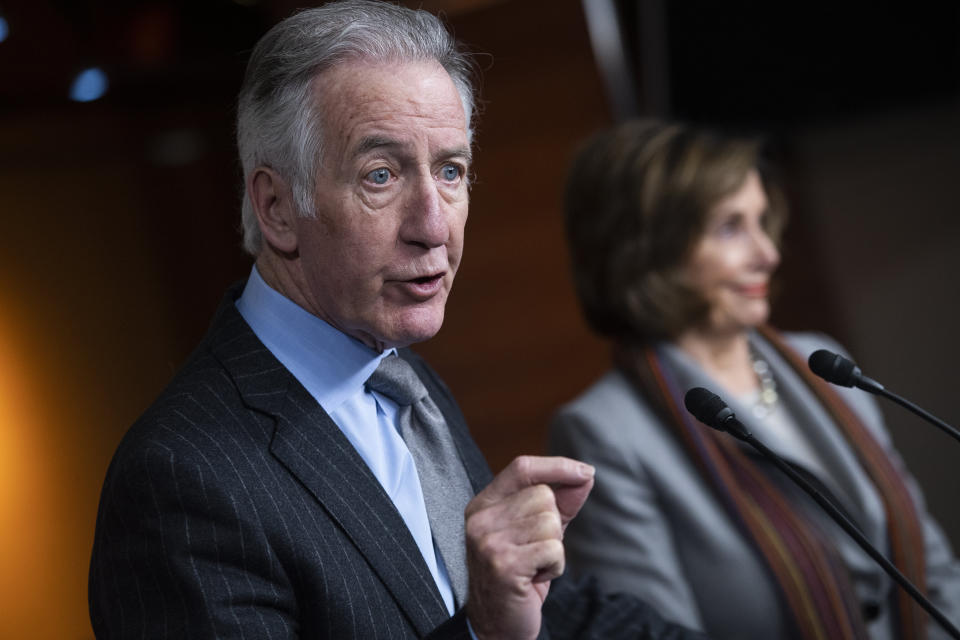

Supreme Court Gives Progressive Challenger Ammunition Against Rep. Richard Neal

A progressive mayor who is challenging Massachusetts Rep. Richard Neal (D) from the left seized on Thursday’s Supreme Court rulings as evidence of Neal’s failure as chairman of the House Ways and Means Committee to hold President Donald Trump accountable.

In a pair of historic opinions written by conservative Chief Justice John Roberts, the Supreme Court rejected Trump’s lawyers’ arguments that the president is immune from subpoenas of his personal records. The rulings could clear the way for the disclosure of Trump’s tax returns.

“What good is Richie Neal’s power in Congress if even [conservative Supreme Court justices] Brett Kavanaugh and Neil Gorsuch are doing more work to hold Trump accountable than he is?” Holyoke, Massachusetts, Mayor Alex Morse asked in a Thursday statement.

Morse, who has the chance to unseat Neal in Massachusetts’ Sept. 1 Democratic primaries, lambasted Neal for waiting until April 2019 to formally request Trump’s personal tax returns. The delay made it less likely the Supreme Court would rule on whether the Ways and Means Committee can compel their release before the November election, depriving the public of information that might influence its vote.

Neal has also declined to take advantage of a New York state law allowing Congress to obtain the president’s New York tax filings.

“As Chair of Ways and Means, Richard Neal should have been leading the fight to get Trump’s tax returns,” Morse added. “Instead, he’s been the biggest obstacle.”

In a statement issued by his House office, Neal celebrated the Supreme Court opinions as evidence that he would prevail in his own federal lawsuit to make the tax returns public. “I remain confident that the Ways and Means case ultimately will prevail,” he said. “The law is on our side and the Administration has no basis whatsoever to continue to refuse to comply with my request.”

Neal’s campaign did not immediately respond to a request for comment on Morse’s attacks.

From the minute Democrats took control of the House of Representatives in January 2019, Neal, as chairman of the House Ways and Means Committee, which oversees federal tax laws, had the power to ask for copies of President Donald Trump’s tax returns.

