Senators push for paycheck guarantee in next coronavirus response bill

A group of senators is pushing to include a paycheck guarantee for laid off or furloughed workers in the next coronavirus relief package.

Sen. Mark Warner (D-VA), Sen. Bernie Sanders (I-VT), Sen. Richard Blumenthal (D-CT) and Sen. Doug Jones (D-AL) have introduced the Paycheck Security Act, which they say will ensure workers maintain their health insurance and keep getting paid until the pandemic subsides.

Under the senators’ proposal, businesses that see at least a 20% month-over-month drop in revenues could receive grants to help cover workers’ payroll and benefits for at least six months. The grants would cover benefits and up to $90,000 in wages for each furloughed or laid off employee. The grants also include up to 20% of revenue to pay rent, utilities insurance policies and maintenance.

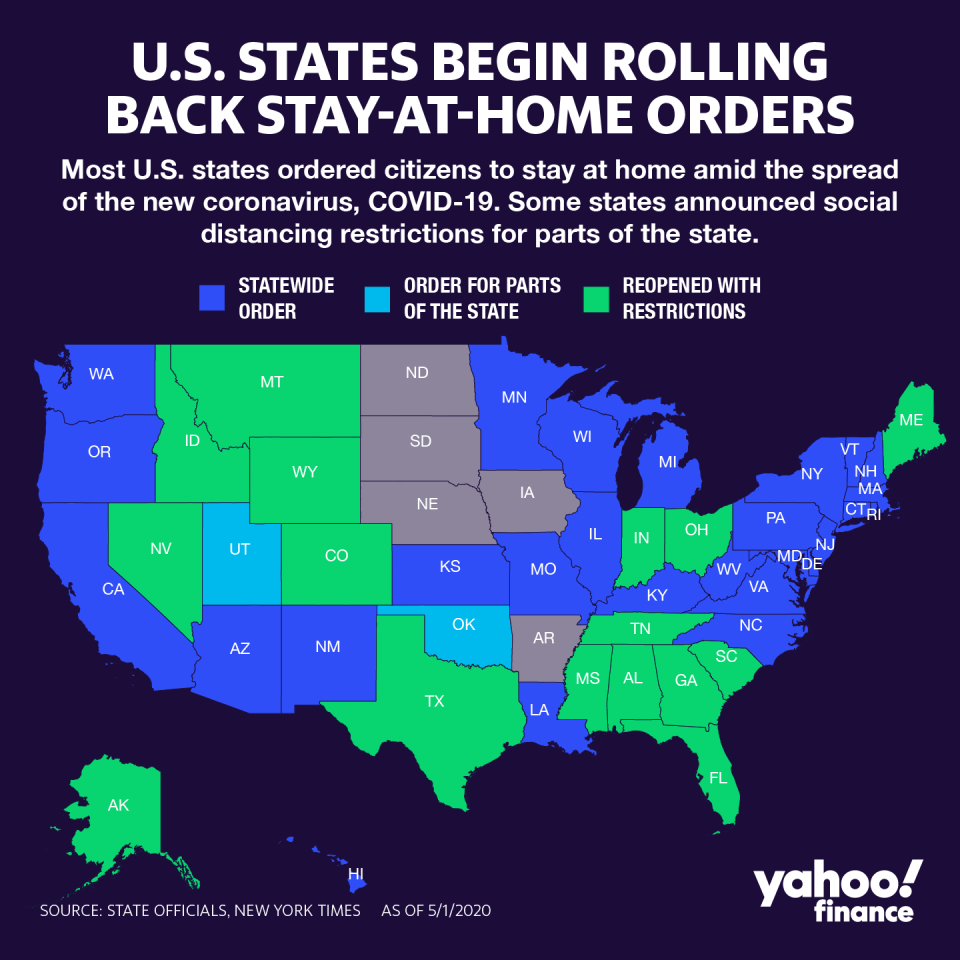

More than 30 million Americans have filed for unemployment benefits over the past six weeks, as the coronavirus wreaks havoc on the U.S. economy.

“America may get up to 20% unemployment. This is not happening in Europe where government has done direct intervention,” said Warner in a call with reporters on Friday.

The senators argue their program would be more effective than the current coronavirus response efforts. On the call, Blumenthal said the current programs are causing too much fear, confusion and uncertainty.

“Uncertainty about how long they're going to last and whether, in fact, loans will be turned into grants, whether there will be another payment,” said Blumenthal on the conference call. “This proposal provides a measure of security and comfort that is absolutely essential.”

Congress has already approved more than $2.5 trillion in coronavirus relief. As state unemployment systems strain to keep up with jobless claims and the Paycheck Protection Program has struggled with technical problems and backlash over big businesses accepting the loans, Warner said it might be time to reassess.

“We’re barely keeping the economy going and we think now is the time to pause and say there may be a better, more efficient and more effective way,” said Warner.

‘Simpler’ than what we have now

The Paycheck Security proposal would allow businesses of all sizes to receive the grants if they prove revenue losses, unless they hold more than 18 months of average payroll in cash or cash equivalents. Businesses that received money from the PPP or other federal relief programs would be ineligible, unless that money ran out.

“We wouldn’t have the kind of abuses that are taking place in PPP,” said Warner. “We really want to make sure we target this towards those businesses and more specially those workers who are feeling the most pain.” (According to reports, the Justice Department has found possible fraud among businesses seeking relief in a preliminary investigation of money disbursed through PPP.)

The IRS and the Treasury Department would issue the grants, either through payroll processors or a direct deposit from the IRS. The program would phase out as the economy recovers.

“In terms of implementation, it’s a heck of a lot simpler than what we have done up to now,” said Sanders.

Rep. Pramila Jayapal (D-WA) has introduced a similar measure in the house, which would cover up to $100,000 in workers’ wagers. Some Republicans have also warmed to the idea of covering company payrolls. Sen. Josh Hawley (R-MO) proposed covering 80% of wages up to the median wage. It’s far less money than what the Democratic senators are suggesting — but Warner still sees that as a promising sign.

“The numbers don't really match, but that would be part of a negotiation,” said Warner. “I think there is recognition on the Republican side. And there's also been actually some strong business support for this because the uncertainty that's created right now — for middle market firms who've got no support, or even businesses that have received PPP support, you know, they're all questioning what happens when that eight weeks runs out.”

“I've actually been really pleasantly surprised at how much broad-based support there is,” he added.

Still, the next round of COVID-19 negotiations will likely prove difficult for a divided Congress. Lawmakers are bracing for a fight as both parties dig in on their list of priorities. Democratic lawmakers insist on funding for state and local governments while Majority Leader Mitch McConnell says liability protections for businesses are a “red line” for the Republican party.

“An absolute blanket heal from any legal responsibility for businesses is going to be a non-starter,” said Blumenthal. “I'm mystified as to why because already the leader wants to confuse and distract us from the basic task of reopening the economy and putting people back to work.”

The Senate is set to return to Washington on May 4, but the House will remain in recess until at least the following week.

Jessica Smith is a reporter for Yahoo Finance based in Washington, D.C. Follow her on Twitter at @JessicaASmith8.

Read more:

Trump administration puts Amazon foreign sites on Notorious Market List

Senator on PPP gridlock: 'It's beyond me why we can't come together'

Democratic congresswoman: Rules for PPP loans are 'too restrictive'

'We're in dire need': Food service shutdown slams dairy farmers, producers

Democratic senators ask for clarity, fixes to small business loan program

Sen. Warren calls on food delivery apps to reclassify workers, increase pay during pandemic