'Severe revenue decline': California faces a record $68B deficit — here's what is eating away at the Golden State's coffers

California lawmakers convened for the first session of 2024 on Wednesday and are tasked with tackling the state's record $68 billion budget deficit.

The enormous shortfall is largely attributed to a “severe revenue decline,” the California Legislative Analyst's Office (LAO) reported last month.

Don't miss

Commercial real estate has outperformed the S&P 500 over 25 years. Here's how to diversify your portfolio without the headache of being a landlord

Take control of your finances in 2024: 5 money moves to start the new year off strong

The US dollar has lost 87% of its purchasing power since 1971 — invest in this stable asset before you lose your retirement fund

While it’s not the largest deficit the state has ever faced as a percentage of overall spending, it’s the largest in terms of real dollars — and could have a big impact on California taxpayers in the coming years.

Here’s what has eaten into the Golden State’s coffers.

Unprecedented drop in revenue

California is dealing with a revenue shortfall partly due to a delay in 2022-2023 tax collection. The IRS postponed 2022 tax payment deadlines for individuals and businesses in 55 of the 58 California counties to provide relief after a series of natural weather disasters, including severe winter storms, flooding, landslides and mudslides.

Tax payments were originally postponed until Oct. 16, 2023, but hours before the deadline they were further postponed until Nov. 16, 2023. In line with the federal action, California also extended its due date for state tax returns to the same date.

These delays meant California had to adopt its 2023-24 budget before collections began, “without a clear picture of the impact of recent economic weakness on state revenues,” according to the LAO.

Total income tax collections were down 25% in 2022-23, according to the LAO — a decline compared to those seen during the Great Recession and dot-com bust.

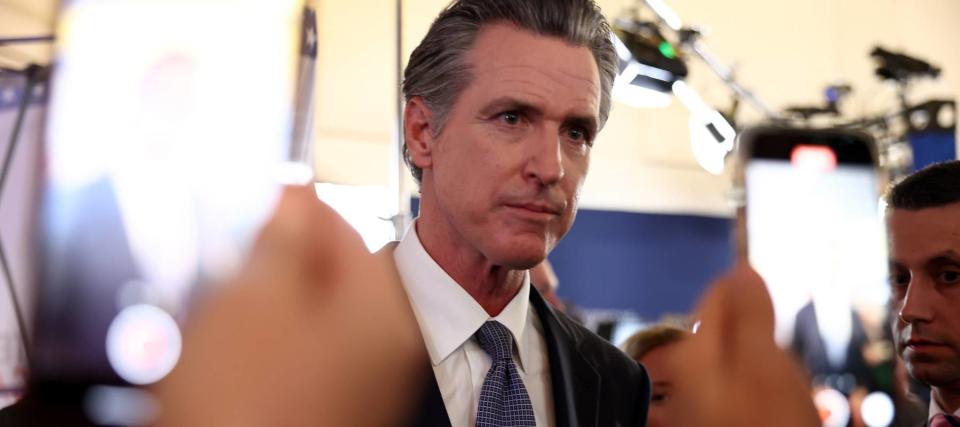

“Federal delays in tax collection forced California to pass a budget based on projections instead of actual tax receipts," Erin Mellon, communications director for California Gov. Gavin Newsom, told Fox News. "Now that we have a clearer picture of the state’s finances, we must now solve what would have been last year’s problem in this year’s budget.”

The exodus

California has also lost residents and businesses — and therefore, tax revenue — in recent years.

The Golden State’s population declined for the first time in 2021, as it lost around 281,000 residents, according to the Public Policy Institute of California (PPIC). In 2022, the population dropped again by around 211,000 residents — with many moving to other states like Texas, Oregon, Nevada, and Arizona.

Read more: Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

“Housing costs loom large in this dynamic,” according to the PPIC, which found through a survey that 34% of Californians are considering moving out of the state due to housing costs.

Other factors such as the post-pandemic remote work trend — which has resulted in empty office towers in California’s downtown cores — have also played a role in migration out of the state.

Poor economic conditions

In an effort to tame inflation in the U.S., the Federal Reserve has hiked interest rates 11 times — from 0.25% to 5.5% — since March 2022. These actions have made borrowing more expensive and have reduced the amount of money available for investment.

This has cooled California’s economy in a number of ways. Home sales in the state are down by about 50%, according to the LAO, which it largely attributes to the surge in mortgage rates. The monthly mortgage to buy a typical California home has gone from $3,500 to $5,400 over the course of the Fed’s rate hikes the LAO says.

The Fed’s rate hikes have “hit segments of the economy that have an outsized importance to California,” according to the LAO, including startups and technology companies. Investment in the state’s tech economy has “dropped significantly” due to the financial conditions — evidenced by the number of California companies that went public in 2022 and 2023 being down by over 80% from 2021, the LAO says.

One result of this is that California businesses have had less funding to be able to expand their operations or hire new workers. The LAO pointed out that the number of unemployed workers in the Golden State has risen by nearly 200,000 people since the summer of 2022, lifting the percentage from 3.8% to 4.8%.

Fixing the budget crunch

The LAO suggests that California has various options to address its $68 billion budget deficit — including declaring a budget emergency and then withdrawing around $24 billion in cash reserves.

California also has the option to lower school spending to the constitutional minimum — a move that could save around $16.7 billion over three years. It could also cut back on at least $8 billion of temporary or one-time spending in 2024-25.

However, these are just short-term solutions and may not address the state’s longer term budget issues. In the past, the state has cut back on business tax credits and deductions and increased broad-based taxes to generate more revenue.

Mellon did not reveal any specifics behind the state’s recovery plan in her comments to Fox News. She simply said: “In January, the Governor will introduce a balanced budget proposal that addresses our challenges, protects vital services and public safety and brings increased focus on how the state’s investments are being implemented, while ensuring accountability and judicious use of taxpayer money.”

What to read next

This Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment building — how to invest in real estate without all the heavy lifting

Worried about the economy? Here are the best shock-proof assets for your portfolio. (They’re all outside of the stock market.)

Rising prices are throwing off Americans' retirement plans — here’s how to get your savings back on track

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.