The U.S. labor market keeps crushing expectations

The U.S. labor market continues to crush economists’ expectations for job creation in the Trump era.

On Wednesday, private payrolls data from ADP showed that 263,000 jobs were added to the U.S. private sector in March, topping expectations for a gain of 185,000. This marks the third straight month this series has topped expectations.

“Consumer dependent industries including healthcare, leisure and hospitality, and trade had strong growth during the month,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute.

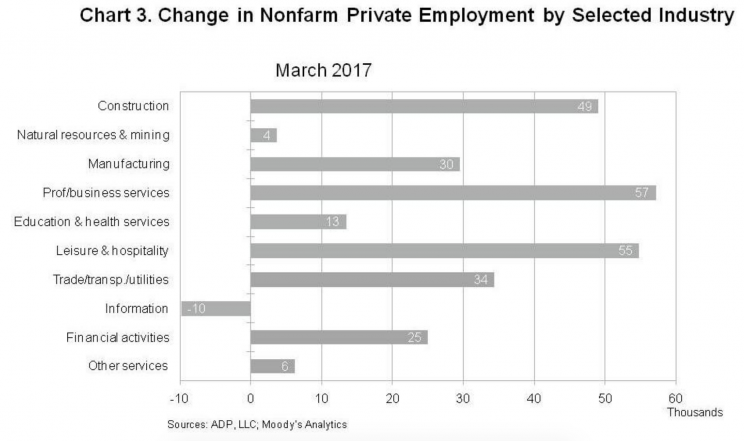

The biggest gains by industry in March came from the professional and business services sector, which added 57,000 jobs, followed by leisure and hospitality, and construction. ADP’s report comes just two days before the Bureau of Labor Statistics releases the government’s official employment report, which is expected to show nonfarm payrolls grew by 175,000 in March.

The continued strength of the U.S. labor market, however, comes at a time when the Federal Reserve has been raising interest rates and economists have discussed whether the economy is at “full employment” — or the unemployment level at which inflation begins to accelerate.

Following Wednesday’s report, Neil Dutta, an economist with Renaissance Macro, said, “Obviously a good number following that blowout ISM manufacturing employment number. But, where are all these people coming from?” (Emphasis added.)

At full employment, economists expect that job gains level off and wages rise as the pool of available labor gets taken up and employers are forced to increase wages to either retain to acquire additional labor. In a study last year, economists at the San Francisco Federal Reserve estimated that trend job growth requires just 50,000-110,000 jobs to be added to the economy each month.

Rising participation

The solid payroll gains not only over the last years or so, and including those since Donald Trump’s election, have been all about an increase in labor participation.

In February, the employment-to-population ratio rose to 60%, the highest since February 2009 and an indication that one of the most discouraging labor market trends of the last decade is starting to turn. Among prime-age workers — those between 25 and 54 — participation rose to 81.7% in February, the highest since 2011. At the height of the last cycle, prime age participation topped out at 83.4%.

The biggest gains were among millennials — ages 25 to 34 — with nonemployment falling below 22% for this age group after having been at 24% just a couple years ago.

An uptick on participation is in-step with the main theme of the U.S. economy since Trump’s election, which is that confidence at the level of workers, consumers, and business owners is up. A continued increase in payroll gains above what “trend growth” might call for likely hinges on how much confidence Trump’s economic agenda continues to engender among American workers that had perhaps viewed themselves as out of the labor market for good.

ADP vs. BLS

Michael Feroli, an economist at JPMorgan, wrote in a note on Wednesday that this better-than-expected ADP number won’t change his forecast for Friday’s release from the BLS for nonfarm payroll gains of 140,000 in March due to methodological differences between the two.

First, the ADP report lags the government’s data, and Feroli thinks the last two months of payrolls gains reported by the BLS were boosted by favorable weather conditions.

Second, the ADP’s includes economic confidence measures, which have been among the strongest economic data reports in recent months but are perhaps overstating actual economic growth.

Or as Ian Shepherdson, an economist at Pantheon Macro said of Wednesday’s number, “Looks great, but likely overstates the official number.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: