Zynga's (NASDAQ:ZNGA) Solid Balance Sheet Provides Comfort for Institutional Bulls

This article first appeared on Simply Wall St News.

After a steady decline through most of the year, Zynga Inc.(NASDAQ: ZNGA) attempts to reverse that trend. The critical catalyst is an earnings report that showed that, although things were not great, they were not as bad as expected. The stock is now trading close to US$8, which is a strong resistance point.

Check out our latest analysis for Zynga

Third-quarter 2021 results

Revenue: US$704.7m (up 40% from 3Q 2020)

Net loss: US$41.7m (loss narrowed 66% from 3Q 2020)

The company reported a solid third-quarter result with reduced losses, improved revenues, and improved control over expenses. Over the last 3 years, on average, earnings per share have fallen by 58% per year, but its share price has increased by 30% per year, which means it is well ahead of earnings.

Institutions reacted positively to the news. Wells Fargo reiterated a Buy rating with a price target of US$13.00. The bank also took an interesting stance regarding policy shifts on the market. Apple's privacy policy changes have hit some ad vendors quite hard, and they believe it caused a short-term disruption of the market, triggering a more cautious approach from advertisers who are looking to optimize their spending. On the other hand, Barclays maintained an Overweight rating, but they lowered a price target to US$10.

Meanwhile, the company announced an HTML5-based game, "Disco Loco 3D," made exclusively for the TikTok platform. Although about 80% of the Zynga revenue comes from in-game purchases, games for TikTok won't be monetized, at least not initially. The first goal is to research the community and learn more about their gaming preferences. TikTok is one of the largest social networking services with over 1 billion users.

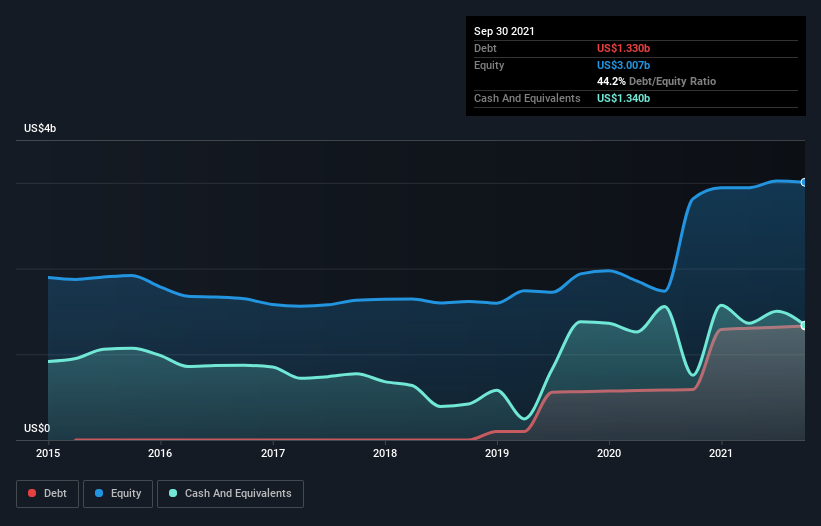

Examining Zynga's Debt

You can click the graphic below for the historical numbers, but it shows that as of September 2021, Zynga had US$1.33b of debt, an increase of US$589.3m, over one year. However, its balance sheet shows it holds US$1.34b in cash, so it has US$9.60m net cash.

How Healthy Is Zynga's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Zynga had liabilities of US$1.42b due within 12 months and liabilities of US$1.64b due beyond that. Offsetting this, it had US$1.34b in cash and US$210.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.51b.

Given Zynga has a market capitalization of US$7.77b, it's hard to believe these liabilities pose much threat. However, we think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Zynga boasts net cash, so it's fair to say it does not have a heavy debt load.

Although Zynga made a loss at the EBIT level last year, it was also good to see that it generated US$463m in EBIT over the previous twelve months. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, the future profitability of the business will decide if Zynga can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the taxman may like accounting profits, lenders only accept cold hard cash. While Zynga has net cash on its balance sheet, it's still worth looking at its ability to convert earnings before interest and tax (EBIT) to free cash flow to help us understand how quickly it is building (or eroding) that cash balance. During the last year, Zynga produced sturdy free cash flow equating to 61% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt when appropriate.

Summing up

Although Zynga's balance sheet isn't particularly strong due to the total liabilities, it is positive to see that it has net cash of US$9.60m. Thus, despite stocks' significant underperformance in 2021, we are not worried about its debt levels.

There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Zynga is showing 2 warning signs in our investment analysis, which you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks today.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com