The US labor market continues to crush expectations

The historic labor market boom that President Donald Trump inherited former President Obama continues.

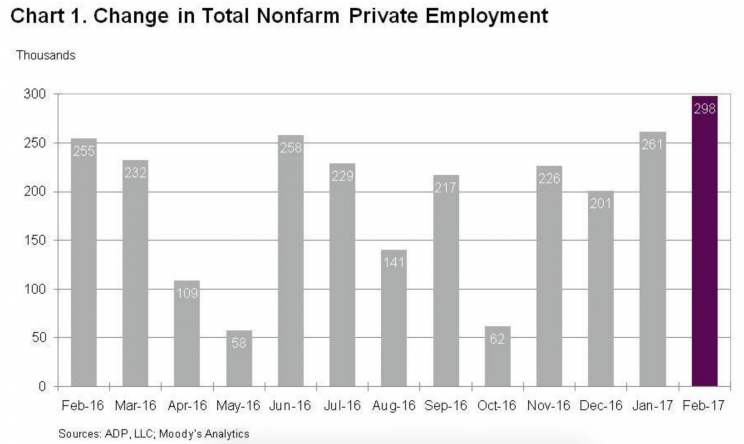

On Wednesday morning, the latest private payrolls report from data provider ADP showed 298,000 private payrolls were added to the U.S. economy in February. Economists were expecting a gain of 185,000.

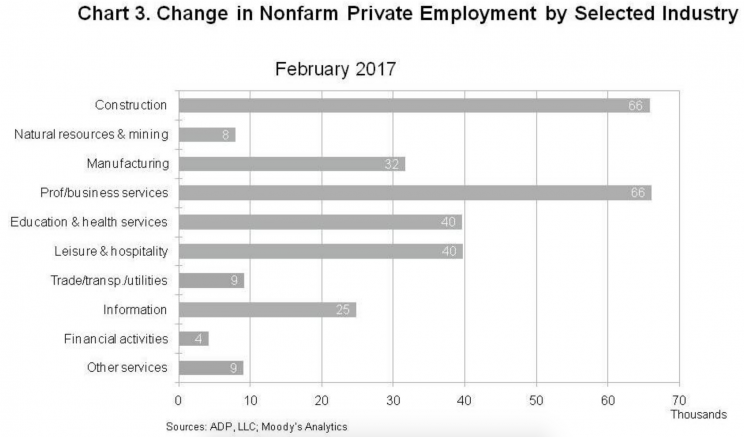

Daniel Silver, an economist at JP Morgan, said Wednesday this was, “one of the strongest gains in the history of the series that dates back to 2001. The report showed that goods-producing payrolls surged 106,000 in February, the largest gain on record, while the service sector added a more trend-like 193,000 jobs during the month.”

And while the ADP’s report is not a straightforward predictor of which way the BLS’ official jobs report on Friday will break, the labor market continues to show characteristics that indicate we’re not as late in the economic cycle as some may have previously argued.

As of January, the unemployment rate in the U.S. was 4.8% as 227,000 jobs were added to the economy in the first month of 2017. Over the previous 3 months, nonfarm payrolls had grown by an average of 184,000.

This re-acceleration in payroll growth comes as wages have begun to pick up and the Federal Reserve appears poised to begin raising interest rates faster than had been expected, which are clearly late-cycle economic dynamics.

But as we noted along with January jobs report, the unemployment rate actually rose as a result of more people coming back into the labor force and either getting a job or starting the search for one. The second-level reading on this, then, is that the election of Donald Trump has coaxed some previously disenfranchised workers to begin working again or at least looking for work.

In recent years, the so-called “missing men” of the U.S. economy, or the roughly 10 million prime-age men not in the labor force, have been the clearest representation of the economic anxiety some have credited with fueling Trump’s candidacy and eventual victory.

And while a drop in the unemployment rate below 5% has had some economists argue we are either at or approaching “full employment” — or the unemployment rate at which wages begin to accelerate due to a lack of remaining labor market slack — recent payroll gains indicate there are still workers yet to be drawn back into the labor force.

Now, ADP’s report did note that an unseasonably mild winter likely played a role in the higher-than-expected job gains, particularly in construction, where 66,000 jobs were added during the month.

But in a note to clients following the report, Ian Shepherdson at Pantheon Macro said, “this report is consistent with our view that the trend in payroll gains has rebounded after last year’s modest softening and is now set to run at 200,000-plus for the foreseeable future.”

Shepherdson added that this is likely to push down the unemployment rate and encourage the Fed to raise rates more quickly than markets expect. On Wednesday, Treasury yields were rising, indicating rates markets are beginning to grapple with this possibility.

And while each month’s jobs report is subject to calendar quirks and seasonal adjustments, stronger payroll gains both as a result of employers feeling more confident and workers feeling better about coming back into the labor force seem not unrelated to the election and the confidence bump we’ve seen since Donald Trump took office.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: