The passive investing revolution is leaving opportunities in its wake

There is one theme that defines the modern investing world: the shift to passive from active investing.

Instead of searching for individual companies with strong fundamentals, investors now can inexpensively buy indexes full of companies that meet a few select criteria.

To some extent, then, this trend makes the work of looking at individual companies less important and, more significantly, less valuable when it comes to making money.

In a note to clients on Friday, UBS restaurant analyst Dennis Geiger looked at who owns stocks in his group’s coverage area. Specifically, he reviewed whether these companies were held more by active fund managers or passive indexes.

This analysis revealed two opportunities for investors amid a trend away from picking individual stocks: buy stocks underweighted by active managers and buy stocks under-owned by passive investors.

And in this we see a new dimension opened up in the investing landscape amid the broad shift to passive and rules-based strategies: good stocks can get left behind.

Passive ownership rising

“As capital has flowed into passive funds and away from active management, we believe there is a potential opportunity among stocks with actively underweight positions, but also below-average passive ownership relative to peers,” Geiger writes.

To take the second thought first, this view says stocks less-owned by passive indexes are poised to benefit from the aforementioned secular shift towards passive and away from active management.

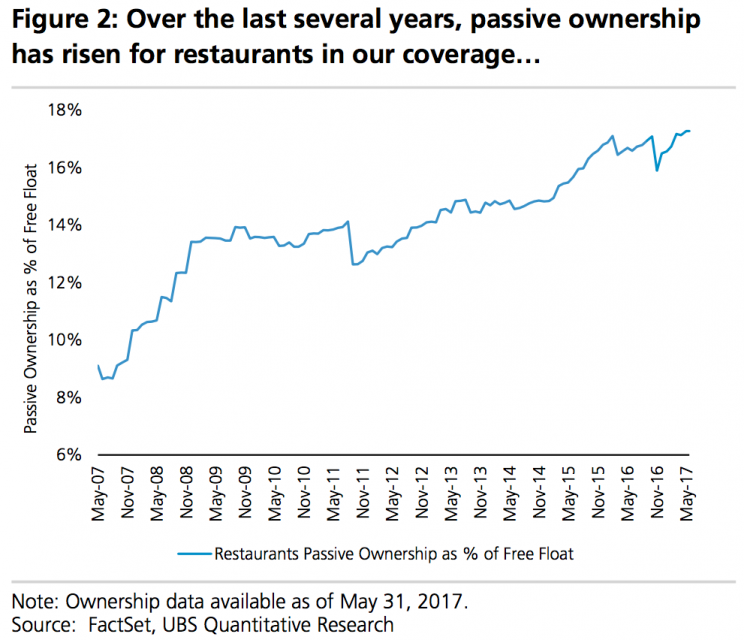

Since 2007, the share of passive ownership among restaurant stocks covered by Geiger and his team has roughly doubled from about 9% in 2007 to nearly 18% today.

And just as this trend has re-shaped returns and ownership across the broad market, so too has this shift to passive investing altered the landscape for restaurant stocks.

Less active ownership has meant better returns

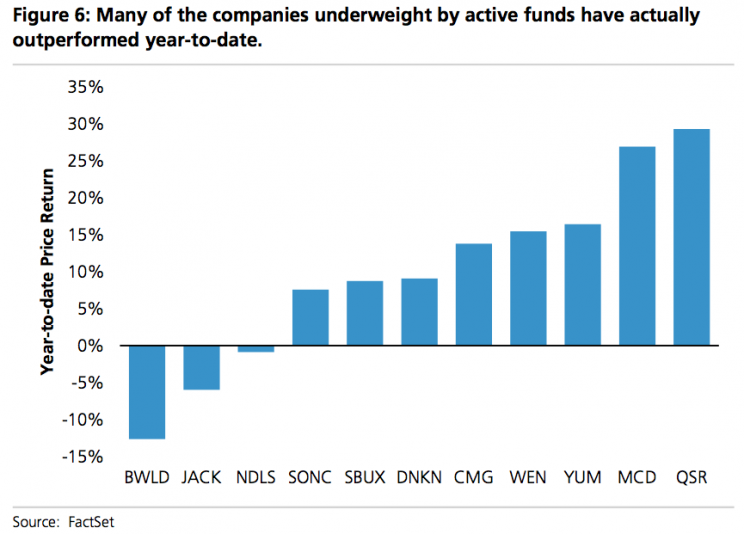

In addition to finding stocks will lower-than-average passive ownership, Geiger also finds there is an opportunity in owning stocks that are currently underweighted by active fund managers.

Because while so much of the talk around trends in investing center, again, on the shift in how people are investing — namely, moving to passive or rules-based strategies over discretionary stock-picking — active management still does exist and offer opportunities.

“For stocks where active managers remain most underweight, we believe there is potential for incremental upside, particularly where company-specific catalysts exist and there are opportunities for additional capital to flow into the stock,” Geiger writes.

For one thing, Geiger finds that stocks underweighted by active funds, notably McDonald’s (MCD), Yum Brands (YUM), Starbucks (SBUX), and Burger King parent company Restaurant Brands (QSR), have outperformed stocks active funds like this year.

And with stocks un-loved by active managers beating those stocks these investors like more, it is natural to expect these stocks to be favored once again.

Additionally, Geiger notes that Starbucks and Yum Brands, in particular, have been underweighted by active managers for some time, and so a reversion is to be expected given earnings growth expectations for both companies.

Now, Geiger notes that short interest could distort the active ownership profile of some stocks, like Sonic (SONC), for example, which has about 20% of its outstanding shares sold short and is 80% overweighted by active funds relative to the restaurant group’s benchmark.

An additional risk to betting on a rise in passive ownership of a stock is that, “Stocks with greater passive ownership may have more exposure to a potential rotation out of select index and ETF funds, with less support and limited visibility into a valuation floor,” Geiger writes.

But that there is a stock-specific way for investors to bet on the broad industry shift away from stock-picking and towards passive or rules-based investment strategies seems to be both counterintuitive but also the logical outcome of this regime change.

Bigger than restaurants

As we wrote earlier this month, new research from JP Morgan analyst Marko Kolanovic indicates that just 10% of trading volumes in the stock market represent “fundamental discretionary traders,” or what might be called stock pickers. Additionally, Kolanovic estimates that 60% of stocks are held by either passive or quantitative investors (or investors who are following a rules-based method for picking stocks).

The trend away from finding individual stocks to buy is way bigger than any one sector.

And with so much activity and focus centered right now on investment strategies that are not about any single company, the opportunity exists for investors to arbitrage stocks that haven’t yet been scooped up by a bigger index or strategy.

At the outset of this year, the theme on Wall Street is that 2017 would be a “stock pickers” year.

And while data on investor flows show passive investment strategies continuing to suck up money once allocated to more active strategies, it is this flow of money which leaves investor opportunity in its wake.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: