Dow dips 400 points on Tuesday, capping its worst first quarter ever

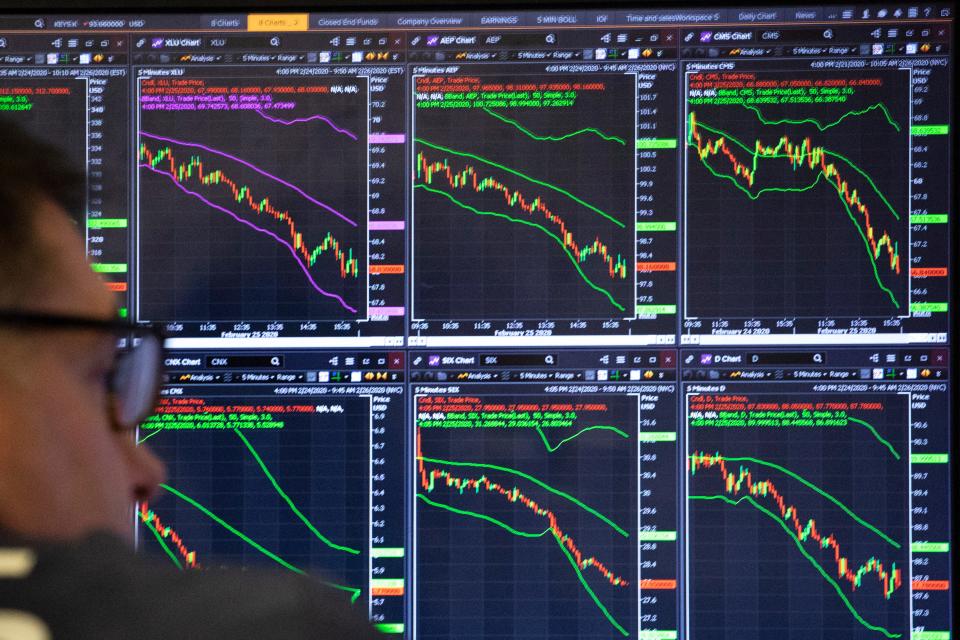

U.S. stocks slumped Tuesday, with the Dow enduring its worst first quarter ever as the coronavirus pandemic battered huge swaths of the global economy.

Stocks snapped the longest-ever bull market in history in March, swiftly retreating from records in mid-February after the outlook for the U.S. economy dimmed. The pandemic forced lockdowns and travel restrictions, weighing on businesses across the world.

The Standard and Poor’s 500 fell 1.6% to close at 2,584.59 on Tuesday, as broad losses in the real estate and utility sectors, which are perceived as safer, offset mild gains in beaten-up energy shares. The broad index was off 20% this quarter, its worst such period since 2008.

The Dow Jones industrial average dropped 410.32 points to end at 21,917.16. The blue-chip average shed 23% in the first three months of the year, its worst-ever performance over that stretch. Both averages posted their worst monthly declines since 2008.

“The economy blew up in the first quarter. It went from being fairly healthy to a massive exogenous shock that no one saw coming,” says Brad McMillan, chief investment officer at Commonwealth Financial Network. “The big takeaway is that the Federal Reserve and the government stepped up with monetary and fiscal stimulus.”

Tax filing deadlines 2020: When are my state taxes due?

What we know: How the $2T coronavirus stimulus will affect you and the economy

Tuesday’s losses cut into recent gains after the number of American coronavirus deaths surged past 3,400. A worrying increase in the number of Spanish deaths linked to the virus also weighed on the market. On Monday, both U.S. indexes closed up by more than 3%.

Traders said volatility likely picked up in the final hour of trading Tuesday as money managers rebalanced their portfolios toward stocks on the last day of the first quarter. Stocks have recovered some losses in recent sessions, with the Dow posting its best week since 1938 on Friday. But analysts caution that the recent rally could fade until there’s a long-term solution to fight infections and virus cases peak in the U.S.

The economy has come to a standstill, jeopardizing the longest U.S. economic expansion in history. S&P Global Ratings forecasts a record downturn in the second quarter with a recovery taking hold in the second half of the year and into 2021. The firm projects U.S. GDP growth for 2020 will contract 1.3%, including a 12% decline in the second quarter from the first.

“The industries most vulnerable to social distancing and the collapse in global demand, such as airlines, transportation, and retail, or those heavily dependent on cross-border supply chains are likely to suffer most, both from slumping cash flows and much tighter financing conditions,” Paul Gruenwald, global chief economist for S&P Global Ratings, said in a note.

The U.S. had more than 177,000 confirmed cases Tuesday afternoon, according to the Johns Hopkins University data dashboard. Worldwide, more than 838,000 people have been infected with the virus and more than 40,000 have died.

Countries across the world have shut down entire segments of their economies in an effort to delay or mitigate the impact of the pandemic. Many of the jobs most impacted by social-distancing measures, such as cashiers, restaurant workers and hotel staff, are in the services sector, which makes up about 80% of U.S. jobs, according to LPL Financial.

“Jobs are likely to return quickly once the economy gets going again, but we know the timing of that is uncertain,” analysts at LPL Financial said in a note. “Until then, backstops from federal programs and support for businesses to help minimize further layoffs will be essential for millions of Americans.”

Congress and the Federal Reserve have promised a staggering amount of aid for the economy and markets, hoping to support them as the pandemic shuts down businesses. President Donald Trump signed a $2 trillion coronavirus economic rescue package Friday that includes direct payments to most American households.

The Federal Reserve, meanwhile, has made a series of emergency moves to help support financial markets including cutting interest rates to near zero and reviving crisis-era bond purchases to pump cash into the financial system. On Tuesday, the central bank announced that it was opening a temporary repo facility to make U.S. dollars available for foreign central banks.

Benchmark U.S. crude oil has dropped by roughly two thirds this quarter and hit its lowest price since 2002 on Monday on expectations of a dramatic drop in demand. The price turned a bit higher Tuesday. U.S. crude gained 1.9% to settle at $20.48 per barrel, closing out its worst quarter ever.

In Europe, Germany’s DAX index rose 1.2%. Britain’s FTSE 100 climbed 2%, while the CAC-40 in France added 0.4%. Japan’s benchmark Nikkei 225 fell nearly 0.9%. Hong Kong’s Hang Seng added 1.9% and the Shanghai Composite inched up 0.1%.

Contributing: The Associated Press

This article originally appeared on USA TODAY: Dow caps worst-ever first quarter with 400 points fall