This Finance Book Just Might Change Your Life

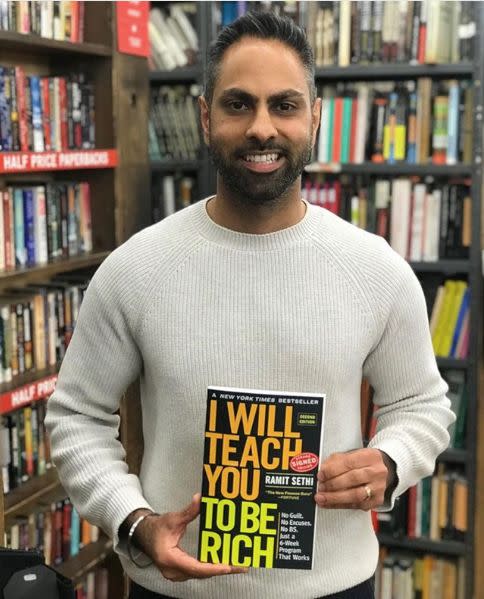

With the onslaught of money diaries, student loan news and articles about what your savings should be by age 30, it’s hard to know where to start and who to trust when you want to become financially literate. For me, that’s where Ramit Sethi’s bestselling book, “I Will Teach You To Be Rich,” came in.

The title is polarizing (Sethi joked that it “haunts” him), but the advice is easy to digest. Sethi’s breezy tone makes him seem like a really smart banker friend who loves answering your questions and occasionally yells at you for paying overdraft fees or sticking with a bad bank (looking at you, Bank of America and Wells Fargo).

His advice is on point, exciting to consume and actionable enough that you’ll actually WANT to look at your credit card debt and figure out how to pay it down or invest that leftover $5, $50, or $500 a month.

The book, a New York Times bestseller, also comes with prewritten, step-by-step guides for people to talk down their credit card company APRs or negotiate late bill charges. Getting started is the hardest part, and Sethi shows you how to keep yourself accountable.

“Yes, the best time to start investing was ten years ago. The second best time is today,” Sethi writes.

I spoke with Sethi for the updated version of his book, which recently celebrated its 10-year-anniversary. He spoke about living a “rich life,” why money should be a positive and bring you joy, and so much more.

On living a ‘rich life’ and what that means:

A rich life to me where you start by saying, I want to take control. I have agency. And you get informed enough to know what a Roth IRA is and you know how these things work.

On our misconceptions about a rich life:

Some people like they think rich is this Richie Rich life. I’m kind of on a crusade to show people no, that’s a toxic message you got from cartoons when you were 4 years old. And if you’re still making decisions based on when you were 4, then you’ve made a wrong turn somewhere. Let’s first re-contextualize what rich is.

If you want to have 1 million bucks in the bank because it makes you feel safe, or a big house, great. Or if you just want to save it and then spend it once a year on a beautiful resort hotel or starting a charity, also great. Rich is not just surviving. We can do better than that and we can think bigger than that.

On not living life in a spreadsheet:

My rich life is not logging into Vanguard or Excel. That’s not a rich life. A rich life is lived outside the spreadsheet. It’s traveling, it’s being out with friends and being comfortable saying, “Hey, let’s order this dessert. Oh, you like both of them. Let’s get them both in trial,” or giving back.

On calling out bad banks:

Many books are very generic about the recommendations they give, like “Here’s the five things you should look for in a bank.” I just said, “Look, here’s the best banks and here’s the worst ones and here’s why you could choose to agree or not.” I’ll tell you why.

Nobody needs generic. Tell me what to invest in. Tell me what I should be investing if I’m 25 versus 45, tell me what to say to the credit cards. In fact, tell me the words to use when they say no. And if you get down to that level, what bank account is the best? What’s the worst?

On the advice other people won’t give you:

Money can provide joy. So often the things we talk about when it comes to money are just negative guilt and saying , “You shouldn’t do this.” No, no, no. I always wanted to start from a position of, yes, what do I want to do? “I want to go to Thailand” or “I want to take a six-week honeymoon.” Or, “You know what? I just want to buy an amazing coat.”

That’s perfectly fine. But when have you ever heard of money experts say, “Yeah, you can go out and buy a $500 or $1,500 coat.” No, they would never let you. My perspective is spend extravagantly on the things you love.

On the harmful money messages we get growing up:

In many cases, we get no messages. Or if we do, they’re negative or toxic. They are: “Do you think money grows on trees” or, “We don’t talk about money in this family.” And when you go to a high school or college, very rarely are you taught about money. We’re taught about the nucleus in a cell, but we’re not taught about money.

On the effects of not learning about money in school:

What happens is we graduate from college, suddenly we’re earning money for the first time. Maybe we have debt, maybe not. And nobody’s really taught us about money and nobody’s talking about it. And so what happens is we go through our formative years of financial development, our 20s kind of just scraping information randomly from a friend.

Most people, they go through life their entire lives that way. And they wake up when they’re 40 and they say, “Oh man, I better start paying attention to this money thing.” But for the fortunate, the people who make a decision to take control, they can change the entire trajectory of their lives like in a weekend.

On why relying on friends and family for advice isn’t optimal:

The money we get almost always come from our parents and our parents are not financial experts. It’s unrealistic to expect them to be. So we pick up these money messages from someone who never really was formerly trained. They never even read a personal finance book, I’m willing to bet, and sometimes good things happen, sometimes bad things happen. But we pick these things up, these little phrases that are said at dinner.

On finding ― and naming ― your magic money number:

A lot people think to themselves, “I need more money to feel safe, I need more to show off to my friends from college or whatever.” And the thing is they never actually sat down and said, “How much [money]?” And what you discover is that the number is often much more modest than you think. So people say “rich,” oh that’s like, oh my God, that’s so much money.

And then I’m like, okay, well how much? And they never literally never thought about it ― and their eyes are just glazed over. I’m like let’s break it down ― no judgment. And so they feel comfortable with me cause I’m not here to judge. If you want to make $115,000 ― perfect.

On dialing down emotions when it comes to money:

I want every single one of us reading this book to be able to take our emotions around money from hot to cool. Now remember, cool does not mean that it’s all boring to you and you never look at it and you’re ignoring it. I want everybody to be able to use the information in the book and use the psychology that incorporated to go from this guilt, fear, rage, all this stuff to cool. It’s all running automatically. That’s my goal with the book.

On the one thing you should always buy, no matter what:

I have this book-buying rule and it says, if you are even thinking about buying a book just buy it, don’t even question it, just buy it. That’s why I say if you want to invest in a trainer or a tutor, this is a no-brainer. I’m encouraging people like when you travel, don’t just walk around, get a tour guide. It changes the way you experienced something.

This interview has been edited and condensed for clarity.

Related...

11 Things That Surprisingly Don't Affect Your Credit Score

This Map Shows The Average Credit Score In Every State

6 Quick Ways To Raise Your Credit Score Before Applying For A Mortgage

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost.