Here is the moment markets believed Donald Trump would become president

Donald Trump looks likely to be named the 45th president of the United States.

And financial markets were way out in front of it.

On Tuesday night a little after 8:00 p.m. ET, stock market futures began their descent as — in a result that surprised almost every political pollster — Trump pulled ahead of former Secretary of State Hillary Clinton.

But it was the hang-up in Florida — which the Associated Press called for Trump just before 11:00 p.m. ET — that eventually pushed markets sharply lower and for good.

When all was said and done, S&P 500 futures fell 5% to hit limit-down, halting trade until Wednesday morning. Nasdaq futures also went limit-down. At around 12:30 a.m. ET, however, both issues had resumed trading. Dow futures also nose-dived, declining as much as 800 points, a drop of more than 4.5%.

The other major predictive market move on Tuesday night was the Mexican peso, which fell more than 13% against the dollar.

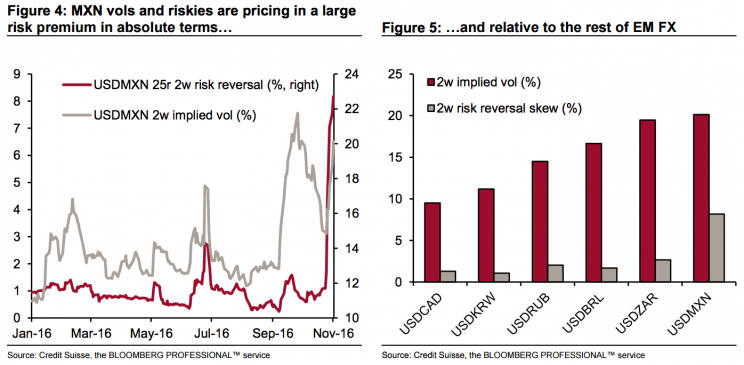

Throughout the election, the peso had tracked the fortunes of Hillary Clinton closely, and forex markets had priced in the possibility of a massive move were Trump to prevail.

Trump has not only jawboned extensively on seeking more restrictive US trade policy, but has singled out Mexico, particularly with his election promise to build a wall along the US-Mexico border and proclaiming that “Mexico will pay for it.”

In a recent note to clients, Credit Suisse analysts Shahab Jalinoos and Alvise Marino wrote, “We first mentioned ‘Trumpxit’ risk back in Q1 this year (the stylized tail risk that the US economy under Trump moves to disconnect from the global economy in the same manner as the UK is seeking to do from the EU now).

“At the time, we flagged MXN as the ultimate market indicator of the probability of a Trump victory, seeing it as the ‘canary in the coal mine’.”

On Tuesday night, this prediction proved prescient as the peso is where markets first started to see the kind of massive dislocation that indicated markets believed Trump would prevail.

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland