Why Options Traders are Targeting SSR Mining Stock Today

Precious metal producer SSR Mining Inc (NASDAQ:SSRM) is seeing an uptick in options activity today, following the stock's addition to the Russell 1000 Index (RUI) and broad-market Russell 3000 Index (RUA). Separately, the company responded to recent Turkish media reports that indicated a possible temporary pause in operations in its Çöpler mine, noting it was seeking a formal response from the Ministry of Environment regarding these reports. This news is weighing on SSRM, which was last seen down 9.2% to trade at $17.11.

In response, options traders are pouncing on SSR Mining stock, with 2,700 calls and 1,085 puts exchanged so far -- 11 times the intraday average. The most popular contract is the December 17 call, where positions are being sold to open, followed by the July 18 call, where positions are being bought to open.

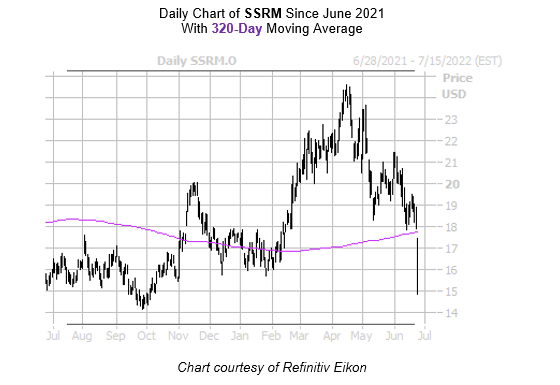

On the charts, the equity earlier fell to its lowest level of trading since October when it briefly dropped below the $15 level Now, SSRM is down 3% year-to-date, though it's managing to cling to its 9.5% 12-month lead. In addition, SSR Mining stock is on track to close below its 320-day moving average for the first time since February.