Why Home Depot, Inc. Could Be a Gold Mine for Income Investors

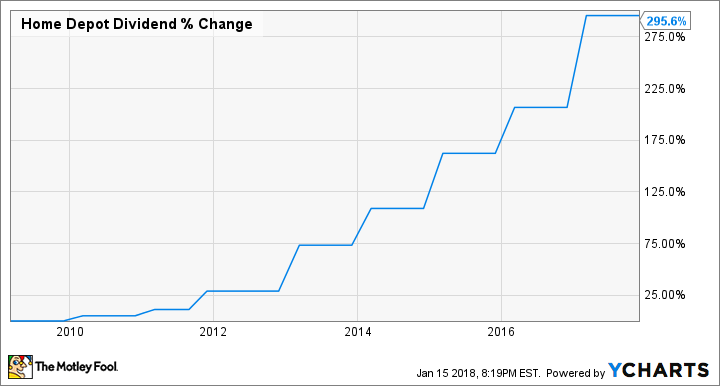

During the housing crisis last decade, Home Depot, Inc. (NYSE: HD) temporarily halted raising its dividend as it waited to see how long the economic crisis would last. Since 2010, however, Home Depot has resumed increasing its dividend, making eight consecutive years that the company has done so. In 2017, the company raised its quarterly dividend to $0.89, a more-than-robust 29% increase. Since 2009, the year before Home Depot continued raising its dividend, the quarterly payout has increased an incredible 295%.

Home Depot's current dividend yield stands at 1.85%, roughly on par with the yield of the S&P 500 index. Yet because of the company's recent history of strong dividend hikes and fantastic business prospects, I believe dividend lovers would be well served by investing in this home-improvement retailer for their dividend-growth needs.

Home Depot has increased its dividend by 295% since 2009. Image source: Home Depot Inc.

Hitting a Home run

While Home Depot's recent dividend hikes are nice, they wouldn't mean much if the business writing the checks was deteriorating. Fortunately for Home Depot shareholders, nothing could be further from the truth. In the company's third quarter, net sales increased to $25 billion, an 8.1% rise, and diluted earnings per share increased to $1.84, a 15% rise. Comparable-store sales, the gold standard by which to measure any brick-and-mortar retail operation, increased 7.9% across all Home Depot stores and 7.7% in domestic locations.

While Home Depot's growth has been driven by several factors, one longtime standout has been the integration of its online operations with its in-store shopping experience. E-commerce represents 6.4% of all sales, and 60% of in-store foot traffic begins with a digital experience. In each of the last four years, Home Depot has grown its online sales by more than $1 billion, a streak that doesn't seem in any danger of ending anytime soon. At its recent Investor and Analyst Conference, management stated 45% of the company's online orders are picked up in stores, and 85% of online returns are completed in stores.

Another area where Home Depot has shown great success is with the "Pro" customer. In its 10-K filing, Home Depot defines this type of customer as "primarily professional renovators/remodelers, general contractors, handymen, property managers, building service contractors and specialty tradesmen, such as installers." Pro customers are especially attractive to Home Depot because they tend to make more visits and spend more money per ticket than the average do-it-yourself weekend warrior. Pros currently account for about 40% of the company's sales, and sales growth to this customer segment is growing twice as fast as DIY customers.

Bringing Home the bacon

With Home Depot hitting home runs in so many of its business initiatives, income investors have little reason to believe that dividend hikes will cease anytime soon. Management also seems committed to passing on returns to shareholders in the form of dividends and share buybacks. At the Investor and Analyst Conference in December, CFO Carol Tome said:

We will use our cash to invest in the business, pay dividends and buy back our shares ... Our dividend principle is to target a dividend payout of approximately 55% of earnings with the goal of increasing our dividend every year ... And finally, our share-repurchase principle is to use excess cash to repurchase shares as long as it's value-creating.

With only one quarter to go in fiscal year 2017, the company is currently guiding for full-fiscal-year EPS to be $7.36. Home Depot is currently on pace to pay out $3.56 in dividends this year. This gives it a payout ratio of only 48.4%, below its goal of 55%, leaving plenty of room to raise it as earnings increase in the future.

For income investors looking for a stock with a fast-growing dividend that's supported by strong business fundamentals, it might be time to fix up their portfolios with this home-improvement retailer.

More From The Motley Fool

Matthew Cochrane owns shares of Home Depot. The Motley Fool has the following options: short May 2018 $175 calls on Home Depot and long January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot. The Motley Fool has a disclosure policy.