SoftBank cuts 150 jobs as investments plummet

The world’s largest tech fund has axed 150 jobs in a bid to cut costs as it deals with the fallout from the plummeting value of its investments.

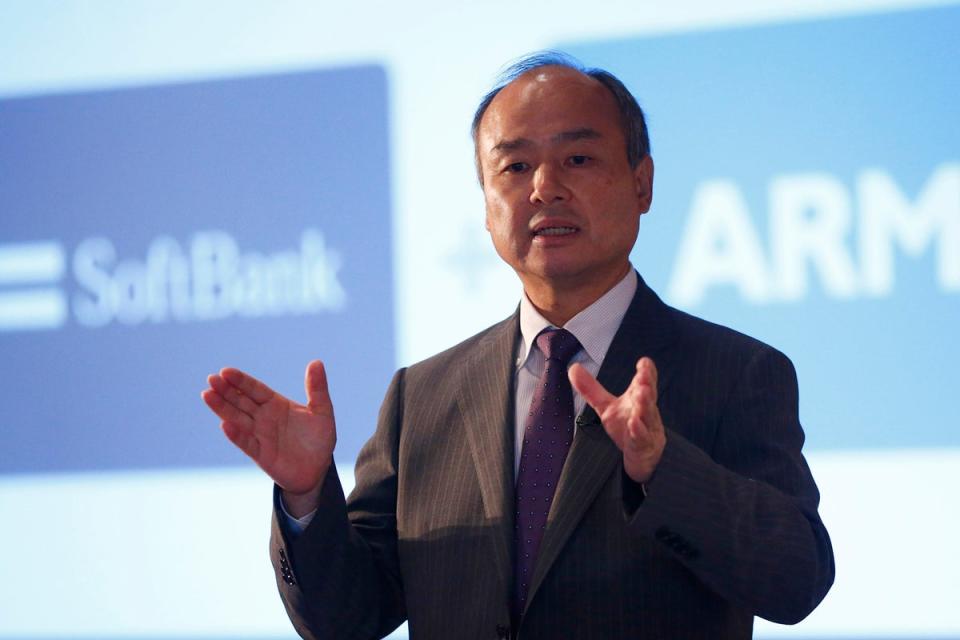

The SoftBank Vision fund, run by Japanese billionaire Masayoshi Son, is set to send notices out to employees in the UK, US and China, affecting around 30% of the workforce, according to the Reuters news agency.

It comes just weeks after the firm posted a staggering $23 billion (£19 billion) net loss, the largest in the company’s history as it became the latest victim of surging inflation and global recession fears.

The company said the loss “reflected the global downward trend in share prices due to growing concerns over economic recession driven by inflation and rising interest rates, as well as the decline in the fair value of private portfolio companies.”

SoftBank CEO Masayoshi Son admitted the company had invested in too many start-ups with valuations in a bubble. “The world is in great confusion,” he said at a results briefing.

It is not the first time the company has had to write down the value of its investments, after it lost over £1 billion from its stake in failed supply chain finance business Greensill, as well as around £750 million from its stake in collapsed German payments business Wirecard.

The Nasdaq-100 index of US-listed technology companies has dropped almost 40% since January, with social media firms like Meta and Snap among the biggest losers, having seen 59% and 78% wiped from their respective share prices.

Tech stocks have lost a combined $3 trillion in value since the start of the year, as soaring inflation, war in Ukraine and fears of a looming recession erased gains made in 2021 and prompted firms to slash growth forecasts and cut back budgets.