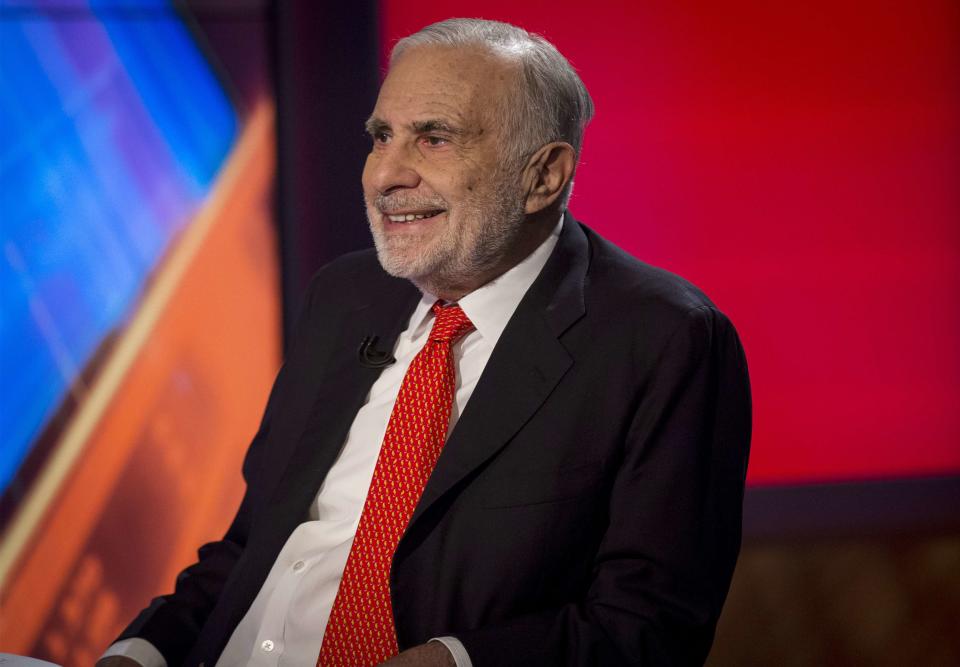

How will Carl Icahn’s post-election windfall ‘trickle down’ to the economy?

On election night around 12 a.m., billionaire Carl Icahn left the Trump celebration early to buy, buy, buy. The markets, giving into emotion, were crashing—Dow futures were down a whopping 5.6%—and Icahn correctly saw how nonsensical that was: Donald Trump’s tax cuts would surely boost the market in the short term. So he laid down a $1 billion bet. By the morning, the decline had reversed, and in the following days the markets were booming, with the Dow showing seven straight days of gains.

We don’t know exactly which horses Icahn laid his three-comma bet on, but if he were to have simply invested in something that reflects the market broadly, like the S&P 500, he would have made over $64 million even before Hillary Clinton’s concession speech.

President-elect Trump’s tax plan cuts taxes across the board, including a reduction in the top income tax rate from 39.6% to 33%, for income over $415,050. With these cuts, the hope is that someone like Icahn, with an extra $64 million in their pocket, uses gains to start a business or spend, boosting US growth and create jobs.

Supply-side economics, or trickle-down, as it’s often called, is meant to lift the economy: higher-income individuals will invest and spend the money they saved on taxes, which will spur a need for more jobs, as higher investment translates into higher demand for goods and services, and eventually workers’ wages.

So is Icahn going to go out and hire a team of landscapers, buy a new boat, or start a large (or small) business? Who knows? He’ll likely invest more in the stock market, which is fine but it doesn’t directly spur job creation.

To help to the poor, give the rich a break

If Trump manages to execute on his tax plans, the nation’s top earners would see big tax cuts. The average millionaire would get a tax cut of $317,000, according to the Tax Policy Center. Middle class families, on the other hand, might save a couple thousand—unless they have children. (The Tax Policy Center told NPR that a single parent making $75,000 with two school-age kids would see a $2,400 increase.)

More capital in the pockets of the top earners, unfortunately, does not mean it will flow down to the working people Trump’s campaign targeted. In fact, according to the nonpartisan Congressional Research Service, it has the opposite effect.

“The top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution,” its 2012 analysis concluded. Big tax cuts for the wealthy are, simply put, big tax cuts for the wealthy. (Trump also wants to kill the estate tax, which only affects around 4,400 extremely wealthy families per year, according to the Tax Policy Center.)

In addition to contributing to inequality, trickle-down tax-cuts-for-the-rich economics has not been shown to help long-term economic growth in the past. According to the CRS research, “the results of the analysis suggest that changes over the past 65 years in the top marginal tax rate and the top capital gains tax rate do not appear correlated with economic growth.”

Tax cuts for the top income brackets also don’t pay for themselves, though Republican politicians often tax income from higher economic growth make up for lower tax rates. “Hardly ever do we see it making up for the loss of revenue that happens when rates are cut,” Larry White, professor of economics at NYU’s Stern of Business, told Yahoo Finance.

This strategy has been debunked plenty. “If the income share of the top 20% (the rich) increases, then GDP growth actually declines over the medium term, suggesting that the benefits do not trickle down,” the IMF wrote in a study from June 2015. At best, Harvard Kennedy School professors found a tiny, tiny, 0.12% rise in GDP from a 1% rise in the top 10 share. “The effect was quite small, because it would take 13 years for people in the lower 90% to be fully compensated by the proceeds from economic growth for the loss in income shares,” the HKS website noted. The study’s author equated it to giving aspirin to someone with cancer.

Tax plans probably won’t address inequality in America, anyway

It’s possible to look at all of this and see Band-Aids on bullet wounds, even if the economists weren’t ignored. According to White, even if there were evidence that tax cuts for the wealthy ultimately benefited lower-earning workers, it wouldn’t be enough to stop the vast income gap. “It’s not going to make a big difference,” he told Yahoo Finance.

“We have a longer-run issue of a change in income distribution that has favored the upper income households. This is not something recent. It seems to have become exacerbated over the past two decades.”

White says there are myriad possibilities and reasons to drive this wedge between the two Americas, but in his view, changes in technology and consumer taste have affected our economy in enormous ways that go beyond tax policy. Though domestic manufacturing is at an all-time high, White says consumer preferences have steered us away from physical goods and toward consuming TV, sports, movies, tech services—things that employ fewer people for similar high-output tasks. It’s not hard to see why: It’s easier to make software than hardware. (Still, that might not matter either—automation is phasing out tons of manufacturing jobs here, a fact pretty much ignored in the 2016 election.)

Amidst high-level changes in what the economy looks like, it almost seems like a mere detail to talk about tax cuts for the wealthiest earners, when it comes to helping working people. “[Trickle-down] isn’t going to make a big difference in those underlying tech forces or preferences one way or another,” says White.

But that’s not to say Trump’s plan can’t cause some considerable damage. White points to another trickle-down tax cut plan, the cuts under George W. Bush, which squandered the massive surplus, and surplus projection left behind by Bill Clinton. “[It] completely got undone by George W. Bush tax cuts,” says White. “It did not lead to the expansion that he hoped for, and it created the large deficits that were then exacerbated by the recession in 2008.”

With Dodd-Frank under attack—Trump has promised to deregulate and repeal rules enacted after Wall Street’s systematic risk created the financial crisis— spending plans and tax cuts on the horizon, America is looking at a recipe it’s seen before.

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumerism, tech, and personal finance. Follow him on Twitter @ewolffmann.

Read more:

Trump’s jobs plan faces a bigger challenge than China

History says Trump probably won’t repeal Dodd-Frank any time soon

What ‘Trumpcare’ will look like