the drugstore chain, for conspiracy to defraud, making false statements, as well as accounting fraud. In 2004, Grass pleaded guilty and reached a plea agreement to serve at least eight years in prison and pay a $500,000 fine, as well as waive $3 million in owed salary. In 2009, Grass moved into a halfway house and was subsequently released in 2010.

Read more at 24/7 Wall St.

2. Joseph Nacchio

> Current status of the company: Acquired

In March, 2005, telecommunication company Qwest's CEO Joseph Nacchio and several executives were indicted by the SEC. The charges included inflating revenue estimates, lying about nonexistent forthcoming government contracts, and illegally profiting from the run-up in the stock price. In 2007, Nacchio was sentenced to six years in prison. He was also ordered to pay a $19 million fine and forfeit an additional $52 million he had made through illegal trading. Nacchio appealed several times, losing his final appeal in the U.S. Court of Appeals for the Tenth Circuit. He began serving his term in February, 2009, but even now his legal team is petitioning to be heard in the Supreme Court.

Read more at 24/7 Wall St.

3. Walter Forbes

> Current status of the company: Split up

In 1998, Hospitality Franchise Systems, a platform used to purchase hotel chains, merged with direct marketing company Comp-U-Card International to form Cendant. The new corporation soon discovered, however, that Walter Forbes, CUC's former CEO and the CEO of the newly formed Cendant, had grossly misrepresented the financial status of CUC. He reported at least $500 million in nonexistent profits. Forbes, who insisted he knew nothing about the situation, was forced out. By 2002, the ex-CEO was indicted under fraud charges, and in 2007, after years of appeals, he was sentenced to 12 years in prison and $3.28 billion in damages. In 2005, Cendant split up and spun off into several different companies.

Read more at 24/7 Wall St. Read more: Top Ten CEOs Sent to Prison - 24/7 Wall St. http://247wallst.com/2012/05/17/top-ten-ceos-sent-to-prison/#ixzz1vEd1RweC

4. Richard Scrushy

> Current status of the company: Still active

Richard Scrushy, former CEO of HealthSouth (NYSE: HLS), has 20 years of illicit practices to his credit. Scrushy authorized the firing of whistle blowers, bribed and threatened HealthSouth execs and was complicit in illegal accounting practices. In November, 2003, Scrushy was indicted on charges of conspiracy, securities fraud, money laundering and mail fraud. However, the slippery Scrushy was acquitted on all charges in June, 2005. Less than four months later, he was indicted once again, this time on 30 counts of extortion, obstruction of justice, money laundering, racketeering and bribery. In June, 2007, Scrushy was finally sentenced to six years and 10 months in prison.

Read more at 24/7 Wall St.

5. Bernard "Bernie" Ebbers

> Current status of the company: Bankrupt and acquired

The fall of Bernard "Bernie" Ebbers, former CEO of WorldCom, began once the telecommunication company's proposed merger with Sprint (NYSE: S) fell through in June 2000 due to antitrust laws. WorldCom's stock subsequently plummeted and Ebbers and his executive team continued to rearrange the books to the tune of $11 billion in a desperate attempt to cover up losses. In 2002, the fraud was discovered by internal auditors and Ebbers ousted. In March 2005, Ebbers was convicted of conspiracy, securities fraud and seven counts of filing false reports with regulators. He's currently serving a 25-year sentence in a Louisiana jail.

Read more at 24/7 Wall St.

6. Jeffrey Skilling

> Current status of the company: Dissolved

Along with Chairman Kenneth Lay, former Enron CEO Jeff Skilling was instrumental in the Enron mega-scandal. Skilling encouraged the use of mark-to-market accounting, which appraises holdings based on expected values. In Enron's case, the lack of concrete pricing data for energy allowed it to act on overly optimistic forecasts. This accounting tactic resulted in Enron grossly overvaluing its holdings and sometimes even reporting gains on contracts that resulted in losses. Adding to his rap sheet, Skilling signed off on Chewco, a subsidiary of Enron that essentially served as a closet in which the company could stuff any debt it was trying to conceal. When Chewco's accounting practices were discovered, Enron was forced to adjust the company's books to reflect $405 million in additional losses; it was the beginning of the end. In May, 2006, Skilling was convicted of conspiracy, securities fraud and making false statements to auditors. He was sentenced to 24 years and four months in prison.

Read more at 24/7 Wall St.

7. John Rigas

> Current status of the company: Paying creditors before dissolving

In 2002, John Rigas was forced out of his position as CEO of cable provider Adelphia after being indicted of securities, bank, and wire fraud. Six other executives were also charged in the incident, including his two sons, Timothy and Michael. It became apparent during the trial that Rigas and his sons had used corporate funds for personal expenses. They had also concealed several billion dollars in owed loans. In 2003, a year after the incident began, Adelphia was still a member of the Fortune 500 companies. By 2006, the scandal had finally caught up with it, and the corporation had spiraled into bankruptcy as a direct result of the scandal. Rigas was sentenced to 15 years in federal prison, and is scheduled to be released in 2018.

Read more at 24/7 Wall St.

8. Dennis Kozlowski

> Current status of the company: Still active

In 2002, CEO Dennis Kozlowski and chief financial officer Mark H. Swartz, were accused of illegally siphoning off roughly $600 million from Tyco (NYSE: TYC). Kozlowski is mostly famous for his unabashed opulent spending of the monies he stole, shelling out for $6,000 shower curtains, expensive artworks and lavish corporate parties. He also threw private parties at the company's expense, including a Sardinia bash that included ice sculptures and a performance by Jimmy Buffett. Kozlowski was charged for receiving bonuses he claimed were paid at the direction of Tyco's board of directors. A judge disagreed and in June, 2005, convicted Kozlowski of theft. He was sentenced to serve a minimum of eight years and four months and a maximum of 25 years.

Read more at 24/7 Wall St.

9. Sanjay Kumar

> Current status of the company: Still active, renamed

Sanjay Kumar, former CEO of Computer Associates, led a $2.2 billion fraud at the company almost entirely via cooking the books. He and his fellow execs utilized sometimes comically simple tactics such backdating contracts and adding an extra week to the financial reporting period -- "the 35-day month." Kumar escaped prosecution for more than five years. His fraud started before 2000, but it was not until 2006 that he was finally indicted on charges of obstruction of justice and securities fraud. He was convicted and is currently serving a 12-year prison sentence.

Read more at 24/7 Wall St.

10. Martha Stewart

> Current status of the company: Still active

Implicated in the ImClone insider trading scandal, former Martha Stewart Living Omnimedia (NYSE: MSO) CEO Martha Stewart is the most famous entry on this list. Stewart's troubles began Christmas Day, 2001. That is when Samuel D. Waksal, CEO of ImClone Systems, found out that the company's experimental cancer drug Erbitux had been denied Food and Drug Administration approval. Waksal passed the information to friends and family, including his broker, Peter Bacanovic. He, in turn, tipped off Stewart, who dumped her shares before the news became public knowledge. Stewart was charged and ultimately convicted -- not of insider trading, but of perjury. She was sentenced in July, 2004, to five months prison time and two years probation.

Read more at 24/7 Wall St.

This article originally appeared on HuffPost.