The most important lesson investors learned from the election

“Stay invested.”

It’s a lesson financial advisors the world over preach to clients on a near-constant basis. Keep the money you’ve invested in financial markets in financial markets.

But there are only so many opportunities for investors to see successful applications of this lesson play out.

Market events before, during, and after the 2016 presidential election, however, provided a textbook example of why time in the market is more important than timing the market.

Up, down, and back up again

As a Donald Trump victory came into focus for financial markets on Tuesday night, markets began sliding. Near midnight eastern, Dow futures were down 800 points. S&P 500 futures hit their limit-down level after falling 5%.

By the time markets closed on Wednesday afternoon in New York, however, stocks had recovered all of these losses and then some, with the Dow gaining 250 points by the closing bell to extend a winning streak to three days.

By Thursday morning, markets were trying to make sense of this market rally. Near noon eastern on Thursday, markets were mixed.

In markets, life comes at you fast.

The oldest lesson in the book

Successful long-term investing is not about timing the market but maximizing your time in the market.

“Investors often think they should move in and out of financial markets, trying to time the buying/selling of stocks based on a series of events, or increasing/decreasing their bond exposure depending on expectations for interest rates,” write Bank of America Merrill Lynch strategists Martin Mauro and Cheryl Rowan.

“History shows the value of staying invested in bonds for the income generated regardless of rates, and proves the rewards of staying invested in stocks despite periodic market declines.”

And what work from Mauro and Rowan’s colleagues on BAML’s stock research team shows is that while investors might want to avoid big declines by selling during uncertain times, the more painful outcome is missing the big gains.

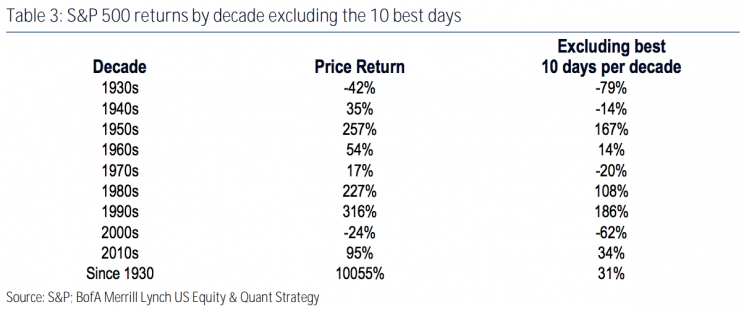

This table from BAML shows the dramatic impact missing the 10 — 10! — best days per decade can have on your portfolio. It is massive.

As we see, in the 1980s, the S&P 500’s price return was 227%. If you leave out the 10 best days, the price return is a still respectable 108%.

But this is the difference between ending the ’80s with a balance of $32,700 vs $20,800 on a hypothetical $10,000 investment. (Caveats:There are fees, you wouldn’t likely invest on Jan. 1 and cash out of Dec. 31, etc. etc. This is just a hypothetical.)

And while this difference matters for an investment spanning just the 1980s, the even bigger difference is going forward.

At the beginning of the 1990s, our hypothetical investment now has a higher starting balance and thus benefits from the benefits of compounding interest.

Our $32,700 investment that stays in the market throughout the 1990s rises to $136,032 by remaining invested and enjoying the 316% price return in that decade.

If our $20,800 investment repeats the same mistakes, it will be worth just $59,488 at decade’s end. Even if the mistakes of the 1980s are rectified the following decade, this investment’s balance totals just $86,528.

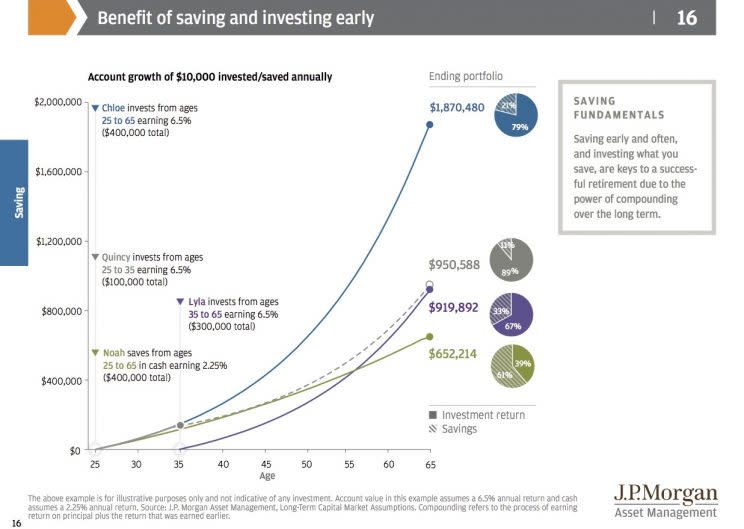

This chart from JP Morgan Asset Management makes the point even more vividly: save early, save often, and keep saving.

The points don’t matter, but the time does

On the 1990s comedy show “Whose Line Is It Anyway?” host Drew Carey used to remind viewers that the points didn’t matter.

In markets, of course, this is not quite right: the points do matter. But they only really matter if you give the points enough time to accumulate.

As we saw in our previous example of how a $10,000 investment grows over time, what mattered more to our investment was how long and how consistently it stayed in the market.

Successful wealth creation requires investors to take a long-term view, no matter if their investment is in stocks, bonds, real estate, or anything else.

“At any point in time, there are reasons to be wary about events that could have adverse effects on financial markets,” Mauro and Rowan write.

“But we urge equity investors to have an action plan in place for the aftermath of those events or in the case that they do not occur as planned. Bond investors may want to re-think the decision to wait out rate increases. That’s because we generally find more risk to being out of markets.” (Emphasis added.)

None of this is to say that any day in the market is meaningless.

Thursday’s action, while still volatile and a bit schizophrenic, is indicating some are concerned about how more restrictive trade policies from Trump could impact the price of imported goods that tech companies sell. Materials and industrial companies, which could benefit from more infrastructure spending, continue to rally.

Markets, in other words, continue to give us information which will matter both today and potentially in the long term.

But if you’re investing for retirement and trying to build long-term wealth, the key is to take each day seriously but never let any one day change everything.

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland