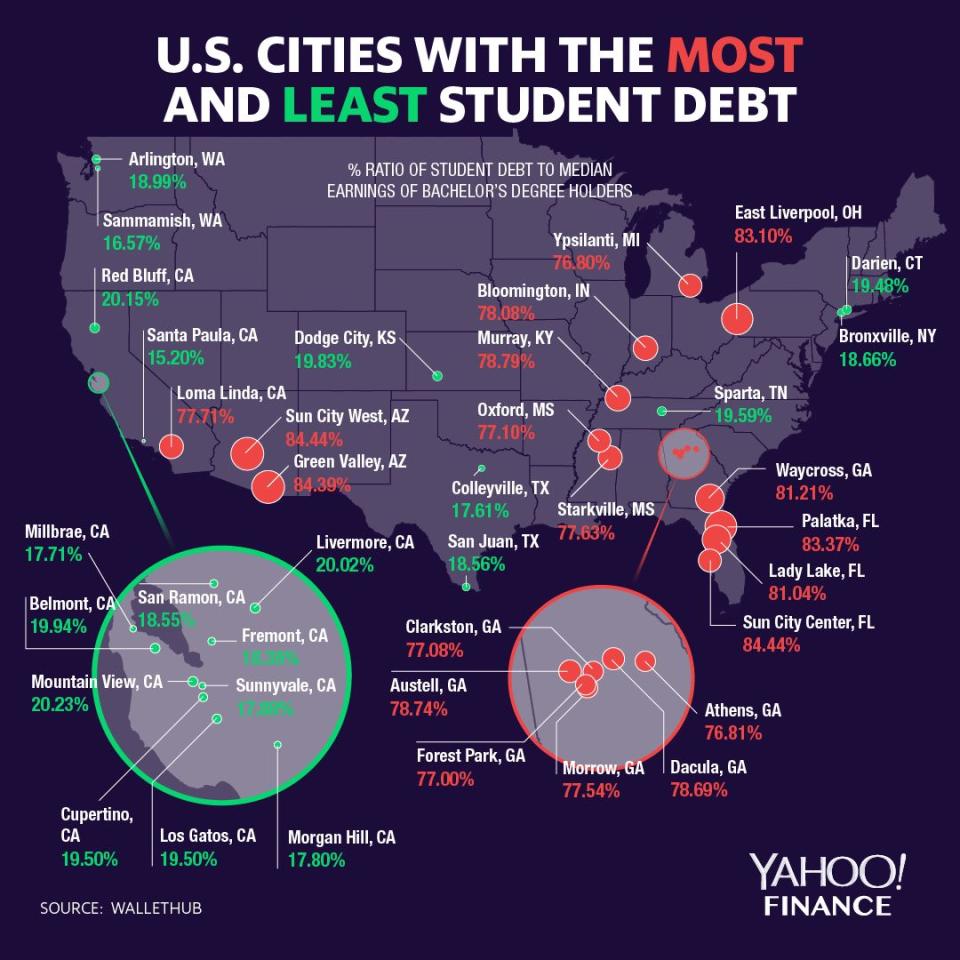

Map: Cities in the South are being held back by student debt

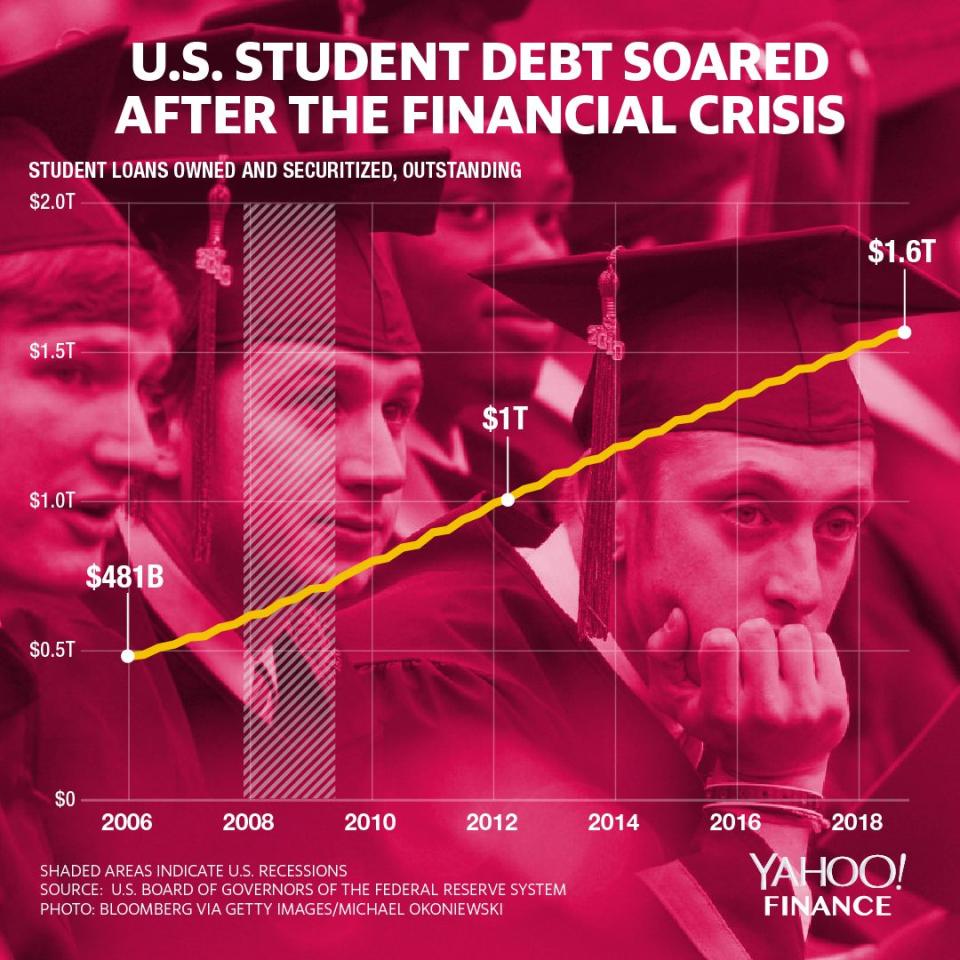

There are more than a trillion dollars in outstanding student loans, affecting millions of Americans, and a new study by WalletHub details how borrowers in the South are feeling the pain more than most.

The study — which looked at 2,510 cities across the U.S. and divided the median student loan balance held by adult borrowers living in those cities by their median earnings — identified cities when residents were most and least indebted relative their salaries.

Thirteen of the bottom 20 cities were in the South (i.e., south of the Mason-Dixon line and east of the Mississippi River). On the other end of the spectrum, 10 of the top 20 cities with the best debt-to-earnings ratio were in California.

"What's worrying is that overall, post-college debt is a huge financial burden to Americans,” WalletHub analyst Jill Gonzalez told Yahoo Finance. “High balances, combined with long payoff timelines and low earnings, make graduates delay other financial goals like owning a home or saving for retirement."

‘Trillion-dollar black hole’ caused by student debt

The hotly debated issue of student loans features a wide cast of characters from presidential candidates — who are calling for broad cancellations of debt — to economists who consider it a “micro” problem.

But with more borrowers going delinquent and defaulting on their loan repayments — as well as a gradual decay of existing loan forgiveness programs — the student loan crisis has created a “trillion-dollar black hole in our financial market” that has left people “drowning under the weight of this unprecedented burden,” former CFPB student loan ombudsman Seth Frotman told the Committee on Financial Services on Capitol Hill in March.

