This Map Shows The Average Credit Score In Every State

It’s been a little more than 10 years since the financial crisis that kicked off the Great Recession. How are Americans’ finances faring today? Credit reporting agency Experian sought to find out with their latest State of Credit report, which examined today’s consumer credit behaviors ― including how credit scores break down for each U.S. state.

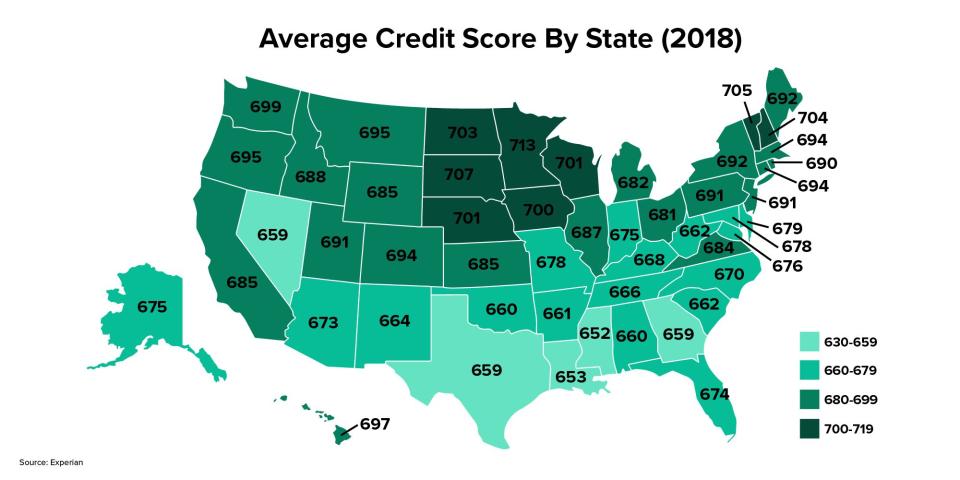

2018 Credit Score Rankings

As part of the annual study, Experian compared credit scores by state and ranked them by their average score in 2018. The top five states were Minnesota, South Dakota, Vermont, New Hampshire and Massachusetts, with average credit scores of 703 or higher. Mississippi, Louisiana, Nevada, Georgia and Texas took the five lowest spots, with average scores below 659.

Though it’s difficult to pinpoint why, exactly, credit scores are higher or lower in certain states, one clear factor is credit utilization. “The one thing that’s consistent across the states is that the utilization rate on revolving accounts is lower in the northern tier than it is in the states with the worst average score,” said Rod Griffin, director of consumer education and awareness for Experian.

Scoring companies recommend that you keep credit utilization under 30 percent; the best-scoring state of Minnesota has an average utilization rate of 26 percent, while Mississippi sits at 35 percent.

“The state rankings follow that utilization rate from top to bottom. So, I think that’s a really telling factor,” Griffin said.

Aside from that, there are many other factors that can influence scores, such as education levels, job markets, cultural approaches to using credit and others.

Credit Scores On The Rise

Though average credit scores aren’t as high as they were before the recession hit, the report found that overall, credit scores have improved since 2008. In fact, 2018 saw the biggest year-over-year increase in scores since 2008, up five points from 2017 for an average score of 680.

“A credit score of 680 falls into what we think of as ‘near-prime’,” said Rod Griffin, head of consumer education for Experian. “It’s good ― not great ― but it is an average so that makes sense,” he said, explaining that the real positive is that scores grew by five points. “It maybe doesn’t sound like a lot, but it really is.”

What’s driving that growth? Griffin said that the economy has improved, consumer confidence has grown, the unemployment rate has decreased and people have generally become more financially stable since 2008.

“Scores tend to be a bit of a lagging indicator in that way,” he said. “As people become more confident in their financial situation, they’re able to use credit as a financial tool ... and scores tend to increase as result.”

The report also found that the average person carries 3.04 credit cards, down slightly from 3.06 in 2017. Average credit card balances increased to $6,506, up $152 over the previous year.

Younger Generations See The Biggest Improvements

It’s clear that younger Americans have seen the most rapid improvements.

Even though those aged 18 to 21 saw increased average credit card balances ― up $203 from 2008 ― they also experienced a 23-point increase in credit scores. That was the largest score increase of any age group.

Those aged 22 to 35 had the second-largest increase in average credit scores since 2008, and also lowered their credit card balances by $990.

“Millennials have been reticent to use credit, and now that they are, they’re using it well,” Griffin said.

On the other hand, those aged 72 and older saw the most significant drop in average credit scores ― 772 in 2008 versus 732 in 2018 ― for a total decrease of 40 points. This group also experienced the largest increase in credit card balances, up $767 between 2008 and 2018 for a total of $4,703. They also experienced the largest increase in mortgage debt, up $29,602 for a total of $160,735 in 2018. Still, this age group continues to have the highest scores on average.

“Relative to the other generations, they’re still managing credit very well. But there are increases in areas that we haven’t seen as much in the past,” Griffin said.

Increasing Credit Awareness

Though the results of the State of Credit report are certainly interesting and may point to important larger trends, the most important takeaway is perhaps not the actual data.

“We want people to be aware of credit reports and credit scores and the importance of their financial lives, and understand that having good credit reports and credit scores are really key to achieving financial inclusion and being more financially successful,” Griffin said.

To find out where you stand credit-wise, start by requesting copies of your credit reports. You’re entitled to a free credit report from each of the three major credit bureaus once a year through annualcreditreport.com. Review your reports for errors, and learn how certain factors such as number of accounts, types of credit and more impact your score. There are several ways to see your credit score for free as well.

Related Coverage

7 Ways You Can Harm Your Credit Score Without Knowing It

Credit Report vs. Credit Score: What's The Difference?

A Perfect Credit Score Of 850 Is Possible, But It Probably Doesn't Matter

Also on HuffPost

Love HuffPost? Become a founding member of HuffPost Plus today.

Roll Over Your Old 401(k)

Switch Banks

Negotiate With Your Internet Provider

Complete A Health Assessment

Sign Up For Auto-Pay

Rethink Your Health Insurance

Skim Your Bank Statements

Listen To A Personal Finance Podcast

Switch To A Prepaid Cellphone Plan

Set It And Forget It

This article originally appeared on HuffPost.