Goldman Sachs busts myth that Trump's tax cuts only fueled stock buybacks

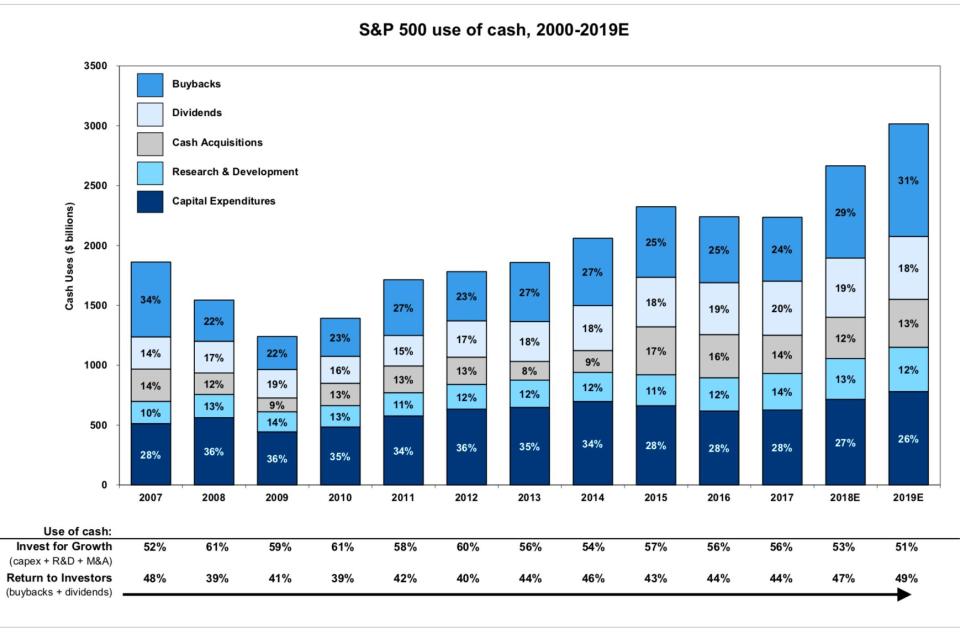

President Trump's corporate tax cuts from the Tax Cuts and Jobs Act of 2017 triggered a spike in stock buybacks as companies repatriated cash overseas, Goldman Sachs strategist David Kostin said. But it's also led to more investment in capital projects and research and development.

"Growth investment has accounted for the largest share of US corporate cash outlays every year since at least 1990,” Kostin said. “This fact is contrary to the popular belief advanced by some politicians that buybacks dominate corporate spending.”

Kostin notes that that growth investment "has accelerated sharply" since tax reform passed. In 2018, S&P 500 companies increased their spending on capex and R&D by 13% to $1.1 trillion. Kostin’s team expects companies to increase their spending by 9% in 2019 to $1.3 trillion.

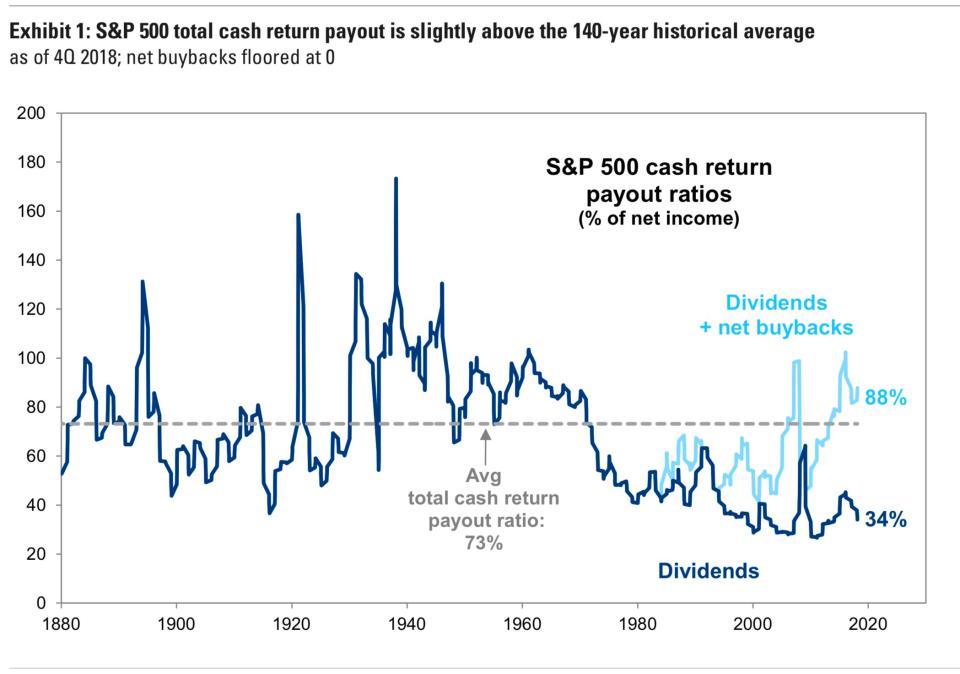

"This fact contradicts the widespread belief that tax reform led only to a surge in corporate cash returned to shareholders in the form of share repurchases,” Kostin added. “US companies have consistently returned cash to shareholders for nearly 140 years. This established historical pattern contradicts the perception of many commentators that significant cash return is a recent development."

Stock buybacks have come under criticism in Washington, D.C. Last month, Senate Minority Leader Chuck Schumer (D-NY) and Senator Bernie Sanders (I-VT) railed against the practice in a widely circulated op-ed and put forth legislation to curb buybacks, which the pair described as a "practice of corporate self-indulgence."

Senator Marco Rubio (R-FL) also plans to offer legislation to curb share repurchases. More recently, Senator Chris Van Hollen (D-MD) argued that company insiders should be prohibited from selling their own shares for a period of time after their firms announce buybacks.

‘Misconceptions’

"One of the greatest misconceptions in the public discourse surrounding corporate buybacks is the belief that managements repurchase stock in an attempt to inflate earnings per share (EPS) and meet incentive compensation targets," Kostin writes. "Contrary to popular belief, executives whose compensation depends on EPS – a metric that would benefit from accretive share buybacks –did not allocate a higher proportion of 2018 total cash spending to buybacks than companies where management pay is not linked to EPS."

Kostin's team found that the 247 S&P 500 companies that do have incentive compensation programs linked in EPS actually spent a smaller percentage of their cash, 28%, on stock buybacks, while the other 253 companies without those incentive programs spent 32% on share repurchases. Of those firms with EPS-linked compensation, they accounted for 44%, or just $360 billion, for all stock buybacks in 2018.

Kostin argues that stock buybacks were "an efficient way" for some companies to put repatriated cash to work.

"In 2018, buyback spending jumped by $279 billion or 52% above the prior year’s level. However, just 20 stocks in the S&P 500 index accounted for 38% of the $819 billion in aggregate cash spent to repurchase shares during 2018, but those firms represented fully 69% of the $279 billion overall increase in share buybacks. Unsurprisingly, these companies from six different sectors also had the largest amount of earnings trapped overseas."

In fact, those stock buybacks have benefited the broader economy, according to Kostin.

"Much of the cash that firms repatriated in 2018 has been recycled back into the domestic economy through a combination of both buybacks and dividends. Much of this distributed cash has likely been invested in firms with superior growth prospects, retained by investors as cash savings, or has led to consumption. These uses of cash are more productive than if the company had simply left the funds abroad."

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.