The Smartest Oil Stocks to Buy With $1,000 Right Now

Want to find profitable oil stocks? Pay attention to what Warren Buffett is buying. His holding company, Berkshire Hathaway, now owns several oil stocks. Two in particular are worth diving into now.

Buffett is betting big on this oil stock

As of last quarter, Berkshire Hathaway held around 250 million shares of Occidental Petroleum (NYSE: OXY) worth roughly $14 billion. Given that Occidental has a market share of only $57 billion, Berkshire's stake translates into nearly 25% ownership of the entire company.

Occidental has many things going for it in today's operating environment. Analysts at Scotiabank recently upgraded the stock to sector outperform with a price target of $90 per share. With the current stock price hovering just above $60, that would represent nearly 50% in total upside.

What is it about Occidental that Berkshire and Scotiabank like so much? The company is certainly primed to benefit from a "higher-for-longer" pricing environment for oil. Its $12 billion purchase of Permian Basin oil producer CrownRock, for example, is expected to generate $1 billion in free cash flow in year one based on $70-per-barrel crude.

Oil prices today are closer to $80 per barrel, and given political instability across many key regions of the world, there's reason to believe prices will remain elevated for some time. Much of Occidental's production, including CrownRock's assets, is in high-decline areas. But high oil prices should keep these assets highly profitable.

Occidental isn't just an upstream energy producer. It also owns stakes in value-added businesses like chemicals and refineries. Over the next several years, the company expects to free up another $1 billion in annual free cash flow due to cost savings related to its midstream and downstream assets, plus reductions to its total debt levels.

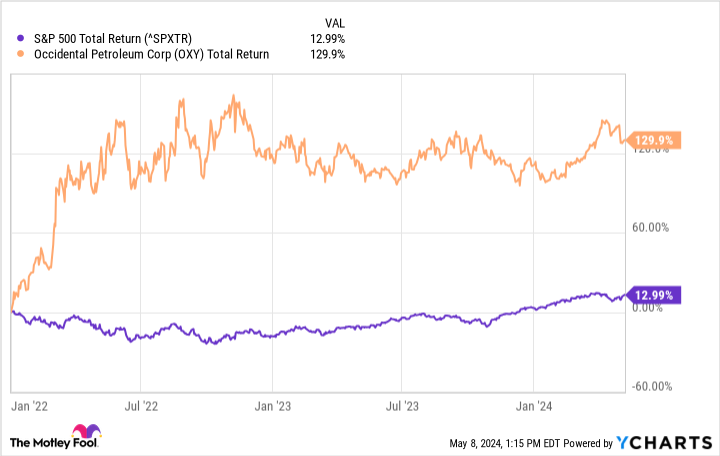

Keep in mind that Berkshire has owned Occidental stock since the first quarter of 2022, meaning the company has already produced huge gains on its investment. Still, it has yet to wind down its position, suggesting someone at Berkshire -- maybe even Buffett himself -- still thinks there's plenty of upside to go.

Pay attention to this $19 billion bet

Berkshire is betting even more on Chevron (NYSE: CVX) stock than it is on Occidental. Its Chevron position is currently valued at nearly $19 billion. Berkshire has also owned its Chevron stake longer than its Occidental position, first purchasing shares back in 2020.

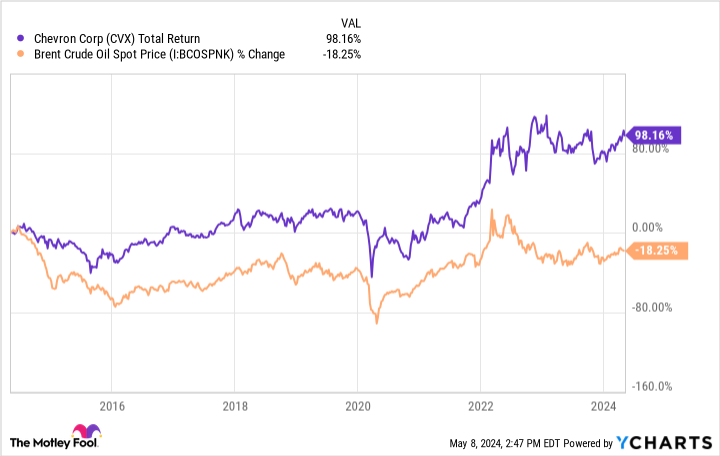

What makes Chevron worth a $19 billion investment? The biggest reason to love this company is for its operational excellence. All you need to do is plot Chevron's stock price against oil prices to get the picture. Over the past decade, oil prices have fallen by around 18%, yet Chevron stock has risen by nearly 100%.

There's clearly something special about a company that can add significant shareholder value over a time period in which the price of its main product deteriorates.

What exactly is Chevron doing so well? Its two main advantages come down to operational discipline and capital management. This year, for instance, its production profile is expected to grow by 4% to 7% thanks to rising productivity across both its Permian and Denver-Julesburg basin assets. Improved well performance is coming even as unit costs remain flat. This combination has helped Chevron's upstream earnings per barrel continually rise, from roughly $7 per barrel in 2019 to around $10 per barrel today.

Chevron's capital management, meanwhile, is exemplary, something Buffett no doubt admires. The company has demonstrated a strong ability to allocate shareholder capital, with impressive returns on capital employed that lead the oil majors. Management expects free cash flow to double from 2022 to 2027 all while repurchasing 3% to 6% of shares each year. As a bonus, the stock also delivers a 4% annual dividend.

Both Occidental and Chevron will face some operational challenges in the years to come. Occidental will be tasked with justifying its $12 billion acquisition of CrownRock, while Chevron is involved in its own takeover: a $53 billion all-stock deal for Hess.

But if oil prices remain where they are, both companies can be expected to do quite well. Occidental has more leveraged upside if oil prices head higher, while Chevron has proven its ability to deliver shareholder returns even if oil prices weaken, making both stocks a complementary fit for oil and gas investors.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Chevron. The Motley Fool recommends Bank Of Nova Scotia and Occidental Petroleum. The Motley Fool has a disclosure policy.

The Smartest Oil Stocks to Buy With $1,000 Right Now was originally published by The Motley Fool