2018 still haunts the Fed: Morning Brief

Monday, October 28, 2019

The market says the Fed isn't done yet

The Federal Reserve is likely going to cut interest rates on Wednesday.

Data from the CME Group suggests there is a 93.5% chance we see the Fed's third rate cut of the year on Wednesday, marking the central bank’s third rate cut in as many meetings.

And while views on Wall Street might diverge on whether this rate cut will be the last of the current "mid-cycle adjustment" — and views differ on whether this rate cut is warranted at all — the Fed's stated reason for cutting rates right now means this won't be the end of their cycle.

Because what the Fed is trying to do right now is avoid a recession. And that probably takes more easing.

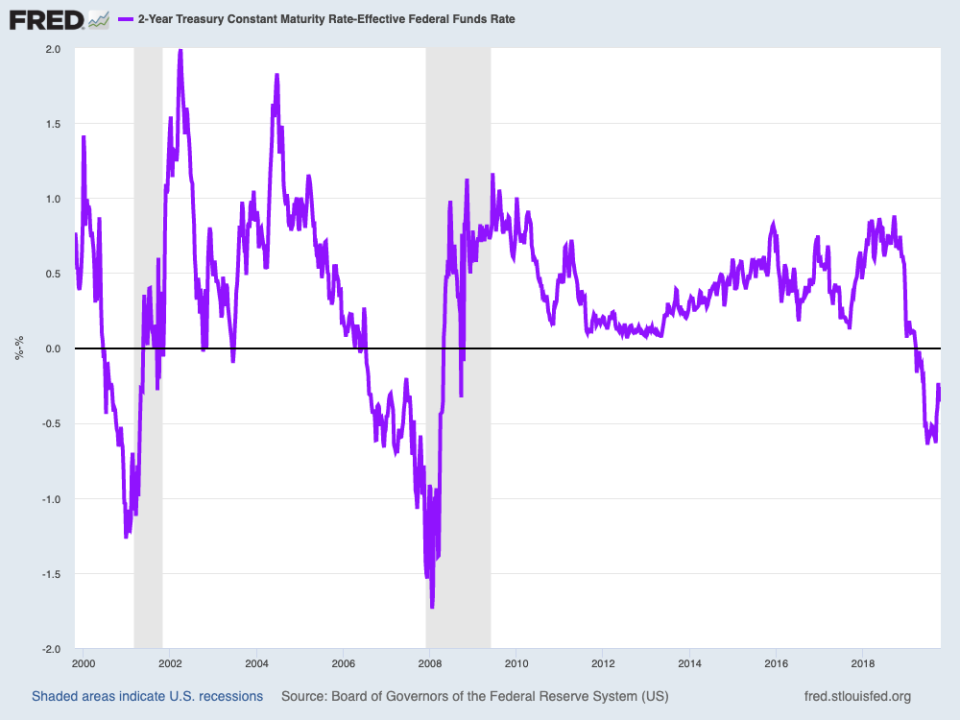

The 2018 rate-hiking cycle tightened financial conditions and triggered a stock market selloff that resulted in the worst year for the S&P 500 since said financial crisis. And even with the Fed reversing course this year, economist Joe LaVorgna at Natixis highlighted in a note to clients this week that 2019's easing cycle still hasn't worked off the Fed's 2018 mistakes.

In his note, LaVorgna highlighted that the spread between the current two-year Treasury yield and the targeted Federal Funds rate is currently negative. In LaVorgna's view, this inversion is telling the Fed that more than 25 more basis points of easing are needed right now, adding that, "from a risk management perspective, the Fed should maintain maximum optionality — leaving the door open to further interest rate cuts."

"After all," Lavorgna added, “if the economy surprises to the upside over the next few months, interest rates will rise accordingly. Then, the Fed can stand pat.”

Last week on The Final Round, we spoke with Merrill Lynch strategist Matt Diczok who reminded viewers that there are basically two ways to get a recession — either a negative shock to supply or demand, or the Fed tightens too much and the economy turns south.

The Fed right now is working to prevent the latter.

This past week, economic data suggested that the decelerating economy is not getting worse. But as we noted, questions about the labor market — and in turn, the U.S. consumer — are still outstanding.

Rob Martin and the economics team at UBS estimate that Friday's jobs report will show just 60,000 new jobs were created this month, with the General Motors (GM) strike impacting that headline number by 49,000. Combining this data with an expected GDP print showing the economy grew at an annualized rate of just 1.6%, concerns about the state of the economy aren't likely to recede.

“It is too early for the Committee to communicate a neutral stance for policy at the October meeting,” said economists at Deutsche Bank in a note to clients this week. “With risks remaining skewed to the downside, incoming data continuing to soften, and leading indicators signaling a further slowdown in the coming quarters, the Committee will find it hard to send a clearly hawkish signal at the October meeting.”

So while trade headlines can still be a market mover — as we saw on Friday — the market's message to the Fed remains one that calls for easier monetary policy.

“Mid-cycle adjustment” has become the defining phrase of the Powell Fed in 2019. And it's not yet clear that we'll enter the new decade having retired this guiding principle for the current Fed regime.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Chicago Fed National Activity Index, September (0.10 in August); Wholesale Inventories month-on-month, September preliminary (0.2% prior); Dallas Fed Manufacturing Activity, October (0.0 expected, 1.5 in September)

Earnings

Pre-market

Post-market

4 p.m. ET: Alphabet (GOOGL) is expected to report earnings of $12.57 per share on $32.71 billion in revenue

4 p.m. ET: Beyond Meat (BYND) is expected to report earnings of 5 cents per share on $77.10 million in revenue

From Yahoo Finance

On the Move co-anchor Adam Shapiro will be on the floor of the New York Stock Exchange to talk to Sir Richard Branson, founder of Virgin Galactic, Chamath Palihapitiya, founder of Social Capital Hedosophia Holdings, and George Whitesides, Virgin Galactic CEO, about Virgin Galactic’s first day of trading under the ticker SPCE. It will become the first commercial commercial space company to list on NYSE. Watch the interview on On the Move at 11:10 a.m. ET.

Top News

Pound climbs after EU agrees three-month Brexit 'flextension' [Yahoo Finance UK]

Louis Vutton owner confirms takeover talks with US jeweler Tiffany [Yahoo Finance UK]

HSBC's profit slips as CEO vows to ‘remodel’ the bank [Yahoo Finance UK]

Survey: US business hiring falls to a 7-year low [AP]

YAHOO FINANCE HIGHLIGHTS

World's first tech ambassador: 'We're grateful' to big tech for the crisis

How does vaping work? The science and history explained

New American Dream 'mall' has much more than retail

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.