In the WalletHub study, the cities in the 99th percentile — those with borrowers who saw their student loans comprise of around 68% to 85% of their income — were at the highest levels in Sun City West in Arizona, followed by Green Valley in Arizona and Palatka in Florida.

The median student debt held by borrowers in those three cities was between $17,000 to $21,000, while their earnings were between $21,000 to $25,000, yielding a student debt-to-income ratio of more than 83%.

"The common thread among the 99th percentile was low median earnings for bachelor's degree holders, some even as low as $20,000 annually,” Gonzalez said. “This is why even cities with a lower amount of debt such as Forest Park, GA or Lexington, NC still manage to have a student debt to median earnings ratio around 75%.”

What the top cities have in common

Conversely, cities in the top percentile saw a student debt-to-earnings between 15% at the lowest end and 21%.

These cities with the lowest levels of student debt were predominantly in California, with a handful in New York, Texas, Wyoming and others. The lowest levels observed were specifically in Santa Paula, California, Sammamish in Washington and Colleyville in Texas.

The median student debt held by borrowers in those three cities was between $10,000 to nearly $17,000, while their earnings were between $70,000 to $99,000, yielding a student debt-to-income ratio of less than 18%.

Hence, "among the 1st percentile, the common thread was low median student debt, even as low as about $9,000 in places like Dodge City, KS or Dinuba, CA,”said Gonzalez. “In addition to that, in most cities the median income for bachelor's degree holders is also very high."

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Dimon: U.S. student loan debt is ‘now starting to affect the economy’

'The clock is ticking' on U.S. consumer loans — and that could mean a slowdown, Deutsche Bank warns

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.