The Dow just hit 20,000, but half of America missed out

On Wednesday, the Dow Jones Industrial Average traded above 20,000 for the first time.

This barrier, which is more important psychologically than it is for actual investment decisions, had been in the market’s sights for over a month after the post-election rally that followed Donald Trump’s election sent stocks to new records.

Unfortunately, however, many Americans missed out.

Back in April 2016, Gallup conducted its latest annual poll showing that just 52% of American adults owned stocks, via either individual issues, mutual funds, or self-directed 401(k) plans. This matched the lowest ownership level in Gallup’s 19-year tracking of this measure.

In 2007, 65% of American adults reported owning stocks, and this number has declined steadily since the financial crisis-induced recession and the 38% decline the S&P 500 saw in 2008.

Additionally, the Americans most likely to abandon the stock market are those in the middle class who likely need investment returns on their retirement savings to make retiring viable.

“Although Americans in all income groups are less likely to have stock investments now than before the Great Recession, middle-class Americans have been the most likely to flee the market,” Gallup wrote.

“Nearly three in four middle-class Americans, with annual household incomes ranging from $30,000 to $74,999, said they invested money in the stock market in 2007. Today, only half report having stock investments. This 22-percentage-point drop is more than double the changes seen in stock investing among higher and lower income groups.”

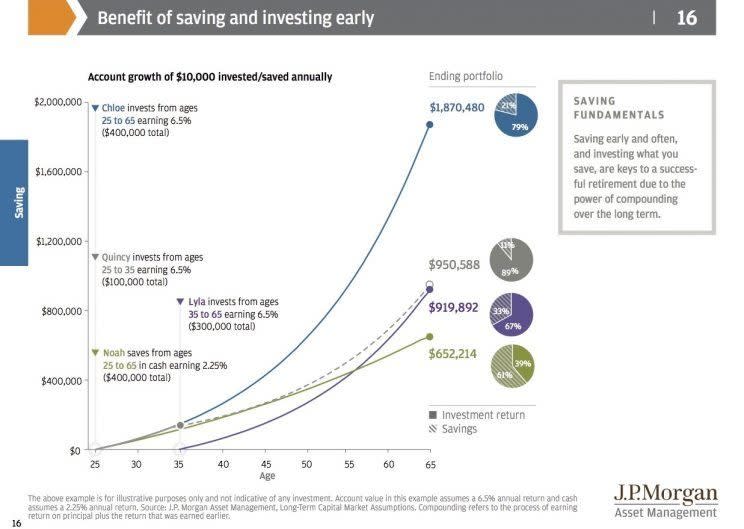

And even more discouragingly, just 38% of Americans ages 18-34 are invested in the stock market, down from 52% in 2007. These are the savers, however, that would benefit most from long-term stock market investments due to the magic of compounding interest.

Meanwhile, investment flows among major institutional investors — who in many cases are investing on behalf of retirement savers — have shown a huge uptick in money moving into bonds and out of stocks.

Part of this move into bonds and out of stocks, no doubt, is due to an aging investment class that has shifted their portfolio towards the relative safety of fixed income. But there is certainly some element of fear and long investor memories driving money out of the stock market.

Additionally, stagnant incomes for most Americans over the last several decades have simply left many households with less money or no money available to put aside for retirement savings.

On Wednesday, Donald Trump and some of his top advisors were quick to either celebrate the Dow cracking the 20,000 milestone or outright take credit for the rally. And there is more than a little bit of truth to this. Markets rallied after Trump’s election, largely on hopes that his tax proposals would increase corporate profits and that his infrastructure plans would boost economic growth.

But as Yahoo Finance’s Rick Newman wrote following Trump’s election and the ensuing market rally, the first benefits of his presidency have accrued to the shareholder class. This trend has continued.

And while seeing the Dow hit 20,000 and the S&P 500 and Nasdaq hit new records might make some people nervous about investing in the market, the last century-plus of market history has taught us that over time, stocks usually go up.

Since its inception in 1896, the Dow has averaged an annual return of a bit better than 7%. Mixed in there, however, were decades in which the index lost about 40% of its value; the Dow’s worst-ever year saw a 52% drawdown. On the other side, we’ve seen the Dow roughly triple since the financial crisis bottom, and in the 1990s the Dow rose over 310%.

Research from Bank of America Merrill Lynch shows that if an investor misses the best 10 days per decade, their long-term stock market gains get absolutely shredded. Excluding the 10 best days of that 1990s rally, for example, would see an investor earn a 186% return against 317%. Going back to the 1930s, missing the 10 best days each decades earns a cumulative 31% return against the S&P 500s actual return of 10,055%.

Of course, to enjoy any of these benefits, one needs to be invested. And unfortunately, many Americans haven’t taken that first step.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: