Pharma And Biotech Dividend Stocks That Will Add Value To Your Portfolio

Regularly affected by the ever-changing regulatory environment, the pharmaceutical and biotech industry is not one for producing the most stable cash flow. Thus, investors don’t usually associate this industry with strong and reliable income. However, some of the best-known pharma and biotech names are also very solid dividend providers. Companies such as Eli Lilly and Bristol-Myers Squibb, dish out income to shareholders by leveraging their size to constantly refresh their drug portfolios. As a long term investor, I favour these pharma and biotech stocks with great dividend payments that continues to add value to my portfolio.

Eli Lilly and Company (NYSE:LLY)

LLY has a sizeable dividend yield of 2.62% and pays out 98.23% of its profit as dividends . LLY has increased its dividend from $1.88 to $2.25 over the past 10 years. It should comfort existing and potential future shareholders to know that LLY hasn’t missed a payment during this time. Analyst estimates for Eli Lilly’s future earnings are certainly promising, predicting a triple digit earnings growth over the next three years. More on Eli Lilly here.

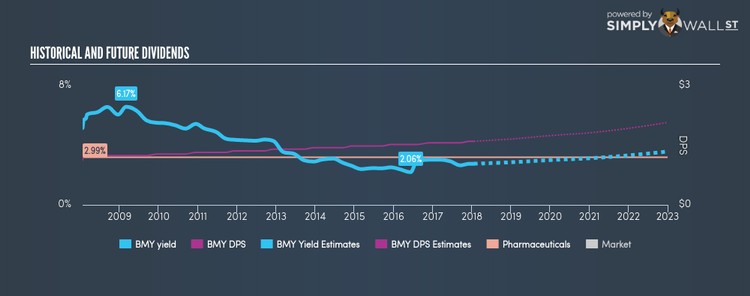

Bristol-Myers Squibb Company (NYSE:BMY)

BMY has a good dividend yield of 2.59% and the company has a payout ratio of 61.03% . In the case of BMY, they have increased their dividend per share from $1.12 to $1.6 so in the past 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. Over the next three years, analysts predict double digit earnings growth for Bristol-Myers Squibb of 55.89%. Continue research on Bristol-Myers Squibb here.

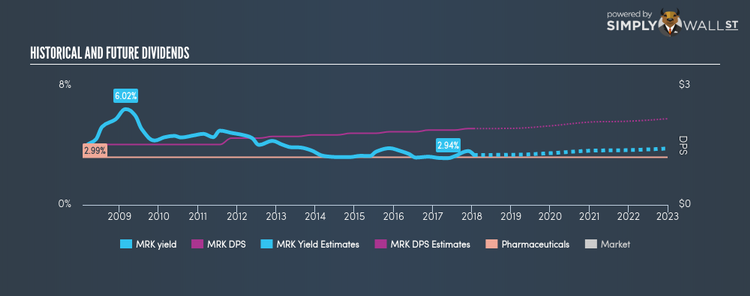

Merck & Co., Inc. (NYSE:MRK)

MRK has a solid dividend yield of 3.14% and distributes 180.13% of its earnings to shareholders as dividends . MRK’s last dividend payment was $1.92, up from it’s payment 10 years ago of $1.52. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. Merck is also a strong prospect for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next three years. Continue research on Merck here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.