Presidential candidate Pete Buttigieg: ‘I have six-figure student debt’

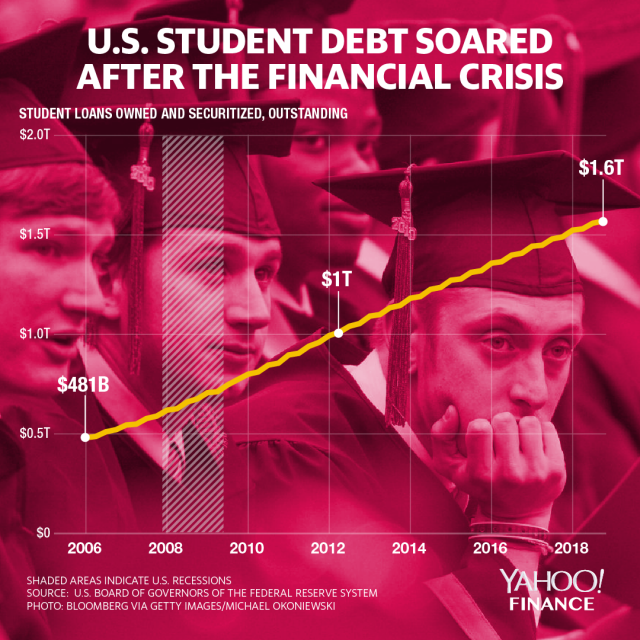

As Democratic presidential candidates take turns pitching radical solutions to the $1.5 trillion student debt crisis — everything from debt cancellation to free college — South Bend, Indiana, Mayor Pete Buttigieg weighed in on the debate, revealing that he and his husband have “six-figure student debt.”

Responding to a question about free college during the second night of the 2020 Democratic presidential debates on Thursday, Buttigieg said: “College affordability is personal for us. Chasten and I have six-figure student debt. I believe in reducing student debt.”

Buttigieg household owes $131,296 in student debt

Buttigieg’s campaign spokesperson previously revealed to the AP that both he and his husband have student loans that total to exactly $131,296.

If elected, Buttigieg would be the first president with student debt. He graduated from Harvard University in 2004 and Oxford in 2007. The bulk of the debt was taken on by his husband, who pursued undergraduate and post-graduate degrees in education, he told Vice.

On the topic of free college, Buttigieg said that he believes lower- and middle-income students should be entitled to that benefit, because he doesn’t “believe it makes sense to ask working-class families to subsidize even the children of billionaires.”

Buttigieg also said that the importance placed on attaining a college degree may be overstated. “Yes, it needs to be more affordable in this country to go to college. It also needs to be more affordable in this country to not go to college,” Buttigieg explained. “You should be able to live well, afford rent, be generous to your church and Little League, whether you went to college or not.”

Democrats and the student debt crisis

Other Democratic presidential candidates also addressed the student-debt crisis during the debate.

Andrew Yang said he’s “got $100,000 in student loan debt,” and Congressman Eric Swalwell said that he was “the first in my family to go to college and have student loan debt.”

Candidates like Massachusetts Senator Elizabeth Warren and Vermont Senator Bernie Sanders have also called for massive debt cancellations to relieve graduates of the debt burden.

Many experts — from the former top student loan official at the federal Consumer Financial Protection Bureau, Seth Frotman, to JPMorgan CEO Jamie Dimon — have said that the current crisis is the result of a “lousy system" of student lending.

In an interview with Yahoo Finance, Dimon emphasized that “what we've done is a disgrace, and it's hurting America.”

“I think they should look at all parts of student lending, fix the broken parts, and then forgive those people need forgiveness,” said Dimon.

The current crisis in the U.S.

Across the United States, there are more than 44 million Americans holding $1.5 trillion in outstanding student loans. An increasing amount is turning sour — with around 11% in serious delinquency or in default in the first quarter of this year, according to the New York Fed.

While states like Maine and California have pursued — and some have even passed — a student loan “‘Bill of Rights” where they have appointed various authorities to supervise student loan servicers and ban “abusive” practices that hurt student borrowers, other states are still lagging behind in addressing the problem.

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Bernie Sanders unveils sweeping student debt cancellation plan

Over half of parents willing to go into debt to pay children’s college tuition

Household debt hits $13.6 trillion as student loan and credit card delinquencies rise

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.