Tax returns can reveal information about a person’s income, charitable giving, and the amount of taxes they paid. They are generally treated as private information, with stiff penalties for unlawful disclosures. A law dating to the 1920s, however ― enacted specifically as a check on corruption in the executive branch ― gives tax committees the power to ask the Treasury Department to hand over any American’s tax info to committees sitting in a closed session.

Since Trump became the first major candidate and sitting president to withhold his tax returns in the decades since releasing them became common practice, Democrats anticipated wielding this power even before they retook the House.

But Neal was in no rush, saying he couldn’t do his oversight with an eye toward November 2020. “I can’t substitute my timetable for the federal courts’,” Neal told HuffPost in March 2019.

The 16-term incumbent alternately explained his foot-dragging as the result of his desire to draft the letter “methodically” or to wait until then-special counsel Robert Mueller completed his investigation of the president. (Neal would end up requesting the returns two weeks before Mueller issued his final report.)

All along though, critics warned that time was of the essence, since Trump’s Treasury Department was sure to deny the request and the president would then have the power to tie up efforts to compel their disclosure in the courts.

One such critic, Jeff Hauser, who runs the Center for Economic and Policy Research’s Revolving Door Project, an executive branch watchdog, estimates that a speedier Neal could have gotten his case into federal court by February 2019. That timeline could have put it on track for a Supreme Court hearing in the fall of 2019, and a decision between January and March 2020.

In the event, Neal filed his federal lawsuit seeking to enforce a subpoena for the tax returns in July 2019. Despite Neal’s earlier comments about not needing to rush, Democrats asked the court to hurry ― a request denied by U.S. District Judge Trevor McFadden, whom Trump had appointed to the U.S. District Court for the District of Columbia in 2017.

This past March, McFadden put the case on hold pending a federal appeals court ruling on House Democrats’ subpoena of former White House counsel Don McGahn.

But Democrats only subpoenaed McGahn after Mueller reported “substantial evidence” that Trump had pressured McGahn to fire Mueller. It is possible that if Neal had requested the records months before Mueller’s report, McGahn would not have become an issue in the federal courts.

“This was always a matter of great urgency and it was not treated as such by Richard Neal,” Hauser said. “His approach has very clearly failed.”

Of course, even if he had acted more quickly, there is no guarantee that Neal would have obtained a positive outcome before the Supreme Court.

While the Supreme Court invalidated the Trump’s administration’s case that a president’s personal records are inherently immune from subpoena power and upheld a Manhattan prosecutor’s subpoena of the accounting firm that handles those records, it also handed other House Democrats’ subpoenas of Trump records back to lower courts.

Those courts must assess whether the “asserted legislative purpose” of the subpoenas requires disclosure of the president’s personal papers. Part of the reason Neal didn’t rush to court was that his committee held hearings and drafted legislation related to the annual Internal Revenue Service audit of the president, which Neal cited as his main justification for requesting Trump’s returns.

Hauser believes that unlike the two House committees whose subpoenas the Supreme Court addressed ― the panels overseeing financial services, as well as government oversight and reform ― Neal’s Ways and Means Committee has a stronger case in court, given its explicit legal mandate to compel the release of a president’s tax returns.

He also maintains that Neal would have a clear “legislative purpose” for seeking the disclosure, since it would bear on whether Congress needs to update the law giving it authority to request the president’s tax returns.

If Neal had moved faster, Hauser said, “We’d have the tax returns or we’d have a constitutional war, because we’d have the committee waving the Supreme Court ruling and the president failing to comply with the Supreme Court, which would have clarified the stakes for the election in a meaningful way.”

Neil Kinkopf, a professor at the Georgia State University College of Law, disagreed. McFadden should have respected the fact that the 1924 law granting committees access to private tax information already represented a compromise between the executive and legislative branches. But that didn’t happen, and it probably wouldn’t have made a difference if Neal had rushed to court.

“Had he hurried up it would have been another consolidated subpoena with the others,” Kinkopf said.

Love HuffPost? Become a founding member of HuffPost Plus today.

This article originally appeared on HuffPost and has been updated.