A Once-in-a-Generation Investment Opportunity: 50 Billion Reasons Why Amazon's Story Just Keeps Getting Better.

Over the last year or so, many technology companies have made a splash in the world of artificial intelligence (AI). Microsoft really kicked things off following an investment in OpenAI, the start-up behind ChatGPT. For a brief moment, it looked like Microsoft may have outmaneuvered its big tech peers.

However, e-commerce and cloud computing giant Amazon (NASDAQ: AMZN) has started to emerge as formidable competitor in the AI realm. Let's dig into what Amazon is doing to accelerate its business, and explore why now is an incredible opportunity to scoop up shares.

Don't call it a comeback

The macroeconomy has faced some stark challenges over the last couple of years, with unusually high inflation and rising interest rates impacting businesses and consumers. Unfortunately, Amazon's e-commerce and cloud computing operations are not immune to these measures, and the company's financial results undermine that.

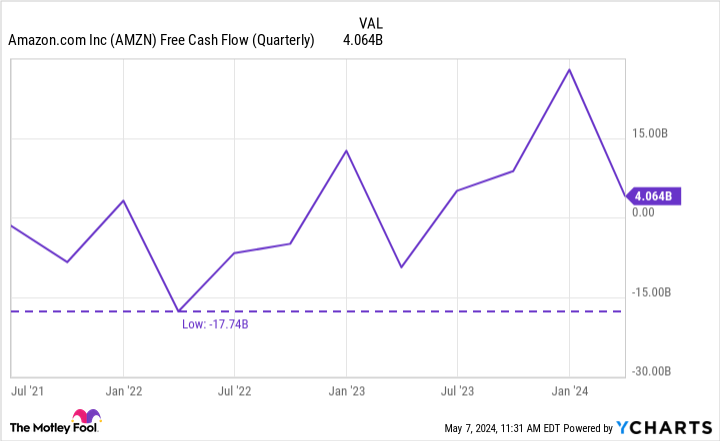

At the end of the first quarter of 2023, Amazon's free cash flow on a trailing-12-month basis stood at a negative $3.3 billion. Indeed, the chart illustrates the magnitude of Amazon's cash burn during periods of peak inflation and decelerating growth.

However, fast-forward a year, and the narrative has changed dramatically. For the trailing-12-month period ended March 31, Amazon's free cash flow was $50.1 billion. Since bottoming out last spring, Amazon has turned its ship around and consistently generated positive cash flow. One of the big contributors to this turnaround is some acceleration in the cloud business in particular.

What has Amazon been doing to jump-start its cloud services? Similar to Microsoft, Amazon has made some notable moves of its own in AI.

Don't overlook investments in AI

Back in September, Amazon announced that it was investing $4 billion into an AI start-up called Anthropic. Interestingly, Anthropic's co-founders originally came from OpenAI. Per the terms of the deal, Anthropic agreed to primarily use Amazon's cloud infrastructure -- Amazon Web Services (AWS).

This is a subtle, yet lucrative, component of the partnership with Anthropic because it should help lead to new sources of lead generation for AWS. Furthermore, Anthropic will also be training future versions of its generative AI models using Amazon's Trainium and Inferentia chips. I see this as another savvy move by Amazon.

At the moment, the AI chip market is dominated by Nvidia. And while Nvidia will likely continue owning considerable market share, Amazon's investments in developing its own chips and data centers could unlock further gains in the cloud business over the long run.

Amazon stock looks like a great value

I think many investors are overlooking Amazon's progress and are thinking too narrowly as it pertains to the macroeconomy. The current inflation rate of 3.5% is well above the Federal Reserve's long-term target rate of 2%. However, it's important to understand just how much inflation has cooled compared to peak levels two years ago.

The chart paints an interesting picture. Amazon's price-to-sales (P/S) ratio reached a 10-year high back in 2020. However, not long after, the company's P/S ratio began sliding dramatically as inflation started soaring. Now, as inflation begins to cool, Amazon's P/S multiple appears to be normalizing.

What I find fascinating about the dynamics in the chart is that even though Amazon's valuation multiples are rising, they are far from prior highs. On top of all of that, Amazon's P/S ratio is the lowest among the "Magnificent Seven" peer set. Considering how much Amazon has grown and redefined itself as an AI behemoth over the last couple of years, I think now is an opportunity to buy some shares at a discount.

I think the growth narrative surrounding Amazon is clear. The company is in early stages of AI development, but it's already making major strides. Given the company's robust operating picture and dominant position in both e-commerce and cloud software, I'm encouraged by Amazon's momentum and am bullish they can keep it up.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 50 Billion Reasons Why Amazon's Story Just Keeps Getting Better. was originally published by The Motley Fool