The coronavirus has caused a wave of early retirement

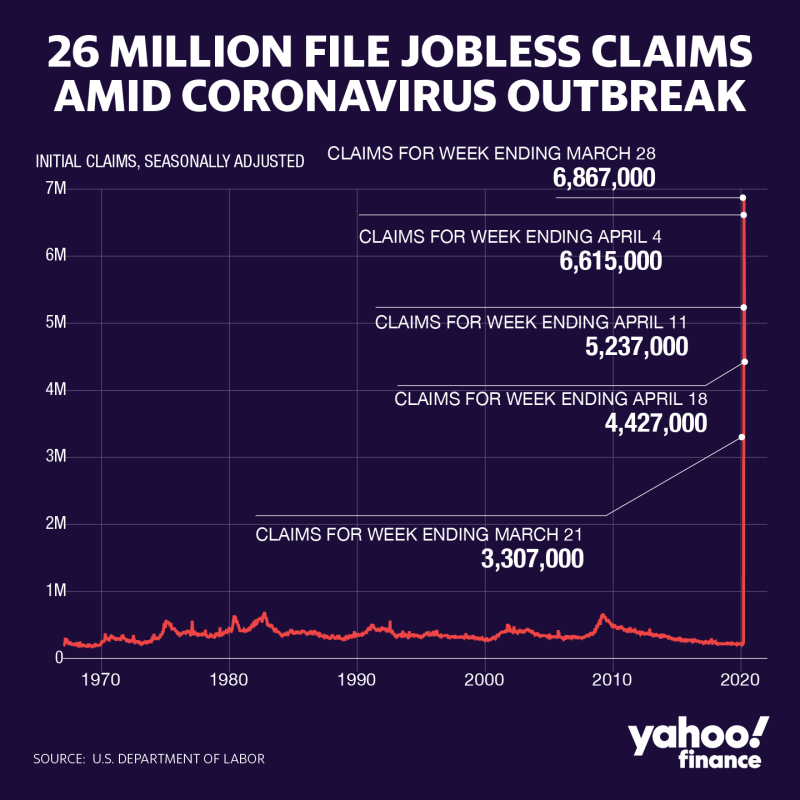

The coronavirus crisis has altered the labor market in a profound way, resulting in over 26 million Americans filing for unemployment insurance claims over the past five weeks.

This week, the job-loss trajectory pointed downwards, with 4.4 million new claims, down from 5.2 million last week and 6.6 million the week before. But those numbers may not tell the whole story, according to a new paper from the National Bureau of Economic Research.

Economists Olivier Coibion (University of Texas at Austin), Yuriy Gorodnichenko (UC Berkeley), and Michael Weber (University of Chicago’s Booth School of Business) wrote that the job losses are far higher than the official figures represent, that many people who are jobless aren’t looking for new jobs. One of the reasons cited: early retirement.

Unemployment, labor force participation, and coronavirus

During this crisis, labor force participation has plummeted by 7 percentage points — far more than the 3 percentage points seen between 2008 and 2016, according to the study.

The researchers examined large-scale surveys similar to those used by the Bureau of Labor Statistics to track household behavior. The most recent surveys in early April showed “striking” results, according to the paper.

“First, the employment-to-population ratio (the fraction of the adult population reporting that they had a paid job) has declined by about 7.5 percentage points,” the paper says. “With an adult (civilian non-institutional) U.S. population of 260 million, this corresponds to nearly 20 million jobs lost as of April 6th.”

These numbers are borne out in the unemployment claims — though higher — but not in the unemployment rate. The researchers point out that 20 million jobs lost would increase the unemployment rate to around 16%, but that instead, BLS methods will likely point to an increase of just 2 percentage points. This is just a third of the increases in unemployment seen during the Great Recession.

What’s happening here, the economists write, is that people aren’t looking for work — and they will be defined by BLS surveys as out of the labor force, and not unemployed. That means they won’t be included in unemployment rate figures the BLS releases (these take into account people who are actively looking for work).

This matches with what the researchers find with the labor force participation rate: a decline of 8 percentage points. Respondents, asked whether they were actively looking for jobs pre- and post-COVID, showed a remarkable change, indicating an “extraordinary decline in the adjusted labor force participation rate, from 64.2% to 56.8%,” according to the researchers.

Not like other recessions

This big change in labor force participation vs. unemployment rate is very different from past recessions, the researchers write.

On the one hand, it’s obvious why fewer people might be looking for jobs now. There’s a global pandemic, people are being encouraged to stay at home, large swaths of the economy are closed. A restaurant cook planning on resuming cooking is likely awaiting the end of a furlough rather than trying to pick up new work right now. In fact the CARES Act and small-business loans are designed to limit the personal economic pain of job loss so people can socially distance and survive financially.

But the survey highlights that a significant number of people who aren’t looking for work are doing so because they’ve actually chosen to retire.

“Only 1.6% of those out of the labor force were claiming that they could not find a job as one of their reasons for not searching,” the researchers wrote. “At the height of the COVID-19 crisis with a much larger number of people now out of the labor force, we see corresponding declines in the share of homemakers, those raising children and the disabled.”

However, there is a spike in the number of people who claim to be retired — 53% to 60%, pre- to post-COVID.

“This makes early retirement a major force in accounting for the decline in the labor-force participation,” the researchers found. “Given that the age distribution of the two surveys is comparable, this suggests that the onset of the COVID-19 crisis led to a wave of earlier than planned retirements.”

There is a good hypothesis for this: seniors are more sensitive to the coronavirus compared to younger people and with no vaccine in sight it might be prudent to retire a little earlier than planned.

The economists compared the labor force surveys in January and April and looked at people who had a job in January but were out of the labor force — not merely unemployed — in April. Around 28% of those people, the study found, had retired. For people who were unemployed in January but now out of the labor force, 21% had retired.

This data deep dive answers some of the questions about people whose jobs are simply cut off temporarily. Of the people who were employed in January but are out of the labor force in April, only 9% said they were on a break from working, which the researchers interpreted as being affected by temporary work closures.

“In short, these results point to an unusual rise in the share of retirements accounting for the exceptional decline in labor force participation during this time period,” the researchers write.

There’s a lot of questions remaining about how the labor market will evolve with the coronavirus pandemic. Specifically, how might medical changes and innovations change the labor market? But what this study highlights is an interesting aspect of the coronavirus economic crisis: the stuff that won’t simply bounce back.

As the researchers write,“the wave of early retirements that we document suggests that more permanent changes may already be taking place.”

—

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

5 key ways healthcare could change post-coronavirus: analysts

Here's a list of CEOs taking pay cuts amid the coronavirus crisis

Coronavirus: Food delivery is 300 times more popular vs. a month ago, according to Yelp data

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube.