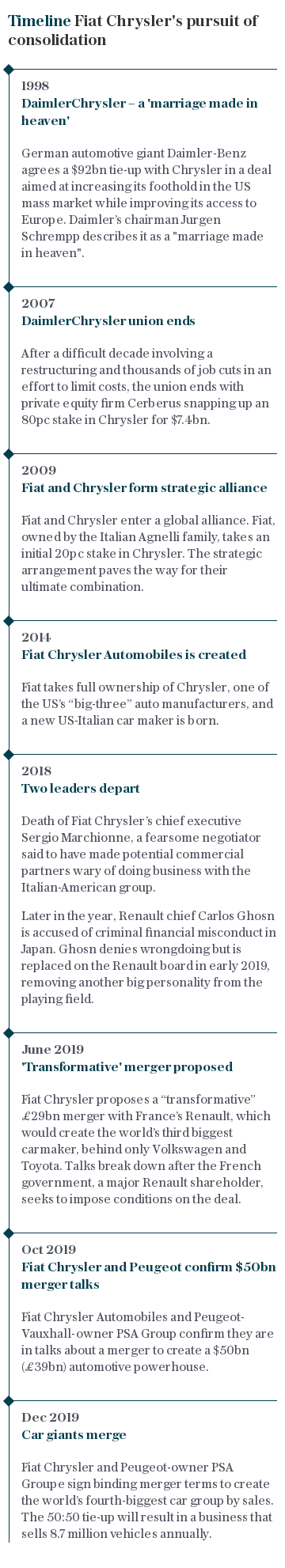

Vauxhall owner merges with Fiat Chrysler to form world’s fourth-biggest car maker

The world’s fourth-largest car company will be created on Monday when investors in Fiat Chrysler and the owner of Peugeot, Citroen and Vauxhall nod through a merger.

Joining forces will result in a €44bn (£39.6bn) automotive powerhouse to be called Stellantis.

Groupe PSA’s main shareholders backed the tie-up at a meeting with 99pc support thanks to their double voting rights, while Fiat Chrysler shareholders have also given their approval.

Merging will create a business of a scale approaching that of the world’s largest car makers, Toyota, Volkswagen Group and the Renault-Nissan Alliance, which each sold about 10m vehicles a year before coronavirus struck.

Fiat Chrysler - which also owns the Maserati, Jeep, Dodge and Ram brands - sold 4.4m cars in 2019/20, with PSA shifting 3.5m vehicles.

Joining forces will allow the two groups to combine resources and share research costs - regarded as essential as the car industry electrifies.

Car makers face huge costs from the transition away from internal combustion engines to electric vehicles, and mergers and partnerships are taking place worldwide as manufacturers seek to ease the financial burden by pooling resources.

Coming together will also create further opportunities for savings, such as combined purchasing power, but also raises questions about excess production capacity.

The industry is awash with under-utilised car plants - a situation exacerbated by falling sales caused by the pandemic - and some will no longer be needed.

PSA boss Carlos Tavares is due to lead Stellantis and his reputation as a fierce cost cutter may well mean he swings the axe to make the enlarged business leaner.

When the merger was first mooted two years ago, the companies predicted they could make €3.7bn of savings a year without closing factories. In September that figure was increased to €5bn, putting more pressure on under-performing plants.

One such factory is the Vauxhall plant in Ellesmere Port that builds the Astra. Mr Tavares has repeatedly warned of the risks posed by Brexit to it, likening Britain leaving the EU to a “train crash”.

A decision on whether to invest in building a new model at Ellesmere Port is drawing closer and although a trade deal has been agreed, it is still unclear just how much of an impact customs regulations as a result of Britain leaving the EU will have on the industry.

Mr Tavares has previously said he would invest in the plant but only “if there is a business case and we can make some money out of it”.

Red tape at the borders that could eat into notoriously thin margins in the industry may sway his decision.

Although Stellantis will be a global giant, neither Fiat Chrysler nor PSA has a strong presence in China, by far the world’s largest car market. Top of Mr Tavares’ to-do list may well be Stellantis targeting China, where 21m cars are bought each year.

Another priority will be rethinking the various marques’ portfolios, eliminating overlaps to stop vehicles from the same parent company competing with each other for sales.