The stock market is on pace to hit another, more impactful trillion-dollar milestone

Apple (AAPL) stole the headlines on Thursday when it became the first U.S.-listed company to be valued at more than $1 trillion.

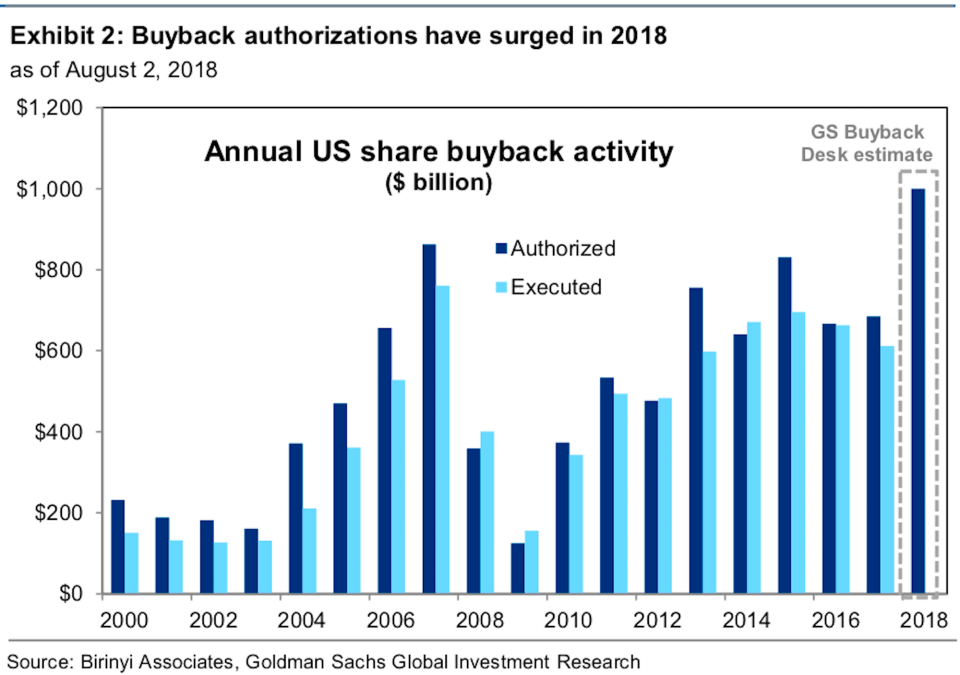

“But investors should focus on a different $1 trillion number that will have a key influence on the market: total buyback authorizations likely to be announced this year,” Goldman Sachs’s David Kostin said in a new note to clients.

Public companies will repurchase shares (or pay out dividends) with excess cash when they feel investing for growth and financing M&A don’t offer attractive returns for the risk. It’s a controversial and often politicized use of cash since it’s considered a less productive option that enriches shareholders. But that hasn’t stopped companies, including Warren Buffett’s Berkshire Hathaway (BRK-A, BRK-B), from embracing the activity.

Furthermore, repurchases help boost the stock market.

“Corporate repurchases remain the largest source of demand for shares,” Kostin said. “Since 2000, there has been roughly 85% follow-through from authorization to execution.”

At least some of this can be explained by multi-national corporations repatriating overseas earnings following the enactment of the Trump administration’s tax reform act enacted in December. Indeed, the 2004 repatriation tax holiday was followed by unusual spikes in announced buybacks in 2004 and 2005.

“Part of the uplift is a direct result of tax reform, but strong cash flow growth has also been essential,” Kostin said.

But while the dollar-value of buybacks is on pace to reach record-highs, it’s important to note that the stock market is also near all-time highs. And as such, the number of announced buybacks as a percentage of the stock market’s total value is actually far from a record high.

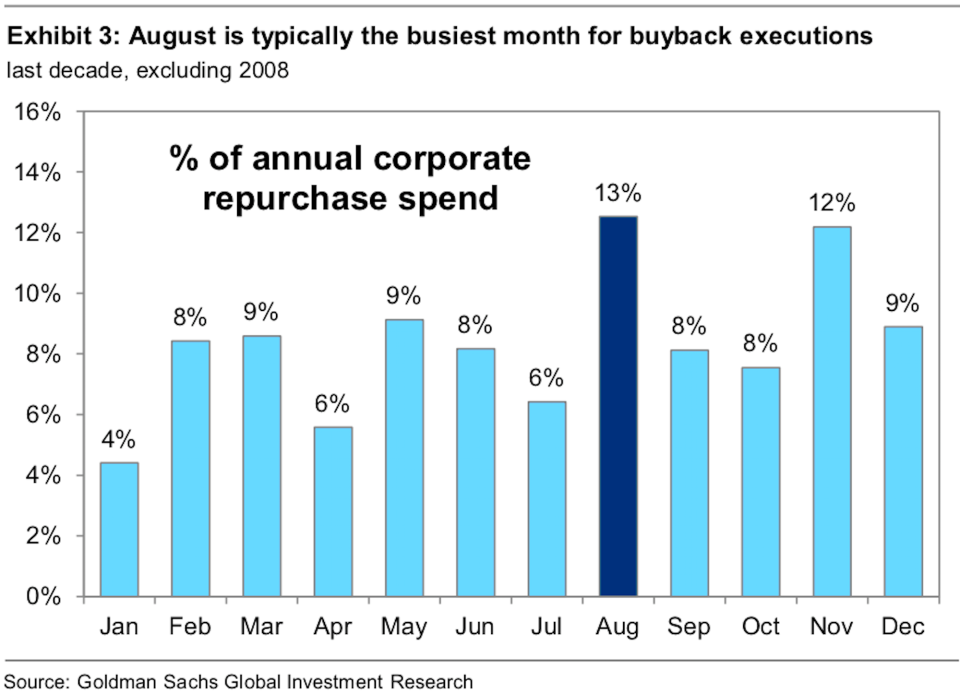

All that said, Goldman’s analysts expect buyback activity to be strong in August now that most companies have their quarterly earnings announcements behind them.

“The buyback blackout period has now ended for most companies,” Kostin said. “More than 80% of firms in the S&P 500 have reported results and may resume repurchasing stock on a discretionary basis after being on hiatus for the past month. Buybacks represent the critical source of demand for shares given most other ownership categories are net sellers of stocks (households, mutual funds, pension funds).”

Buybacks may be bullish. But Kostin also identifies another, far more problematic trillion-dollar metric in the market.

“Another strategically important but more bearish $1 trillion question relates to the U.S. government’s fiscal balance,” he wrote, noting that the U.S. Congressional Budget Office now forecasts an annual deficit in excess of $1 trillion will be reached in 2020. “This could indicate a number of risks for investors, including the possibility that interest rates rise more rapidly than expected and weigh on equity valuations.”

Goldman Sachs has an S&P 500 (^GSPC) year-end target of 2,850, which is about 1% above current levels.

*UPDATE: In an earlier version of this story, Kostin is quoted saying the U.S. government’s “first annual deficit in excess of $1 trillion will be reached in 2020.” The budget deficit actually exceeded $1 trillion in each of the years from 2009 to 2012.

–

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @bySamRo

Read more:

Robert Shiller: The stock market today is similar to the stock market in 1928

Janet Yellen nails how investors should think about valuations

The stock market has been in a new price regime for 20 years

Warren Buffett: One metric tells me the most about the future

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn