Target Corp Is Aiming for a Bullseye

Target Corporation (NYSE:TGT) has been my favorite general merchandise and grocery retailer since 2018. The shares were ~$67 back then, and the stock climbed to a 52-week high of $268.98 on strong sales and profits during the beginning of the Covid-19 pandemic before retreating due to high inflation and a strategic plan to mitigate post-lockdown demand shifts.

The company operates approximately 2,000 stores. It sells across digital channels, including Target.com. Shoppers know Target for value. It sells branded clothing, accessories, home decor, electronics, toys, pet supplies, beauty and household essentials and more, with a reputation of premium quality for a low price. The company has been expanding into perishables, though non-perishables still account for the vast majority of its grocery offerings. In the stores, customers can even find a cafe, Target Photo, optical and pharmaceutical services.

Target has also been modernizing the supply chain to compete with pure e-commerce players. The stores provide same-day delivery or pickup of orders placed by phone and online.

Headwinds will be temporary

The stock has not fared well in 2022. Following the release earlier this week of its second-quarter earnings report, the share price tumbled. But this time, in my opinion, the panic-selling was unmerited and could provide an opportunity for astute investors.

Following the release of the second quarter earnings report on Aug. 17, the share price dived to $170.83. It closed the day up again to $175.34. The price shock was driven by the 90% drop in profits, but this hit was intentional as the company aimed to mitigate overall pain by getting rid of unwanted inventory as consumer tastes changed post-lockdown.

Retail sales softened after the government stopped frantically printing money, but Targets walk-in store traffic rose 2.7% in the second quarter. Digital comparable sales popped 9% on top of almost a 10% increase in the same quarter of 2021.

In my non-scientific survey of friends and family, they prefer Target because the merchandise is good quality, sells at fair prices they do not think of as discount-store sales, the shelves and racks are orderly, the inventory is not the depth of years before but adequate and it is a pleasant shopping experience.

Despite the headwinds, comparable sales rose 2.6% in the second quarter on top of 8.9% in the second quarter last year. Same-store sales were essentially flat, increasing 1.3%, but sales increased 8.7% in the same quarter of 2021. Considering supply chain issues, labor shortages, freight costs and inflation, these numbers are pretty good in the retail business.

Target enjoys 21 consecutive quarters of comp sales growth. Amid a struggling national economy, Target opened five new stores and 80 Ulta Beauty centers at Target locations, aiming to reach 250 by the close of 2022.

Valuation

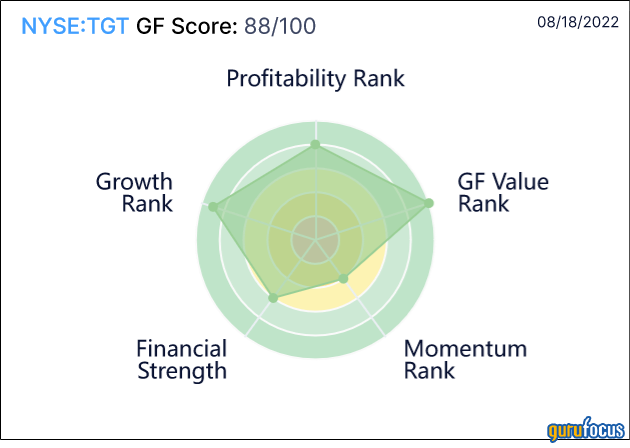

Target has a GF Score of 88 out of 100. The company gets good scores for growth and profitability. The financial rating is weak at just six out of 10.

