Top Rated Dividend Stocks

Archer-Daniels-Midland is one of companies on my list of top dividend stocks. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. Here are other similar dividend stocks that could be valuable additions to your current holdings.

Archer-Daniels-Midland Company (NYSE:ADM)

Archer-Daniels-Midland Company procures, transports, stores, processes, and merchandises agricultural commodities, products, and ingredients. Started in 1898, and currently headed by CEO Juan Luciano, the company employs 31,300 people and has a market cap of USD $23.87B, putting it in the large-cap category.

ADM has a good dividend yield of 3.11% and distributes 45.66% of its earnings to shareholders as dividends , and analysts are expecting a 46.95% payout ratio in the next three years. The company’s dividends per share have risen from US$0.52 to US$1.34 over the last 10 years. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. More on Archer-Daniels-Midland here.

International Paper Company (NYSE:IP)

International Paper Company operates as a paper and packaging company primarily in North America, Europe, Latin America, North Africa, India, and Russia. Formed in 1898, and run by CEO Mark Sutton, the company provides employment to 56,000 people and with the company’s market cap sitting at USD $24.34B, it falls under the large-cap category.

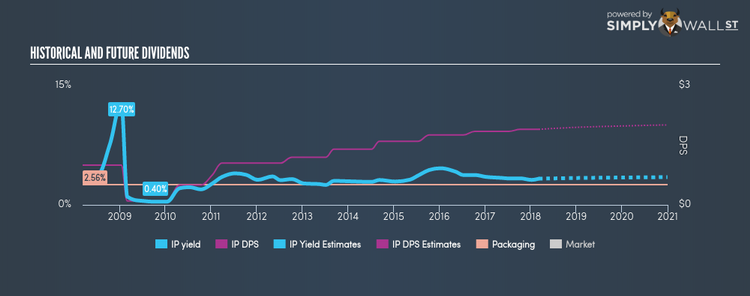

IP has a nice dividend yield of 3.29% and pays 36.43% of it’s earnings as dividends . The company’s dividends per share have risen from US$1.00 to US$1.90 over the last 10 years. The company has been a dependable payer too, not missing a payment in this 10 year period. The company recorded earnings growth of 163.09% in the past year, comparing favorably with the us packaging industry average of 10.93%. Interested in International Paper? Find out more here.

General Mills, Inc. (NYSE:GIS)

General Mills, Inc. manufactures and markets branded consumer foods in the United States. Started in 1928, and run by CEO Jeffrey Harmening, the company currently employs 38,000 people and with the stock’s market cap sitting at USD $28.80B, it comes under the large-cap category.

GIS has a decent dividend yield of 3.84% and the company currently pays out 69.87% of its profits as dividends . The company’s DPS has increased from US$0.80 to US$1.96 over the last 10 years. They have been dependable too, not missing a single payment in this time. Interested in General Mills? Find out more here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.