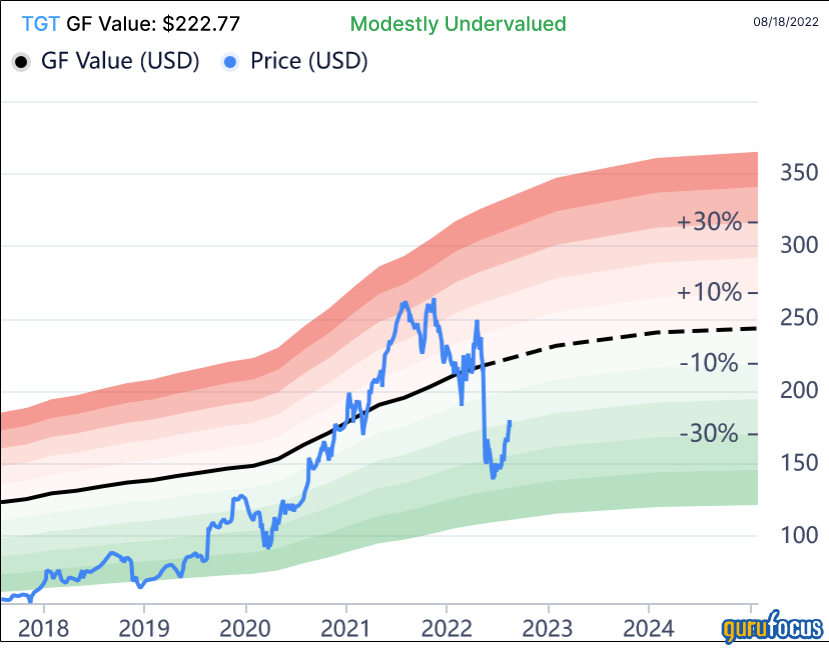

The GF Value is $222.777, making the stock modestly undervalued at the time of writing.

Total assets are $51 billion while liabilities are $50 billion. High debt and a 134.5% debt-to-equity ratio weigh heavily on the balance sheet.

In the second quarter of 2022, net interest expense was $112 million, compared with $104 million last year. This reflects higher commercial paper and average long-term debt levels. A bright side is Targets income tax rate is at 15.8%, compared with the prior year's rate of 23.4%. Cash and short-term investments total just ~$1.2 billion. High debt and its light cash position are severe warnings to consider.

Personally, I forecast that earnings will modestly grow ~11% this year. Ebit should still be enough to cover interest payments. I expect the average price per share for Target will be closer to $190 by January 2023.

Management expected the 90% drop in earnings and the hit to the stock. It was a planned event. The company had to take actions to ensure flexibility in handling outside influences affecting retail; they knowingly made decisions that appear capricious or bad if one simply looks at the numbers, but there is more to the story that bodes well for Targets future.

Other outside influences

The share prices of retail sales companies are hypersensitive to nationwide conditions and economic predictions by experts. Melissa Repko of CNBC puts it best, surmising that Quarterly profits got squeezed sales of a lot of merchandise became less profitable as it got marked down. Freight, transportation and shipping costs rose, as fuel prices increased. And the company had to add headcount and cover more compensation in distribution centers as it dealt with a glut of extra stuff.

The short-term investment culture influences the share price, meaning certain numbers from the earnings results or the economy can have drastic short-term effects on the stock. Targets shares have a high Beta rating of 1.45. The share price moved up 4.57% following the earnings release earlier of another major retailer, then fell 4.85% when its own numbers were released.

Third, media contributes to share price sways. The news headlines are mostly about Targets 90% plunge in profits because that's what will get people to read. The media should have expected the hit, considering managements purposeful plan to reduce inventories and more expenses to generate cash, clear space and bring a fresh look into the stores.

Sales also attracted foot traffic looking for bargains. Perhaps management did not lower guidance enough and played it too safe when estimating the impact on earnings.

Takeaway

By my estimates, Target has the potential to move higher than $190 per share if inflation eases, the U.S. avoids a deep recession and managers keep control of their inventories. That would represent a 13% upside potential from the current share price of about $173. But if a storm hits the economy, I think the share price could fall to the $155 point by the fourth quarter.

Regardless of the short-term situation, I believe Target is on track for a bullseye in the long run thanks to management's superior strategy and excellent reputation among customers. Target also owns valuable commercial real estate, and management talks about using these assets to expand when sales grow again. Target has recorded an incredible 21 consecutive quarters of comp sales growth, which gives me confidence that it can do well even amid a struggling national economy.

This article first appeared on GuruFocus.